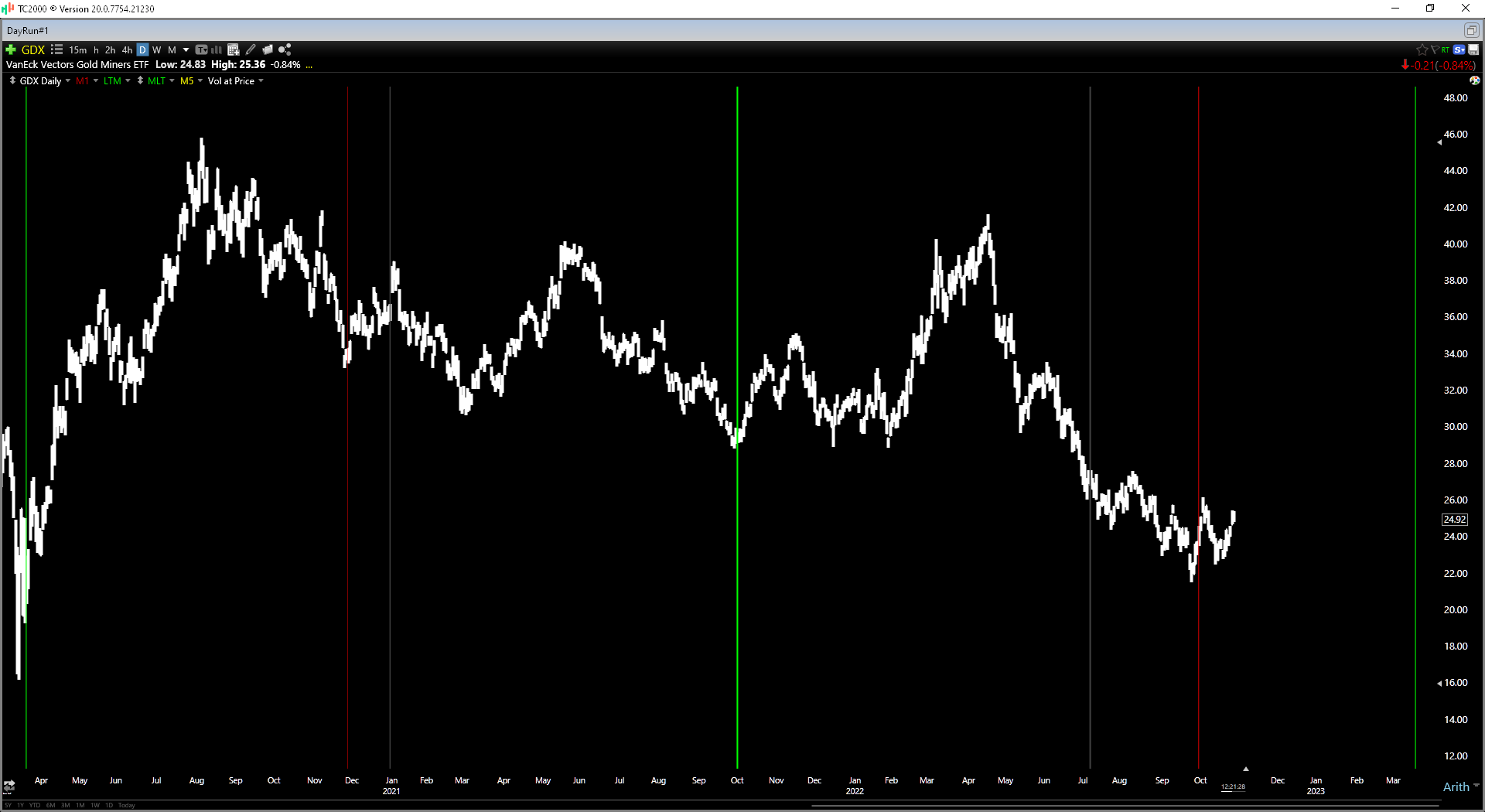

It’s been a challenging two years for investors in the gold space, with the metals making no progress since Q3 2020 and the Gold Miners Index (GDX) suffering a 52% decline from its highs.

This violent bear market can be attributed to significant margin compression for most gold producers, with them being hit by inflationary pressures (fuel, steel, cyanide, labor) and the impact of a lower gold price on sales.

The result? Margins are down over 25% on average from Q3 2020 peak levels.

On the surface, this might not seem like a very attractive investment thesis given that gold producers are price-takers, gold continues to trend lower, and they’re already seeing margin compression at $1,660/oz.

However, the 52% correction in the GDX has left sector-wide valuations at their lowest levels since 2018, when all-in-sustaining cost margins were at $200/oz, nowhere near the $500/oz margins currently.

Hence, I believe this negativity is more than priced into the sector, especially if gold can find a floor near $1,600/oz, which looks likely given that we have extreme pessimism.

