Three weeks ago, I shared the chart of the U.S. Dollar Index (DX) with a bullish outlook.

You supported the idea with the most votes given to the conservative target of $103 located at the peak of Y2020. Your winning vote played out last Wednesday, the 27th of April. Kudos to all of you.

It is time to dust off the big chart again to update on further prospects.

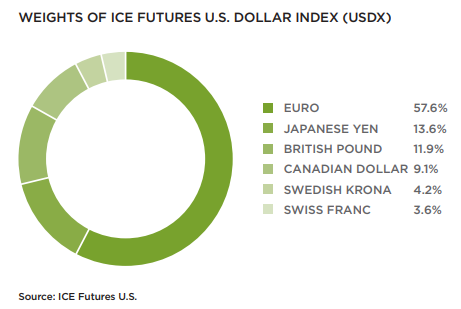

The green triangular scenario has been eliminated as the price surpassed the last year’s peak of $103. The least favored blue path is the primary plan now. I turned the blue arrow into a blue zigzag as the price could take a break after hitting the upside of the blue dotted trend channel around $114.

The next barrier (black) of the Neckline (Giant Double Bottom pattern) is located at $121. It is that very target I was calling for in the title of the previous post.

It is too early to talk about the plan in case the Neckline is broken, although we have no other large barriers beyond, except the all-time high at the peak of the distant 1985 of $164.7. It would be an ultra-optimistic target with the total dominance of the dollar across the globe.

Loading ...

I want to show you one chart below that could shed light on why the dollar could rise further.

