With the S&P 500 (SPX) ending the year up 28.9%, the Dow Jones Industrial Average (DJI) rose 22.3%, and the NASDAQ (IXIC) increased by 35.2% in 2019, much of the year it felt like no matter what you were invested in you were making money. And for the most part, that was true. Some investors made more than others because they had picked what would become the ETF winners of the year.

Did you see market returns, or were you invested in the ETFs that beat the averages and in some cases by a lot? Let’s take a look at the top five best performing ETFs of 2019 in several different categories the average investor has to choose from.

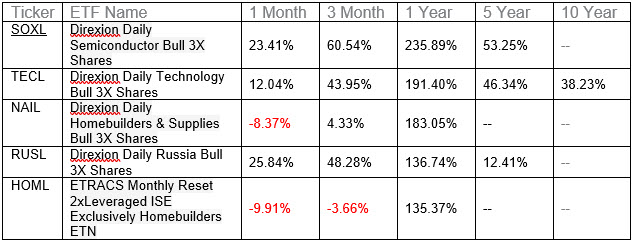

The following table shows the performance of the top five best performing ETFs in 2019, as well as their performance over the last month, the previous three months, the last five and ten years.

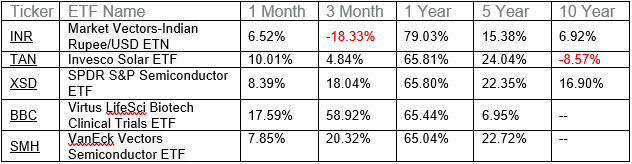

The following table shows the performance of the top five Non-Leveraged ETFs in 2019, as well as their performance over the last month, the previous three months, the last five and ten years.

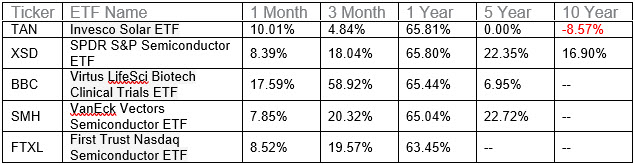

The following table shows the performance of the top five Equity Non-Leveraged ETFs in 2019, as well as their performance over the last month, the last three months, the last five and ten years.

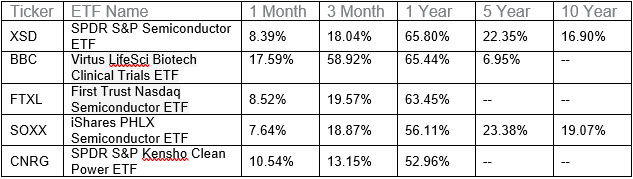

The following table shows the performance of the top five US Equity Non-Leveraged ETFs in 2019, as well as their performance over the last month, the last three months, the last five and ten years.

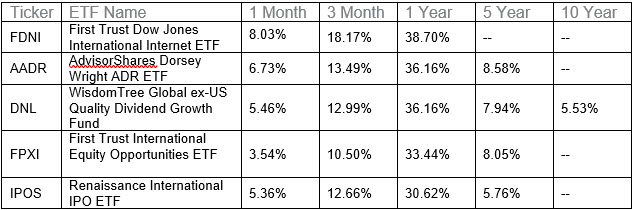

The following table shows the performance of the top five Global Ex-US Equity Non-Leveraged ETFs in 2019, as well as their performance over the last month, the last three months, the last five and ten years.

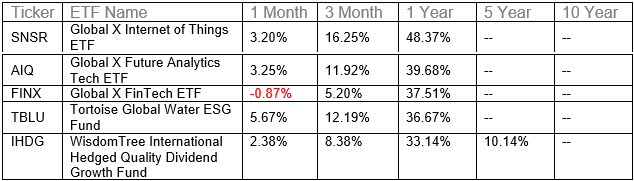

The following table shows the performance of the top five Developed Markets Equity Non-Leveraged ETFs in 2019, as well as their performance over the last month, the last three months, the last five and ten years.

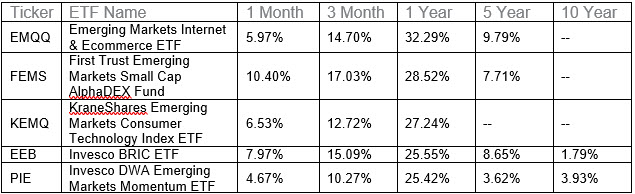

The following table shows the performance of the top five Emerging Markets Equity Non-Leveraged ETFs in 2019, as well as their performance over the last month, the last three months, the last five and ten years.

