Introduction

Netflix Inc. (NASDAQ:NFLX) recently reported stellar quarterly numbers alongside robust subscriber growth that propelled the shares from ~$100 to $120 by the next day and ultimately to $130 within a few days (Figure 1). Netflix announced that it brought in 370 thousand net subscribers in the U.S. during Q3 while posting only 160 thousand net subscribers during the previous quarter. Furthermore, its international strength was very robust, adding 3.2 million against a 2.0 million consensus. Netflix’s guidance was higher than most estimates as well coming in 520 thousand and 3.75 million subscribers domestically and internationally, respectively. I’ve written a series of articles highlighting ways to leverage options trading to augment a long position or potentially entering into a position in Netflix. I’ve highlighted ways in which one can layer in covered calls to mitigate risk in a long position as well as utilizing secured puts to enter into a position at a lower price or avoid owning the stock altogether while making money. I’ll discuss my covered call/secured put combination strategy to unlock additional value, mitigate risk and generate income. I’ll break this strategy out into segments to exemplify the power of options when dealing with an intrinsically volatile stock with significant upside potential such as Netflix. In brief, I’ve realized a 13.2% gain relative to a -3.1% loss based on the traditional buy and hold strategy based on the closing price on 11Nov16 of ~$115.

Figure 1 – Netflix’s upward movement after announcing numbers that beat analysts’ expectations

Overview

Netflix is a highly volatile stock with a 52-week range of $80-$133 per share or a $53 per share range. Layered within that range are swings of $10 per share or more (~10%) throughout the course of any given day. These swings to the upside or downside can be difficult to stomach especially after the most recent earnings announcement where the stock cratered by $15 per share in one day (~$100 to $85). There’s no disputing the fact that Netflix has an outrageous valuation and a wide range of intrinsic volatility. Case in point, a $20 move per share was witnessed the day after Netflix beat expectations when they announced Q3 numbers. This intrinsic volatility is more pronounced during any major news story (i.e. expansion into international markets or subscriber price increases) and specifically around earnings announcements. As a result of the nosebleed valuation and volatility, in my opinion, options are a great companion when committing capital to Netflix stock. Netflix is a high growth and industry disruptor stock thus investors are willing to pay a premium for this growth and technology innovation in the traditionally stagnant media space. However, the trade-off is that traditional metrics such as the price-to-earnings multiple (P/E ratio) and the PEG ratio do not apply. Due to its rapid growth, expanding critically acclaimed original programming such as the new hit Stranger Things followed by Narcos, Orange is the New Black and House of Cards. Netflix has been wrestling market share away from big cable companies, expansion into international markets, partnerships and its overall ubiquity; it's easy to see why investors are willing to pay a premium for this media disruptor. Due to these aforementioned factors, an options strategy may be an effective way to leverage and hedge this high growth stock while mitigating risk. Netflix offers high-yielding options premiums whether one owns the stock or attempting to gain a good entry point. This bodes well for those who are willing to leverage options trading to augment returns and mitigate risk throughout the volatile nature of Netflix’s stock. This could come in the form of covered calls and/or secured puts or a combination of a call/put strategy.

Note: This article discusses a covered call/secured put strategy to mitigate downside risk and generate income around trading Netflix stock. I provide my real life examples embedded around trading Netflix and its intrinsic volatility. I utilize options to extract additional value out of positions in addition to mitigating risk. I earmark a portion of my portfolio solely for options trading in more volatile stocks. The empirical example demonstrated here is part of my overall options strategy. There are numerous positions that I’ve written covered calls and puts on in which my overall position realized a net loss, despite the options income. I do not want to misconstrue readers into the belief that options are trivial in any sense.

The Covered Call/Secured Put Combination

I prefer to break out the options strategy into segments to compartmentalize each segment in order to better understand the overall strategy in digestible pieces. An example of an options segment, in this case, would be if one owns the underlying security and writes covered calls against her position until the stock is relinquished. Hence the stock was purchased and sold (in between the purchase and sale, options were written against the position). The position was opened and closed with a realized gain or loss. Alternatively, when one doesn’t own the stock with respect to secured puts, the secured put option is sold and either the option is bought back and canceled or the stock is assigned. In the case of assignment, until the stock is relinquished with covered calls the segment will not be complete. Thus a leg constitutes money going into the investment and money coming out of the investment for realized gains/losses.

