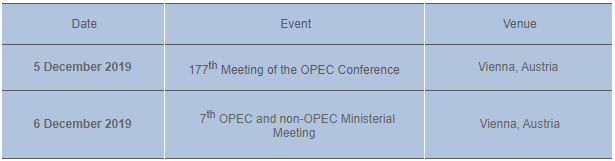

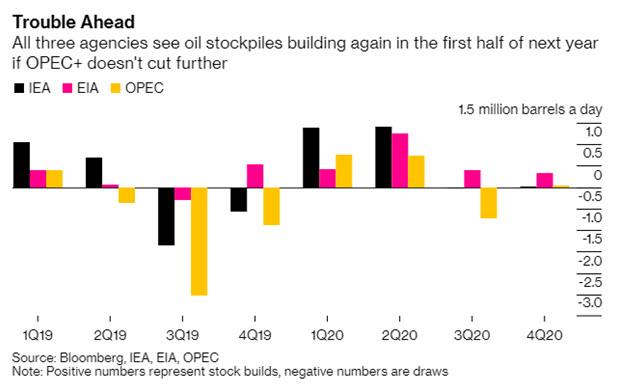

The next OPEC meetings are scheduled for early December. At issue is how they will deal with the outlook for the reduced demand for OPEC oil in 2020.

Source: OPEC

According to Bloomberg:

“The OPEC+ group of oil producers will need to make deeper output cuts when they meet in December. That’s the inescapable conclusion from the latest round of monthly reports published by the three big oil-forecasting agencies.”

According to Reuters reporting, “Saudi Arabia, OPEC’s de facto leader, wants to focus first on boosting adherence to the group’s production-reduction pact with Russia and other non-members, an alliance known as OPEC+, before committing to more cuts, the sources said…A second OPEC source said: “Of course deeper cuts are an option, but some things should happen before that. The rest of the OPEC+ countries will not cut deeply if Iraq and Nigeria don’t comply 100%.”

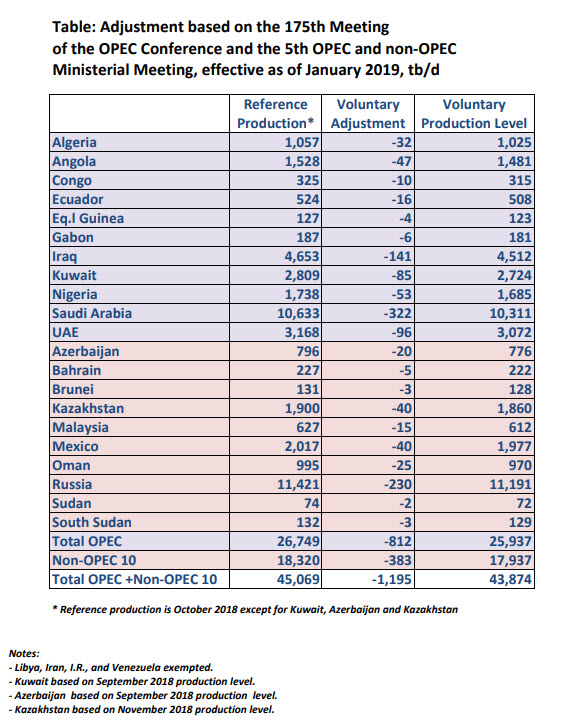

Supply Adjustments

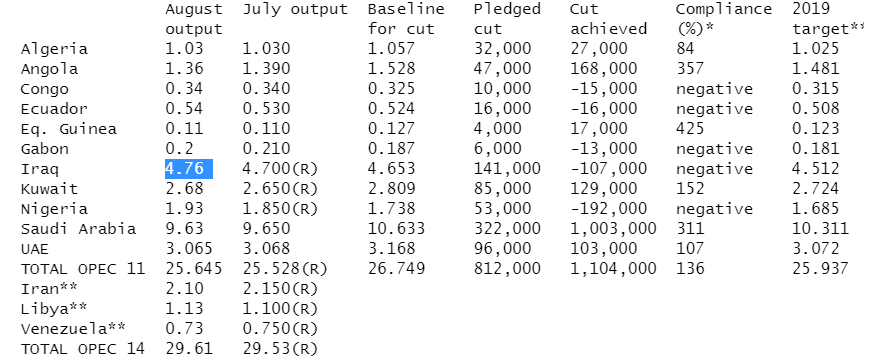

OPEC released a table in January showing the “Voluntary Adjustment” to “Reference Production,” which result in the “Voluntary Production Level” for the OPEC and non-OPEC participants. Libya, Iran, and Venezuela were exempted.

