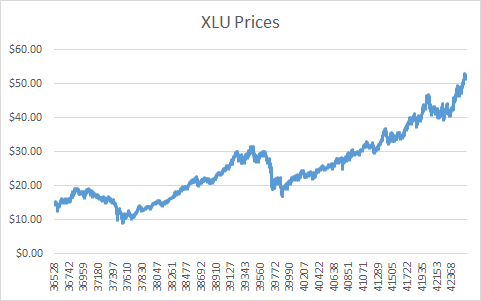

Because the yield in fixed income has remained so low for so long due to the Federal Reserve maintaining low interest rates, investors have transitioned to utilities because they want dividend yields. As a sector, utilities are up 21.96% year-to-date, 24.7% over the past year and provided an average return of 15.78% per year over the past three years.

To participate, the exchange-traded fund (ETF) Utility Select Sector SPDR ETF (PACF:XLU), tracks the price and yield of the Utilities Select Sector Index. The largest holdings of XLU are as follows: Continue reading "The Hot Utilities Sector Needs Risk Management"