After posting my recent options article “High-Probability Options Trading Thrives” where I demonstrated an 87% options win rate throughout the bear and bull markets in Q4 2018 and Q1 of 2019, respectively, I received a lot of questions. I previously walked through how powerful options are and how you can be wrong about the direction of the stock and still make money. This is because options are a bet on where stocks won’t go, not where they will go. When coupled with IV Rank, options provide a high-probability win rate while generating income, mitigating risk and circumventing drastic market moves. Many questions that arose were centered on implied volatility rank (IVR) and how this can be leveraged appropriately when engaging in options trading. IVR is by far the most important and most essential concept to understand when it comes to long-term success in options trading. Here, I’ll discuss how implied volatility and IVR can impact options pricing and provide options traders with a statistical edge over the long term.

Purpose and Implied Volatility (IV)

The whole idea behind options trading is to sell options and collect premium income in a consistent and high-probability manner. Enabling your portfolio to appreciation steadily month after month without guessing which direction the market will move. The main key for options trading success is leveraging implied volatility and time premium decay to your advantage. Since options premium pricing is largely determined by implied volatility, it’s this implied volatility component when used appropriately that provides options traders with a statistical edge over the long term.

Implied volatility is the market’s prediction of how volatile the stock will be in the future or the expected volatility of a stock. Implied volatility has many implications and relationships that should be grasped.

- The higher the IV rank, the wider the expected range of the underlying stock movement becomes

- As IV rank rises, the expectations of share price movement rise and demand for the options increase

- When IV rank increases, options increase in value

- When IV rank decreases, options decrease in value

Since option pricing is determined by IV, the option itself will rise and fall as IV or the expectation of volatility changes. IV largely determines whether or not options are relatively cheap or expensive. Historically, this predicted volatility always overestimates actual volatility, and it’s this overestimation that can be exploited to the benefit to option sellers, providing that edge (Figure 1).

Figure 1 – Implied volatility versus actual volatility for the Dow Jones from 2003-2016 demonstrating that actual volatility is less than predicted over the long-term

This is a powerful graph comparing IV to actual volatility over ~15 years for the Dow Jones. IV is in the blue trace, and actual volatility is in the gold trace. Over the long term, we can see that IV is nearly always overestimated! The same pattern holds true for the S&P 500 and other markets such as gold and bonds.

Put simply, if the market predicted that a stock was going to move 50% in either direction when looking back at the actual move, the stock may have only moved 40% in either direction. Put another way, at the beginning of a 30-day period IV, is predicted for the equity's move over the course of the next month. However, when looking back and comparing the actual volatility after that 30-day period, it is nearly always lower; thus IV is overestimated.

Thus stocks are less volatile than predicted! Therefore the value of options contracts are nearly always high relative to what the actual stock move reflects. This overestimation is where options traders can take advantage and sell overpriced options to maximize profits and the probability of success over the long term.

IV Rank

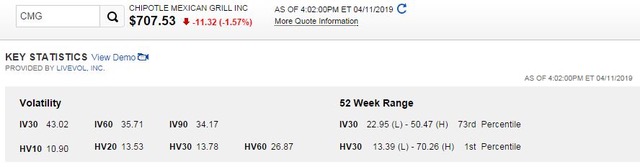

How can we use IV to our advantage in options trading? This is where IV Rank comes into play and how this is the most critical variable in options trading and its success over the long-term. IV Rank is a measure of current implied volatility against the historical implied volatility range (IV low – IV high) over a one-year period. Let’s say the IV range is 30-60 over the past year. Thus the lowest IV value is 30, and the highest IV value is 60. We need to compare the current IV value to this range to understand how the current IV ranks in relation to its historical IV range. If the current IV value is 45, then this would equate to an IV Rank of 50% since it falls in the middle of this range (Figure 2).

Figure 2 – Chipotle example to calculate implied volatility rank (IVR)

IV Rank is used to determine when option pricing is relatively pricey or cheap compared to its historic implied volatility for a specific security. When IV Rank approaches a value of greater than 50, then option sellers can use this to their advantage to take in rich options premium with the expectation that this implied volatility will decrease. Any value above the 50 threshold is where the overestimation of actual volatility thrives and options sellers can take in rich premiums with the expectation that IV will fall thus the option itself will fall in value. This provides an opportunity to sell options with rich premiums and IV falls, the option can expire worthless and/or the seller can buy-to-close to realize profits prior to expiration.

Full Circle

Rich premiums can be paid out to option sellers with the expectation that volatility will revert to its mean. Allowing the option to decrease in value and expire worthless at expiration even if the underlying stock moves up, sideways or down without breaking through the strike price in a high probability manner. Selling options in these high IV Rank situations serves as a two-fold benefit since time premium is always evaporating and IV will likely revert to its mean and fall. Even if the stock moves up, down or trades sideways without breaking through the strike, the option will be profitable as time and IV fall.

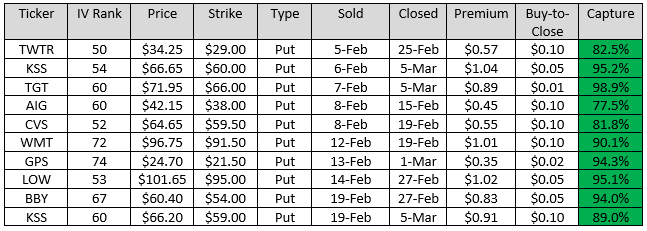

The high IV Rank provides rich premium and as the option lifecycle unfolds and this volatility decreases, the option time value implodes, and the option decreases in value allowing profits to be realized earlier in the lifecycle without waiting until the expiration of the contract (Figures 3 and 4). Leading to consistent income generation in a high-probability manner without guessing which way the stock will move (Table 1).

Figure 3 – Twitter (TWTR) showing spikes in IV Rank in April, July, October, December, and April with subsequent IV Rank implosion

Figure 4 – Target (TGT) showing spikes in IV Rank in May, August, November, December, and February with subsequent IV Rank implosion

Table 1 – 10 examples of selling options in high IV Rank situations to generate income

Conclusion

IV Rank is by far the most important concept and most critical variable when it comes to long-term successful options trading. Since option pricing is determined by IV, the option itself will rise and fall as IV or the expectation of volatility changes. IV largely determines whether or not options are relatively cheap or expensive. Historically, this predicted volatility always overestimates actual volatility, and it’s this overestimation that can be exploited to the benefit to option sellers, providing that edge. When IV Rank reaches a value of greater than 50, then option sellers can use this to their advantage to take in rich options premium with the expectation that this implied volatility will decrease. Any value above the 50 threshold is where the overestimation of actual volatility thrives and options sellers can take in rich premiums with the expectation that IV will fall thus the option itself will fall in value. This provides an opportunity to sell options with rich premiums, and as IV falls, the option can expire worthless and/or the seller can buy-to-close to realize profits prior to expiration. As the option lifecycle unfolds and this volatility decreases, the option time value implodes, and the option decreases in value allowing profits to be realized earlier in the lifecycle without waiting until the expiration of the contract. Leading to consistent income generation in a high-probability manner without guessing which way the stock will move.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.