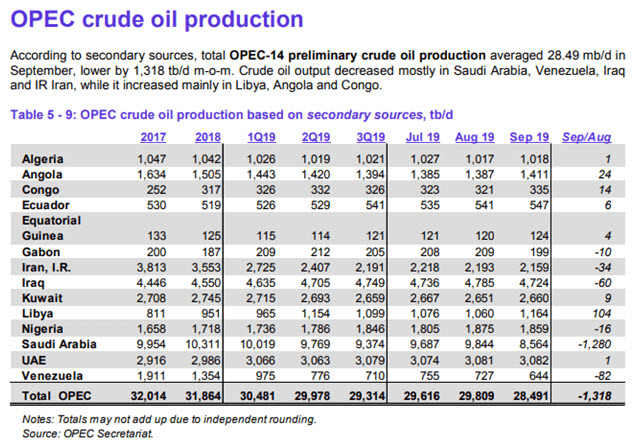

As shown above, OPEC production “quotas” for the other OPEC members totaled 25.937 million barrels per day. For August 2019, prior to the attack on Saudi facilities in September, OPEC production totaled 29.8 million barrels per day.

Using the 25.937 million as a base, and adding actual September production of 2.159 for Iran, 1.164 for Libya, and .644 for Venezuela gives a total of 28.894. Demand for OPEC oil is projected (by OPEC) to be 29.6 in 2020, so it requires an additional cut of .294 million barrels per day.

Saudi Arabia has been willing to cut that much below its target. So the key for them is getting the biggest over-producers to comply, which is Nigeria, Iraq, and Russia.

Nigeria

Nigeria will make cuts to its crude oil output to comply with OPEC output targets, Mele Kolo Kyari of the Nigerian National Petroleum Company (NNPC) said.

According to OPEC’s numbers, Nigeria had pumped 1.859 in September, 175,000 b/d beyond its quota.

However, there may be a bigger problem brewing for the future. Kyari said that Nigeria hoped to raise oil production to about 3 million bpd in the next 2 to 3 years.

Iraq

Iraq will be fully compliant by October with agreed oil output cuts under an OPEC-led supply deal, and Baghdad’s reduction will amount to 175,000 barrels per day (bpd), Oil Minister Thamer Ghadhban said.

Iraq produced 4.724 in September. Its quota is 4.512. So the difference is actually a little more than 200,000 b/d.

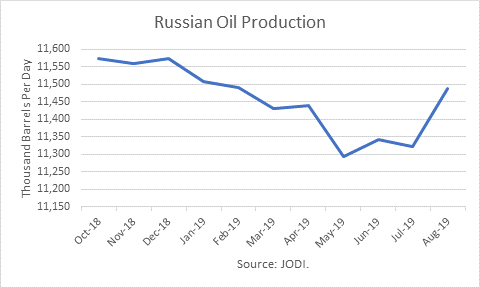

Russia

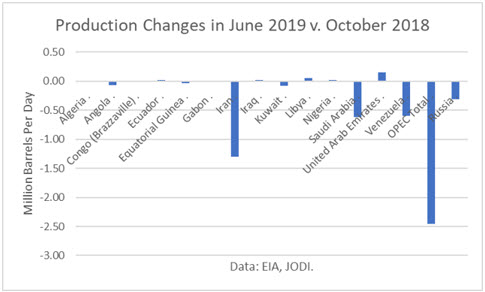

According to numbers reported by the Joint Organizations Data Initiative (JODI), Russian production in August was only 86,000 b/d lower than last October, the reference month. The country had promised to cut its output by 230,000 b/d.

Conclusions

Thanks to the effects of sanctions on Iran and Venezuela, OPEC’s production cuts are far greater than had been planned. And so the task of lowering production to meet demand in 2020 is doable, assuming those overproducing actually do comply, and Saudi Arabia is willing to keep underproducing.

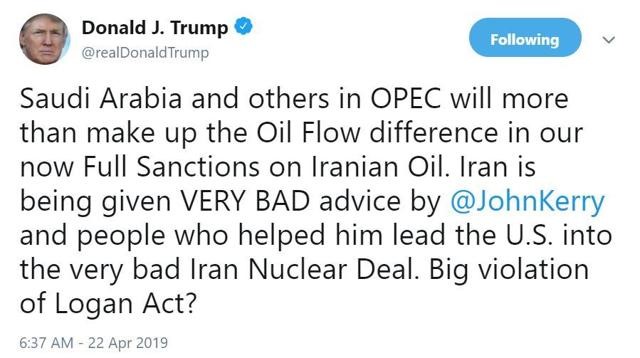

However, the opposite side of the coin is the risk that U.S. sanctions on Iran will be lifted prior to the U.S. presidential election next year. If they are, OPEC will have upwards of another 1.7 million barrels to cut to make room for Iran, and that would be very challenging, at best.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.