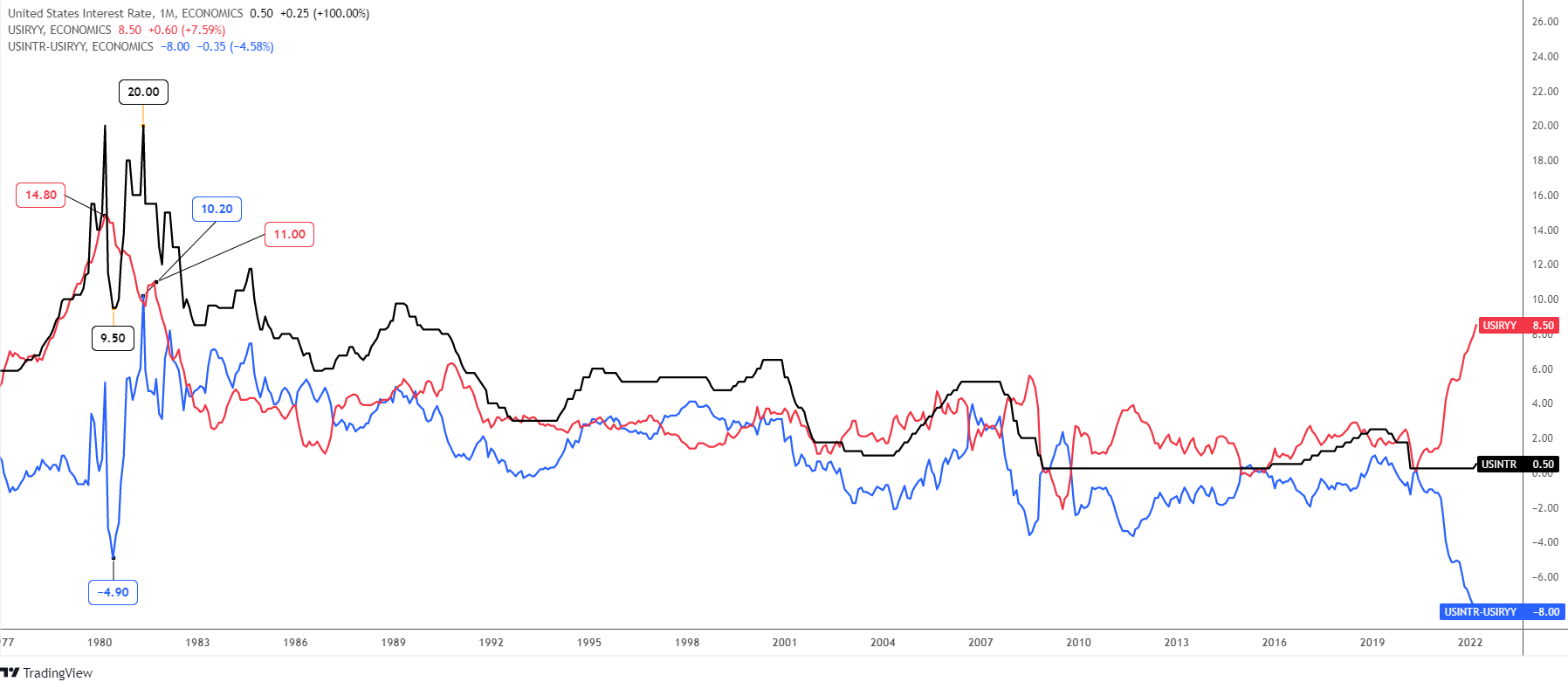

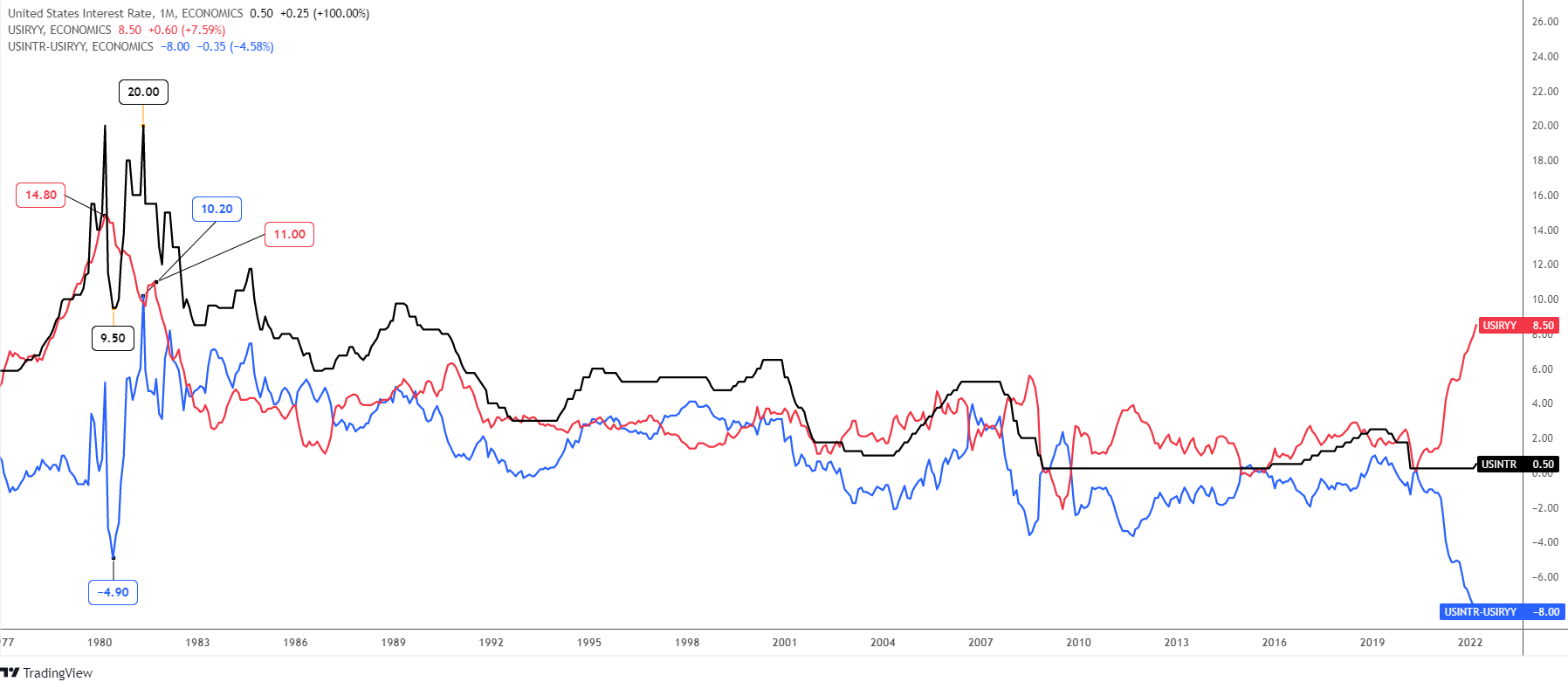

There are three lines in the chart above that represent the U.S. interest rate (black), U.S. inflation rate YoY (red), and the U.S. real interest rate (blue). It starts from 1977, and for the considered period, the current real interest rate has the most negative reading of -8%. Thus, the Fed has been forced to admit that this raging inflation is not transitory, and it should respond appropriately to take the rising prices under control. This week, the market expects a 50 basis point hike from the Fed; this would double the interest rate to 1.00%.

In 1980, the real interest rate had dived deep into a negative area to hit the valley -4.90% amid the strong inflation above 14% and the falling interest rate (9.50%). This triggered the fast-paced tightening of the monetary policy as the Fed rate more than doubled to hit the earlier top of 20% in just one year. The inflation quickly dropped to single-digit numbers under such severe pressure. Indeed, the real interest rate made a V-turn accordingly to match even with the inflation rate of around 10%.

If we take history as a sample, the Fed could take the interest rate much higher beyond the most hawkish expectations. The simple calculation shows that the Fed rate topped at the ratio of 1.35 to the peak inflation rate (20/14.8). Applying this math to the current situation, we should multiply 1.35 by 8.5% of the inflation rate. Then the Fed should hike up to 11.5%, an unbelievable number! Although, it will not update the all-time high.

The time lag between the peaked inflation and the first hike was almost a half year in the past. This time, the Fed took the first step almost immediately if we take the March inflation reading as the peak. It could change the size of the tightening, as the speed really matters.

Loading ...

The higher the real interest rate, the more attractive the currency is. The hawkish Fed could spur even stronger demand for the U.S. dollar.

I am eager to see your opinion in the comments below, as it has enriched our view many times before.

Intelligent trades!

Aibek Burabayev

INO.com Contributor, Metals

Disclosure: This contributor has no positions in any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.