The following table shows the performance of the top five European Equity Non-Leveraged ETFs in 2019, as well as their performance over the last month, the last three months, the last five and ten years.

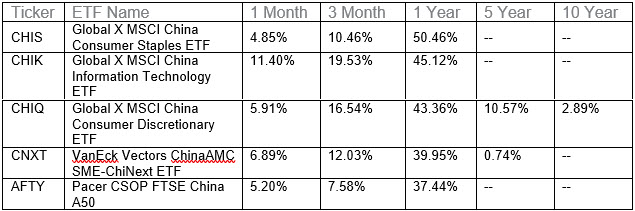

The following table shows the performance of the top five Asian-Pacific Equity Non-Leveraged ETFs in 2019, as well as their performance over the last month, the last three months, the last five and ten years.

The following table shows the performance of the top five Latin American Equity Non-Leveraged ETFs in 2019, as well as their performance over the last month, the last three months, the last five and ten years.

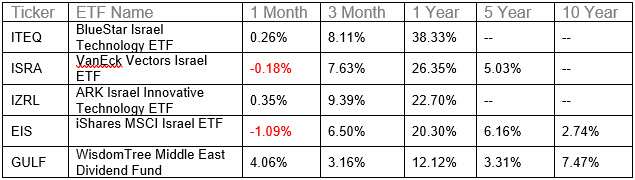

The following table shows the performance of the top five Middle-Eastern and African Equity Non-Leveraged ETFs in 2019, as well as their performance over the last month, the last three months, the last five and ten years.

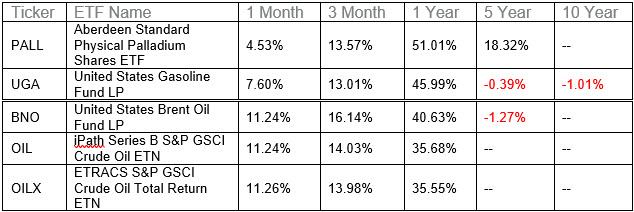

The following table shows the performance of the top five Commodity Non-Leveraged ETFs in 2019, as well as their performance over the last month, the last three months, the last five and ten years.

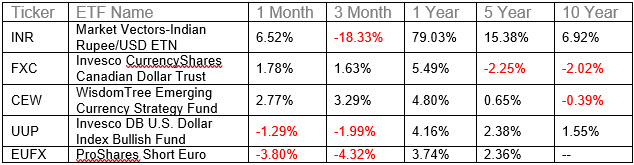

The following table shows the performance of the top five Currency Non-Leveraged ETFs in 2019, as well as their performance over the last month, the last three months, the last five and ten years.

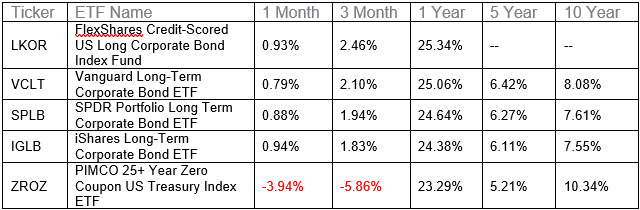

The following table shows the performance of the top five Fixed Income Non-Leveraged ETFs in 2019, as well as their performance over the last month, the last three months, the last five and ten years.

(All figures quoted above are based on December 31st, 2019 closing price)

Clearly, leverage produced the biggest winners in 2019, but even if you’re like me and prefer to stay away from the levered products, you could have still beat the major indexes with a number of different investments made throughout a number of different countries around the world. So, going into 2020, just remember that there may be only one best ETF of the year, but you don’t have to pick the very best in order to beat the market and see sizeable returns.

Best of luck to all investors in 2020!

Matt Thalman

INO.com Contributor - ETFs

Follow me on Twitter @mthalman5513

Disclosure: This contributor held long positions in Apple, Tesla, Intel, Google, Amazon.com, Facebook, Priceline and Microsoft at the time this blog post was published. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Este año 2020 va con buenos pronósticos, en el área de la tecnología, mejora de la productividad en el sector agropecuario, y

tambien financiero en países, como Norteamérica, Sudamérica, China la India.

El comportamiento de los indices en EE UU va a tener una buena expectativa de crecimiento porcentual.

Saludos

Daniel Lozada C

"This year 2020 goes with good forecasts, in the area of technology, productivity improvement in the agricultural sector, and

also financial in countries, such as North America, South America, China, India. The behavior of the indexes in the US will have a good expectation of percentage growth".

Translated using Google Translate