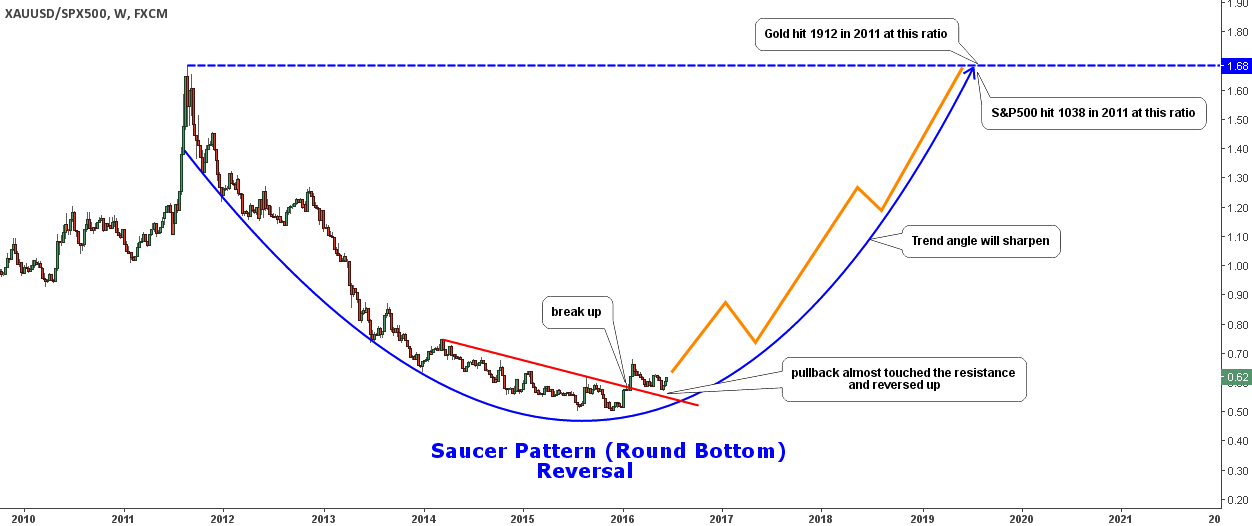

Chart 1. Gold Vs. S&P 500: Saucer Reversal Pattern

Chart courtesy of tradingview.com

The Gold/S&P 500 ratio made a new high this past February breaking above both the August 2015 and October 2014 maximums. It has finally managed to surpass the depressing red resistance. The break was strong and violent pushing the ratio from 0.51 low to 0.68 high. After it runs out of steam we always witness a pullback ( the market digests the price action), the ratio returned to the point of the break at the end of May and now is starting the next round up.

This is a very healthy market move as the price pulled back, but hasn’t broken below the starting point. The first higher high and higher lower are in place now. Once we get a new higher high, we can draw an uptrend with confirmed touch points.

You can clearly see on the chart that the ratio was collapsing rapidly amid falling gold prices from 2011. In 2012 the downfall had even accelerated with a short break in 2013 and then stopped at the start of 2014. Then we can see the dramatic change in the trend; the angle became dull, and volatility evaporated. The former are the harbingers of the imminent change of the trend.

The above mentioned market behavior matches the description of a Saucer Pattern aka Round Bottom - the reversal chart formation. It is a very rare pattern, and we witness it on my charts for the first time. It is similar to Cup And Handle pattern which we have met in the silver market.

When the ratio fills the Saucer to the top as highlighted by the blue curve with an arrow to the top, it will reach the unbelievable 1.68 mark! One of the market wizards has said that "the successful trader should be able to imagine unbelievable price levels," so let us hope that we are ready for success.

I mirrored the action plan, copying the down moves on the left side of the pattern, with the orange zigzag highlighting the possible ratio behavior to the top.

The top of the pattern would bring a triumph for gold bugs. Of course, the coin is two-sided, and the story for gold bugs is the nightmare for stock lovers. Gold peaked at $1912 in 2011 and the S&P 500 bottomed at $1038 at the ratio’s maximum.

