Saudi Arabia's energy minister, Khalid Al-Falih, clarified his position on the cuts and oil price target. After the meeting with non-OPEC producers, there was a press conference, and the media reported that he had implied Saudi Arabia would make deeper cuts than agreed at the OPEC meeting. Also many commentators seem to think Saudi Arabia’s price objective is in the $60s or $70s.

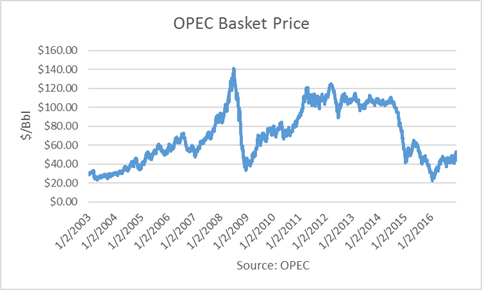

But in conjunction with announcing Saudi Arabia's 2017 budget, Mr. Al-Falih said that the kingdom sees no need for addition production cuts than the ones already pledged by the OPEC and some non-OPEC producers. He said the market intervention is intended only to "nudge along" the re-balancing of an oversupplied global oil market. He said he expects oil prices to rise "tangibly" from the 2016 average, and assumes oil will average $55 in 2017 and $61 in 2018. OPEC's Reference Basket (ORB) was $52.25 on December 21st, so it appears prices are close to where he expects them to average next year.

Economists have estimated that the new Saudi 2017 budget is based on oil prices in a range of $47 to $55/b. Al-Falih said that the budgeted oil price is a "conservative" scenario.

In OPEC's World Oil Outlook, released in November, OPEC assumed its OPEC Reference Basket (ORB) will average $45 in 2017 and gradually increase by $5 per year through 2021. That implies it will not be until 2020 that crude reaches $60 per barrel. The Outlook was published after OPEC's "Algiers Accord" limiting production to 32.5-33.0 million barrels per day (mmbd). The Outlook also estimated the "call on OPEC oil" to average 33.0 mmbd in 2017, 33.4 in 2018, and 33.7 mmbd in 2019-2021.

U.S. Oil Policies Friendly?

Al-Falih commented that the policies of President-elect Trump, and selection of Exxon-Mobil CEO Rex Tillerson, are "friendly to oil." But I think he may be misinterpreting Trump's America First Energy Plan.

On the campaign trail, Trump ad said:

"American energy dominance will be declared a strategic economic and foreign policy goal of the United States. We will become, and stay, totally independent of any need to import energy from the OPEC cartel or any nations hostile to our interests."

President-elect Donald Trump's transition team is discussing a proposal to impose tariffs as high as 10% on imports. The government already provides tax benefits for oil and gas, such as the depletion allowance. It could enlarge these types of incentives to encourage full employment in the energy sector, as Trump has stated, without causing oil prices to rise, which has an inflationary effect.

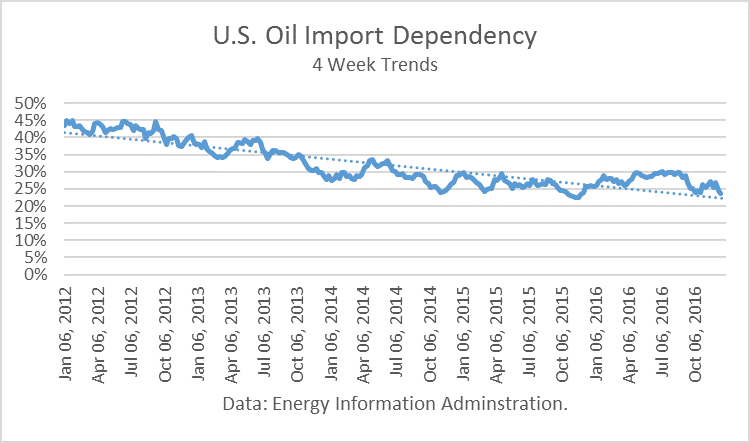

People often do not know that the U.S. currently imports just 24% of its oil on a net basis, considering both imports and exports. When prices were higher, shale oil added about 2 million barrel per day of liquids production (including natural gas liquids) in 2014. With net imports at 4.9 million barrels per day, it would not take many years to reach oil independence.

Such an achievement would bring large benefits beyond employment. It would improve the balance of payments, which would be highly supportive for the dollar. It would also reduce America's need to defend oil fields in the Middle East.

If Trump is able to get the American oil industry pumping a lot more oil, OPEC's recent problems will seem minor compared to the issues it will have to deal with in the future.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Due to some of the dark side of crude oil based fuels like high rate of pollution, comparatively more expensive, and dependency on some other country for getting required supply, all such factors have boosted innovation for some alternative energy source as a substitute of Oil, and therefore, all most entire world is trying to shift towards any other cheaper, and laser pollution creating energy system, CNG, Methanol, Solar Power, Electric Auto vehicles, Hydrogen technology, in a pure or hybrid form. This will result in a constant decreasing demand of Oil, and ultimately it will create major pressure on oil price.

Considering above probabilities, As per my study, Crude oil had complied it's historical bull run, and now long term down ward trend all ready taken place.so we just cant expect any remarkable up trend.

Past Down trend has given a harsh effects on the Economies of OPEC Countries, and still their Financial Situation became quite fragile, so now they will more conscious about this Factor too, therefore, this issue will play a key role towards production and pricing of Oil

As per Technical Views, there will be big hurdle at around between $ 54 to $ 59, and there after, $ 62 and $ 66 are big and hard resistance, over and above crossing thereof, any trend changing signals would be found so far.

I recently watched a video with T. Boone Picken's, it's amazing how little informed we are in America, I did not realize we do not have an energy plan in this country, he was talking about it, and has been very aggressive in natural gas field, to get it used more in this country, we have an abundance of natural gas, he said some of the smallest countries in the world have energy plans, we don't, his hope is, under the Trump admin, we can move forward to getting that changed, and that no matter how much money, we throw at alternative energy, that fossil fuels would be source of energy for at least, five hundred more years. think about it.

Who gets a depletion allowance? Sure not Exxon. What other tax benefits are there?