Netflix’s Volatility and Covered Calls – Segment #1

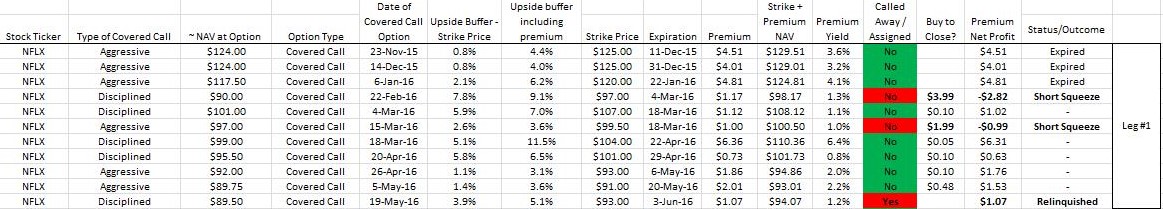

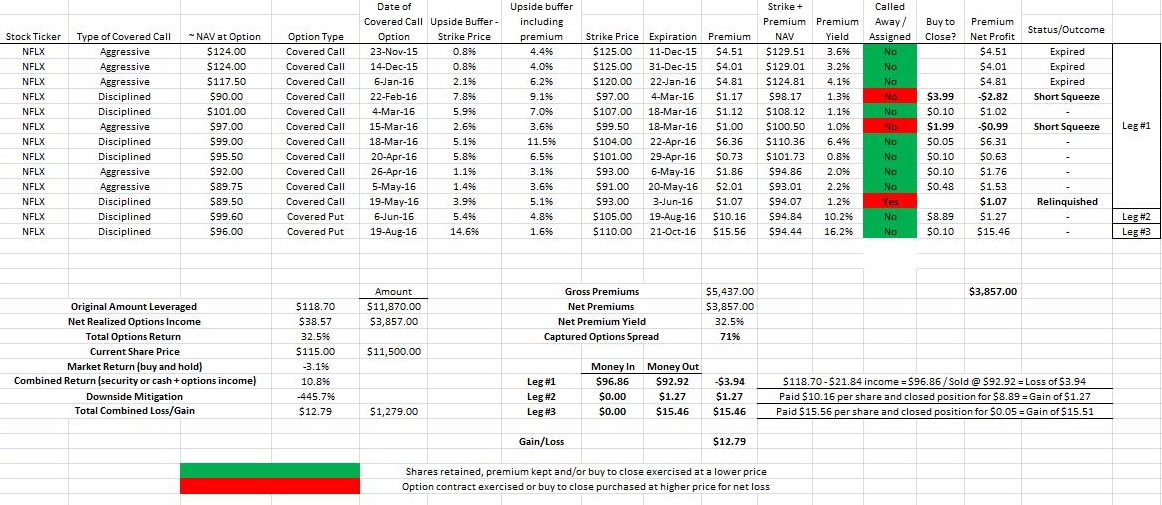

To contend with Netflix’s volatility, one can leverage her stock via writing covered call options to mitigate these swings while remaining long in this volatile stock. I initiated a position in Netflix at a price of $118.17 and sold a series of covered calls against the underlying position on the downward trend from ~$118 to the high $90s as detailed in figure 2.

Figure 2 – Details of my covered call results of the call/put combination strategy

Taken together, leveraging covered calls against my original Netflix position generated a realized income per share of $21.84 in cash. This equates to a realized 18.5% yield ($21.84/$118.17). This strategy has rendered my effective share price to $96.33 at the time of relinquishment ($118.17-$21.84). I reduced my average share price from $118.17 to $96.33 by executing options on my Netflix position. The underlying security was purchased at $118.17 and sold at $93.00 however I realized $21.84 in options income thus my loss was confined to $3.33 a share as opposed to $25.70 per share loss at the time. I mitigated my losses by 87% in this scenario albeit my overall position had resulted in a loss.

