If you're an advocate of EMH (Efficient Market Hypothesis), then you likely assume that markets are rational and bargain pickups are hard to come by. Stocks that take off without notice shouldn't happen since investors, whether institutional or everyday, have access to the same information. However, there are some cases that simply defy the rules.

Stealthy stocks that are relatively unknown can surprise investors. These types of companies might have few or no analysts covering its stock letting it easily slip through investors sights. But once it starts hitting new highs, it makes waves.

Many have immortalized investors like Benjamin Graham and Warren Buffett. The value investor style of stock trading has been a winner for decades, but a look back at recent history tells a different story. It's growth stocks that have outperformed value stocks over the past decade. Advances in technology and a the globalization of the world's financial markets have led to an aggressive bull market that undervalued stocks just haven't been able to keep up with.

One stock has slipped through the ranks and hit a new 52-week high and it doesn't look like it's going to stop anytime soon. Off the radar stock picks can be big winners – if investors are willing to take the plunge on a gamble.

A Stealth Winner With No Ceiling

Primo Water Corporation (NASDAQ:PRMW) is a small cap $245 million beverage company that specializes in water dispensers for corporate, industrial and residential usage. The company manufactures and dispenses 3 and 5-gallon water tanks that can refilled at any of their exchange centers which number in the tens of thousands.

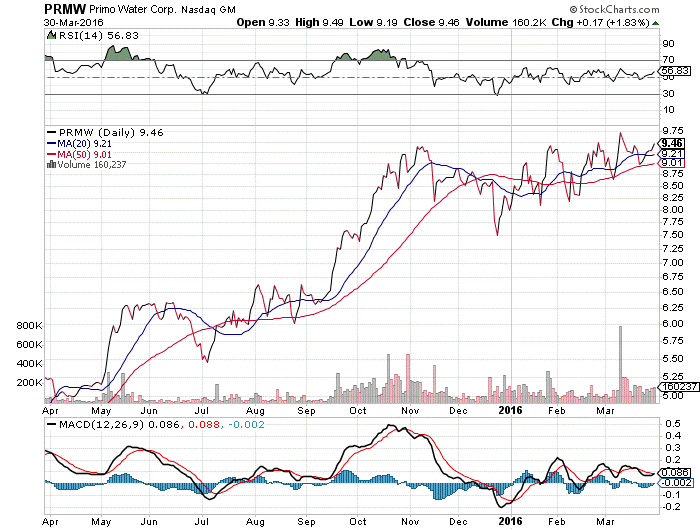

Primo's chart is impressive.

Chart courtesy of StockCharts.com

Notice the upward channel in the stock price accompanied by its 20-day moving average surpassing the 50-day moving average. The MACD is starting to show signs of momentum while the RSI is reading a tepid 56.83 letting investors know that despite hitting a new 52-week high, the stock still doesn't look oversold.

Looking at the stocks fundamentals can be dizzying. It has an incredibly high P/E ratio which may scare off investors, but it's 1-year EPS growth rate of nearly 70% brings it back into focus. For doubters, a look back may be in order. Over the past year, this stock has gained 80%. Barrington Research, one of the few analysts covering the stock, recently upgraded its status from “market perform” to “outperform.”

The company beat 4th quarter earnings as well at $0.04 per share versus the expected $0.02. It might not seem like much, but consider that this makes a beat of double the analysts expectations. EPS estimates have been revised a number of times to more than double their original as well making this stock a surprise winner even for Wall Street's best.

Taking into account Primo's revised full year EPS estimates, this stock could easily be valued at $11.50 per share – or higher if future quarters turn out to be as surprising as the last. That gives investors a potential profit of 21.50%.

Check back to see my next post!

Best,

Daniel Cross

INO.com Contributor - Equities

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.