After an incredible rally phase that initiated just one day before the US elections in November 2020, we’ve seen certain sectors rally extensively. Are the markets starting to warn us that this rally phase may be stalling? We noticed very early that some of the strongest sectors appear to be moderately weaker on the first day of trading this week. Is it because of Triple-Witching this week (Friday, March 19, 2021)? Or is it because the Treasury Yields continue to move slowly higher? What’s really happening right now, and should traders/investors be cautious?

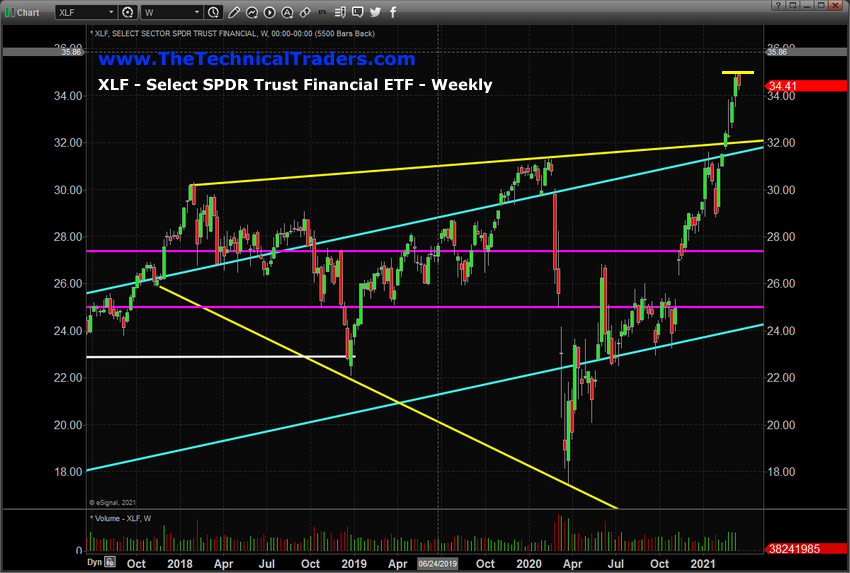

The following XLF Weekly chart shows how the Financial sector rallied above the upper YELLOW price channel, which was set from the 2018 and pre COVID-19 2020 highs. Early 2021 was very good for the financial sector overall; we saw a 40%+ rally in this over just 6 months on expectations that the US economy would transition into a growth phase as the new COVID vaccines are introduced.

We are also concerned about an early TWEEZERS TOP pattern that has set up early this week. If the price continues to move lower as we progress through futures contract expiration week, FOMC, and other data this week, then we may see some strong resistance setting up near $35.25. Have the markets gotten ahead of themselves recently? Could we be setting up for a moderately deeper pullback in price soon?

The following SSO, ProShares S&P 500 ETF Weekly chart, shows a similar setup. Although the rally in the SSO is not quite the same range as the XLF, we see a solid TWEEZERS TOP pattern setup on the SSO chart over a period of many weeks. We also found the moderate weakness in the US indexes interesting this morning. Last week, we continued to see very strong buying trends. Today, we see those trends have almost vanished. Are the markets setting near highs waiting for some announcement or news to push them into a new trend? Continue reading "Are The Markets Sending A Warning Sign?"