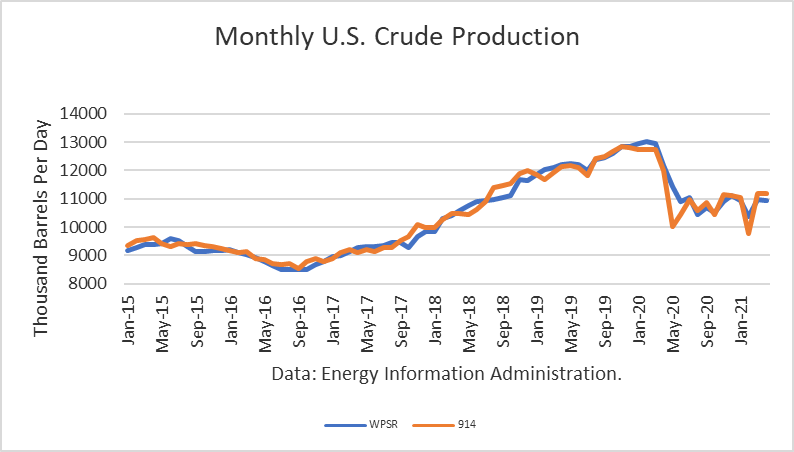

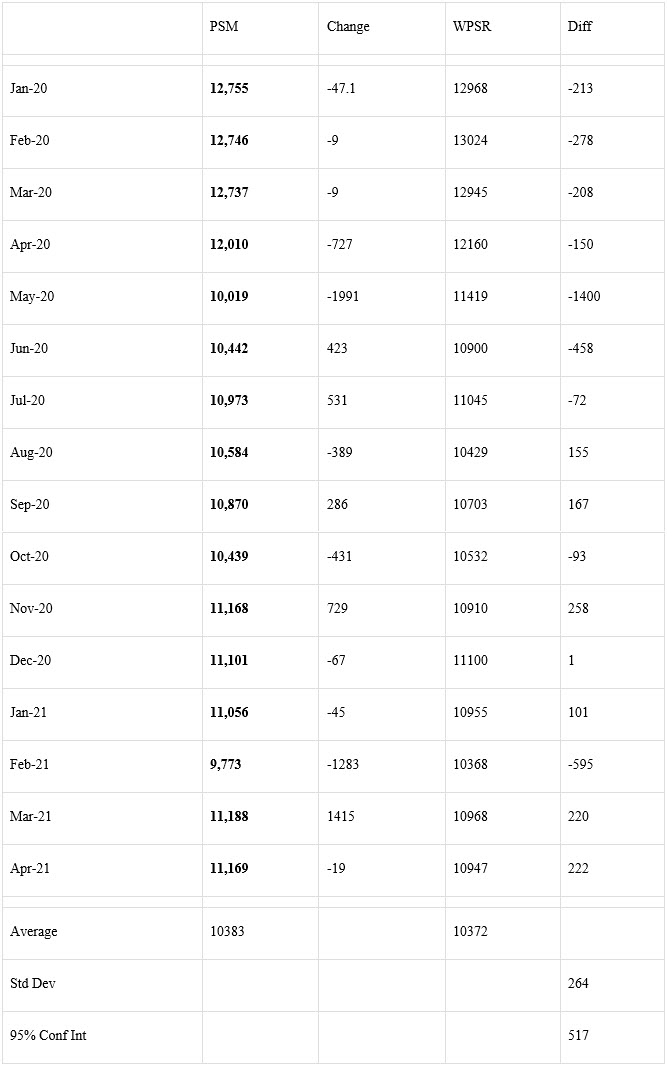

The Energy Information Administration reported that April crude oil production dipped 19,000 barrels per day, averaging 11.169 mmbd. This follows a gain of 1.415 mmb/d in March as production returned after the freeze in Texas. In addition, the April 914 figure compares to the EIA’s weekly estimates (interpolated) of 10.947 mmbd, a figure that was 222,000 lower than the actual 914 monthly estimate.

