In today's video, I'll be examining nine different sectors of the economy and analyzing their trends using SPDR ETFs. Out of the nine different sectors, I'll be looking at three of these sectors with strong uptrends, while the remaining six sectors are in a transition stage.

I will, of course, be applying the Trade Triangle technology to each of these nine sectors so you can clearly see how to put each of these sectors to work you.

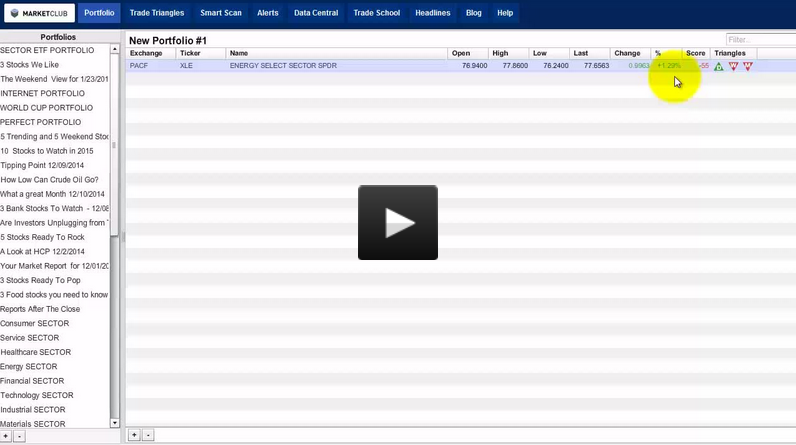

Creating an ETF sector portfolio is easy and is not as difficult as you may imagine. The first thing you need to do is create a separate portfolio in your Portfolio Manager and enter these nine ETF symbols.

Energy Select Sector SPDR ETF (PACF:XLE)

Financial Select Sector SPDR ETF (PACF:XLF)

Health Care Select Sector SPDR ETF (PACF:XLV)

Industrial Select Sector SPDR ETF (PACF:XLI)

Materials Select Sector SPDR ETF (PACF:XLB)

Consumer Discretionary Sector SPDR ETF (PACF:XLY)

Consumers Staples Select Sector SPDR ETF (PACF:XLP)

Tech Select Sector SPDR ETF (PACF:XLK)

Utility Select Sector SPDR ETF (PACF:XLU)

Once you get all these symbols into your portfolio, you can name it, "Sector ETF Portfolio" or any other name you choose.

There are advantages and disadvantages using ETFs, take for example XLK in the Tech sector. The advantage is that you have an ETF that invests in a broad spectrum of tech stocks. This gives you a way to invest without having to invest in each of the individual stocks contained in the ETF. The disadvantage is that an ETF is not going to perform as well as the individual stock. Because of its diversified structure, an ETF will only reflect the general trend of a sector.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub