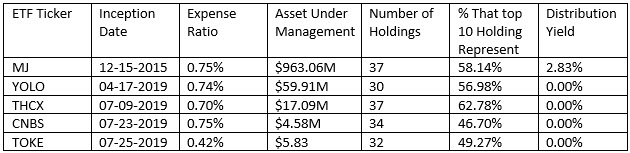

Until April Exchange Traded Fund investors only had one legitimate option, the ETFMG Alternative Harvest ETF (MJ), if they wanted to invest in the marijuana industry. But in April the AdvisoreShares Pure Cannabis ETF (YOLO) began trading. Then in July, the industry saw a marijuana boom when three new ETFs focused on the controversial industry began trading. On July 9th The Cannabis ETF (THCX) began trading, then the 23rd saw the Amplify Seymour Cannabis ETF (CNBS) begin trading and finally on the 25th the Cambria Cannabis ETF (TOKE) opened for business.

Before we get into the differences of each ETF, I wanted to let everyone know that for the most part, all five of these ETFs are rather easy to buy. In the past when I have written about the marijuana ETFs, I often mentioned the Horizons Marijuana Life Sciences Index ETF (HMMJ) which is actually traded on the Toronto Stock Exchange. Thus for U.S. investors, it can be difficult to purchase this fund unless you have an account which allows trading on foreign exchanges and in my experience, most retail investors don’t have those types of accounts.

I know these five are all easy to buy because I actually bought all five of them. I have two different brokerage accounts, one with Merrill Lynch and one with TD Ameritrade. The TD account allowed me to purchase all five ETFs with absolutely no issues and the Merrill Lynch account allowed me to buy MJ no problem. However, the Merrill Lynch account required that I call in and have a Merrill Lynch representative assist with the purchase of YOLO, THCX, CNBS, and TOKE, but not because they were marijuana ETFs but because they were thinly traded or had small asset bases.

So, let’s take a look at the five US listed marijuana ETFs and see what makes them different.

From the surface, it would appear the only viable option at this time is to buy MJ and be down with your search. MJ is the clear leader in terms of assets, has essentially the same cost as three of the four other funds, the same number of holdings as the others with the top ten holdings representing a very similar percent. Furthermore, MJ is the only fund that currently offers a yield and did I mention the only one that you can find historical data on for more than a few weeks? (MJ is up 6.19% over the past year but down 22% over the last three months).

On the other side, the other four ETFs just don’t have long enough history to have yet been able to offer a distribution yield, or show their long-term historical averages or even been able to go out and raise a reasonable amount of capital.

From a holding standpoint, MJ, THCX, CNBS, and TOKE all seem to hold the big names in the marijuana industry in their top ten holdings. Companies like Aurora Cannabis Inc., GW Pharmaceuticals, Tilray, Inc, Canopy Growth Corp., and Aphria Inc. These companies are all very well-known buy marijuana industry investors but besides Aphria Inc., don’t hold a position in YOLO’s top ten positions, but of course hold spots in YOLO’s portfolio.

While I own shares of all five ETFs today, that is not my plan long-term. I will eventually sell off the shares of four of the five ETFs and only hold the one. How and when that will happen is unknown, but I don’t believe I will be making any sales until we get more information about the four ETFs that have been released this summer, which is something I have warned investors about waiting for in the past. The only reason I broke my own rule this time was to see how difficult it was going to be to purchase these five ETFs due to their somewhat questionable legal status.

Stay tuned for the follow-up piece on when I announce which of the five marijuana ETFs I sell and which of the five I keep.

Matt Thalman

INO.com Contributor - ETFs

Follow me on Twitter @mthalman5513

Disclosure: This contributor held shares of AdvisoreShares Pure Cannabis ETF, ETFMG Alternative Harvest ETF, Cambria Cannabis ETF, The Cannabis ETF, and Amplify Seymour Cannabis ETF at the time this blog post was published. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.