A large decline in the Gulf of Mexico (92,000 b/d) caused a dip in U.S. production. However, that drop was largely offset by gains in Colorado (31,000 b/d), Texas (28,000), and New Mexico (17,000).

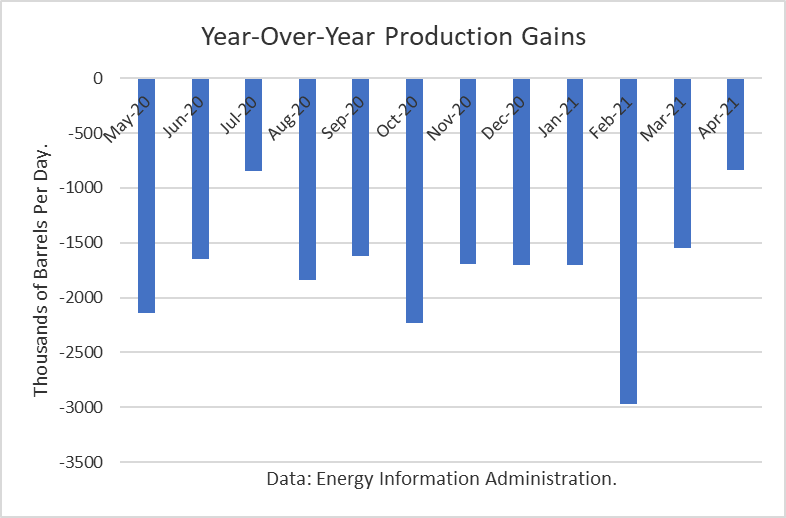

Given the huge reduction in May 2020, production dropped by 841,000 b/d over the past 12 months. This number only includes crude oil.

The EIA-914 Petroleum Supply Monthly (PSM) average figure was nearly identical to the weekly data average reported by EIA in the Weekly Petroleum Supply Report (WPSR).

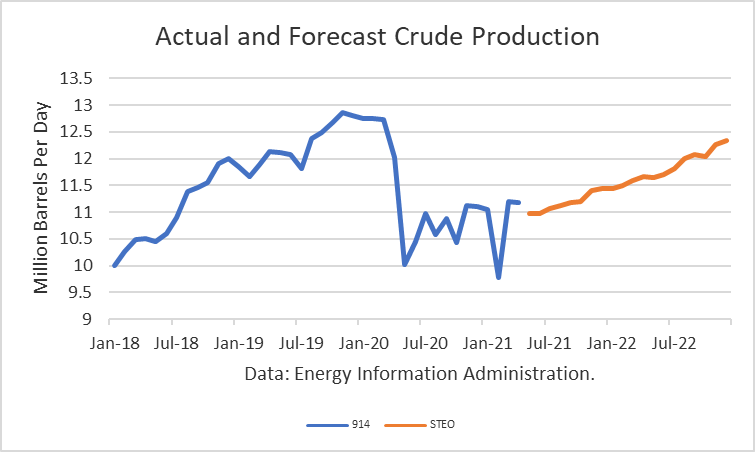

The 914 figure was about 203,000 higher than the 10.970 mmbd estimate for that month in the May Short-Term Outlook. This difference is enough to trigger a “rebenchmarking” to EIA’s model in future production levels.

The EIA is projecting that 2021 production will exit the year at 11.43 mmbd. And for 2022, it projects an exit at 12.330 mmbd.

Drilling rigs have been steadily rising, and the August WTI contract has rebounded to $ 73.46 /bbl.

Conclusions

The unprecedented oil price collapse of 2020 has not only been totally erased, but WTI is at its highest level since late 2018, when the market expected Iranian crude exports to be halted. Moreover, U.S. crude production has responded to a limited extent. Still, it appears that EIA projections for low growth in 2021 and 2022 may be too pessimistic, and EIA's model has been underestimating production.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.