Layering In Secured Puts – Segment #2

I’ve since layered in the secured put side of options as part of my combination options strategy. This simply stated presents a situation where I sell a put option and receive a premium in exchange for the obligation to buy the shares at a specified price by a specified date. A recent contact that I sold was a secured put at a strike price of $105 in exchange for $10.16 per share while at the time the shares were ~$100. As expiration approached, I decided to buy back the contract at a gain so I would not be assigned the shares and I could use this freed-up capital to make additional moves. I was paid $10.16 per share, and I paid $8.89 per share to cancel the contract for a net gain of $1.27 per share without ever owning the shares. Since money was allocated to the option contract and the shares were not assigned as a result of my cancellation of the contract, this constituted the closing of an options segment at a profit.

Recent Secured Put – Segment #3

I sold a secured put with a strike of $110 on 19-Aug-16 when the underlying security was trading at $96 per share. This contract provided two months’ worth or trading activity at a price of $15.56 per share. Any price above $94.44 is profitable ($110 less $15.56 premium) thus my strategy is to buy back the contract when the stock hit an uptrend approaching the $110 level to capture the majority of the option premium. Netflix reported earnings on 17-Oct-16 just prior to the expiration of the option contract (21-Oct-16). My plan was to hold the contract through earnings and exercise a buy-to-close cancellation of the contract. Since earnings expectations were low as a result of the previous two disappointing quarterly results and lowered numbers by analysts, I felt that Netflix could easily beat the low expectations thus a secured put contract was sold.

The Results

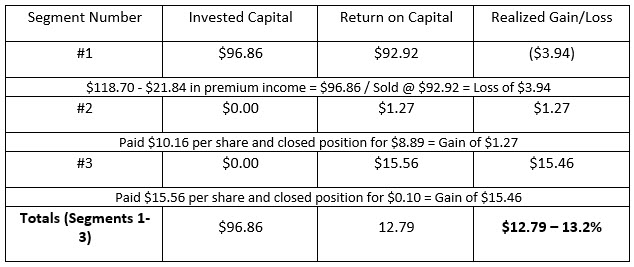

I originally purchased the shares at $118.70 and wrote covered call contracts until relinquishment that generated a net income of $21.84 per share rendering my average share price to $96.33. I relinquished my shares at $92.92 per share thus $9,292 from the underlying equity plus $2,184 from options premiums equates to $11,484 total. Taken together, money going into Netflix was $11,817 and money coming out Netflix was $11,484 or a $394 loss (-2.8%). Adding in the profit that was made from segment #2, the loss is then decreased to $267 or -2.2% compared to a loss of -16.2% at the time (trading at $99.50) had I kept the shares and sold them at the same price. With segment #3 factored into the covered call/secured put combination strategy, adding in the $15.46 per share profit I arrive at a net profit of $12.79 per share or 13.2% ($15.46 less $3.94 and $15.46/$96.76) (Table 1 and Figure 3).

Table 1 – Comprehensive results of my call/put combination strategy in mitigating downside risk

Figure 3 – Details from each options segment and the resulting differences between the traditional buy and hold versus the call/put combination resulting in an overall return of 10.8% versus -3.1% return, respectively.

Summary

Whether you’re investing or trading in Netflix Inc. (NASDAQ:NFLX), an options strategy can be highly beneficial in augmenting this position and mitigating risk. As a result of its valuation and volatility, in my opinion, options are the ideal defense when deploying capital to Netflix stock. Thus far I’ve demonstrated my overall covered call/secured put combination strategy with a realized gain of 13.2% without owning any shares. This compares to a loss of (3.1%) with the traditional buy and hold strategy as a result of my call/put combination or alternatively a 5-fold greater return or difference of 16%. Due to Netflix’s intrinsic volatility, an options strategy may be an effective way to leverage and hedge this high growth stock while mitigating risk. This could come in the form of covered calls and/or secured puts or a combination call/put strategy as I outlined above. Netflix’s recent string of earnings disappointments followed by a strong earnings announcement highlights the value of an options strategy to mitigate losses and smooth out drastic moves in the stock price.

Thanks for reading,

The INO.com Team

Disclosure: The author has no business relationship with any companies mentioned in this article. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.