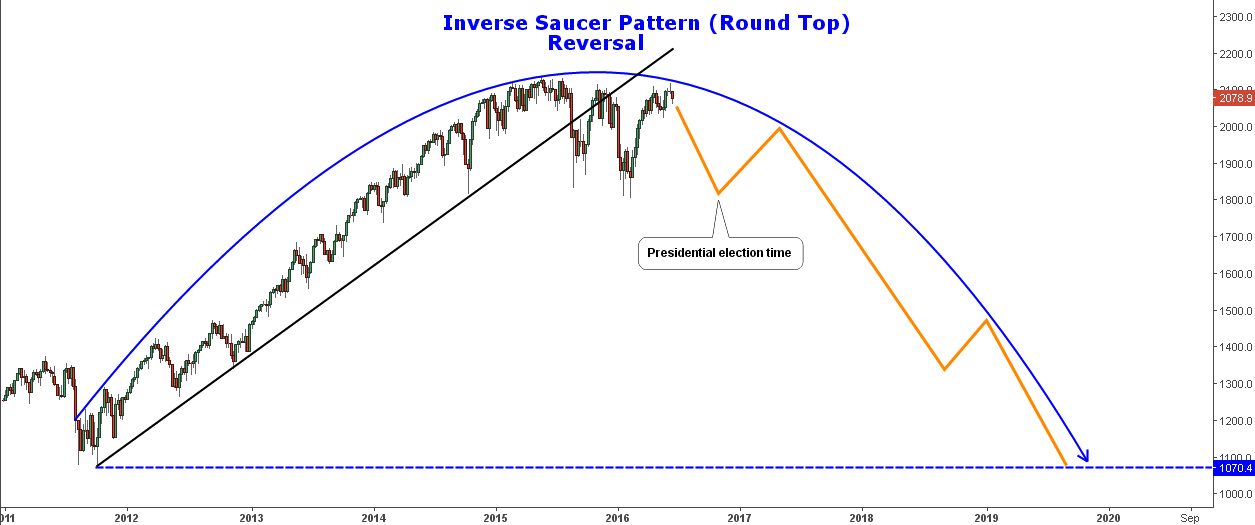

Chart 2. S&P 500 Weekly: Goodbye All-Time High?

Chart courtesy of tradingview.com

The plan for the gold already elaborated in previous posts. It is bullish, and it supports the Chart 1 pattern. But let us also review the chart of the S&P 500 index separately to have a full picture for a final judgment.

We can see on the chart above that the index literally doubled in value from the bottom; we also know that gold lost almost half of its value last year from the all-time high levels. Now it is obvious why the Gold/S&P 500 ratio has dropped more than 3 folds from the maximum; it was a strong synergy of both assets moves in opposite directions.

The index shaped the same (Chart 1) but the inverse pattern on the weekly chart. The initial takeoff from the 1000 area was followed by rocket speed move to the (unbelievable in those days) 2000 levels and then it transformed into a horizontal range locked between $1800 and $2140 marks.

The Round Top (another name for the pattern) is as much aesthetically beautiful as strong – the curve, which is touching 2011 and 2015 highs, repelled this year’s upside attempt successfully.

The black support line was broken last summer and right after that the index made a nice pullback and again this month. These attempts to grasp above both the black support and Round Top curve didn’t succeed. I put the same orange zigzag as on Chart 1 which reflects the left side index path to the top but in the opposite direction. The target for the pattern lies at the bottom of the curve at $1070 level. It’s a panic sell or anyway, something catastrophic. The future is hidden from us, and we have to wait and see if the chart signs are true or false.

The first drop is supposed to come this November, and we got a presidential election there which in some way can affect positively to the index as the zigzag makes the move upside there. It will be quite interesting to see what will happen then.

Intelligent trades!

Aibek Burabayev

INO.com Contributor, Metals

Disclosure: This contributor has no positions in any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Now that's some wishful thinking! Shall we come back in 3 years and see how you did?

S&P is crushing much sooner, so come back in few months 😉