That said, not all miners are created equal, so it’s essential to focus on quality and those names bucking the margin trend. In this update, we’ll look at two names trading at deep discounts to net asset value that have outstanding business models:

Agnico Eagle Mines (AEM)

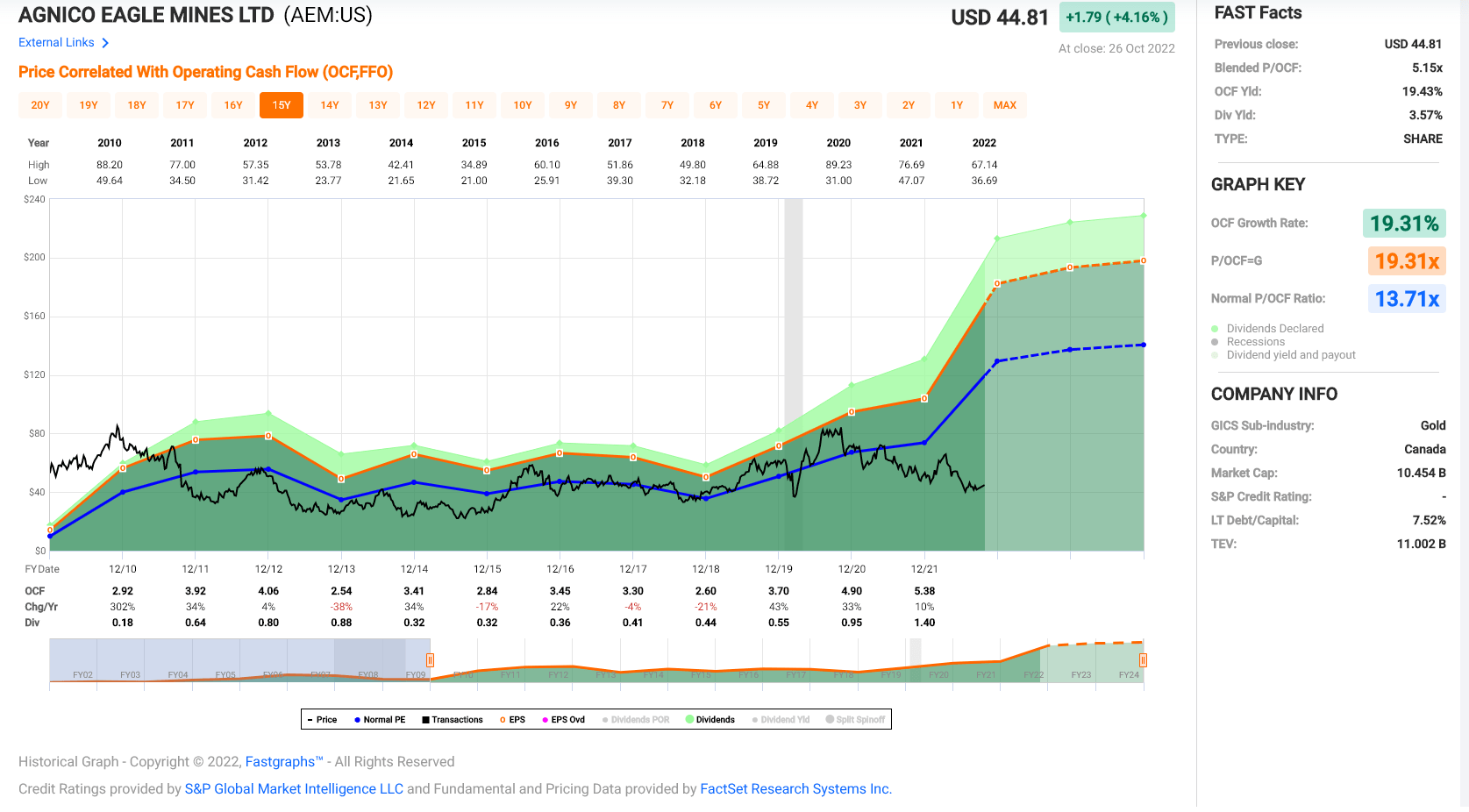

Agnico Eagle (AEM) is the world’s third-largest gold producer with a $20.3BB market cap. The company has 11 mines in four countries (Australia, Canada, Mexico, and Finland), with over 95% of its gold production coming from Tier-1 ranked jurisdictions, deemed to be the most favorable from a permitting and geopolitical standpoint.

The company recently released its Q3 2022 production results and produced 817,000 ounces of gold at $779/oz costs, a significant increase from the year-ago period due to its merger with Kirkland Lake Gold.

While most producers in the sector have seen a $150/oz increase in costs since Q3 2020 due to inflationary pressures, Agnico Eagle has been much more resilient than its peers, seeing only a $50/oz increase. This is because it’s benefiting from significant corporate and operational synergies related to its merger, potentially shaving up to $50/oz off its all-in-sustaining costs.

Meanwhile, the merger brought three lower-cost mines into Agnico’s portfolio, reducing the consolidated costs for the portfolio. Hence, Agnico Eagle is bucking this trend, yet it’s still been sold off similarly to the GDX, down 50% from its highs.

Following this violent decline in the share price despite much better cost performance than its peer group, Agnico has found itself trading at just ~8.3x FY2022 cash flow estimates ($5.41) at a share price of $45.00. This is a massive discount to its historical cash flow multiple of 13.7, and this discount makes even less sense given that AEM should trade at a premium to its historical multiple.

The reason is that it now has a larger and more diversified portfolio, two of the highest-grade mines globally (Fosterville and Macassa), and higher margins due to its lower costs.

Based on what I believe to be a fair multiple of 13.0x cash flow, I see a fair value for the stock of $70.20. Hence, I see this multi-quarter correction as a gift with a ~57% upside to its target price.

i-80 Gold (IAUX)

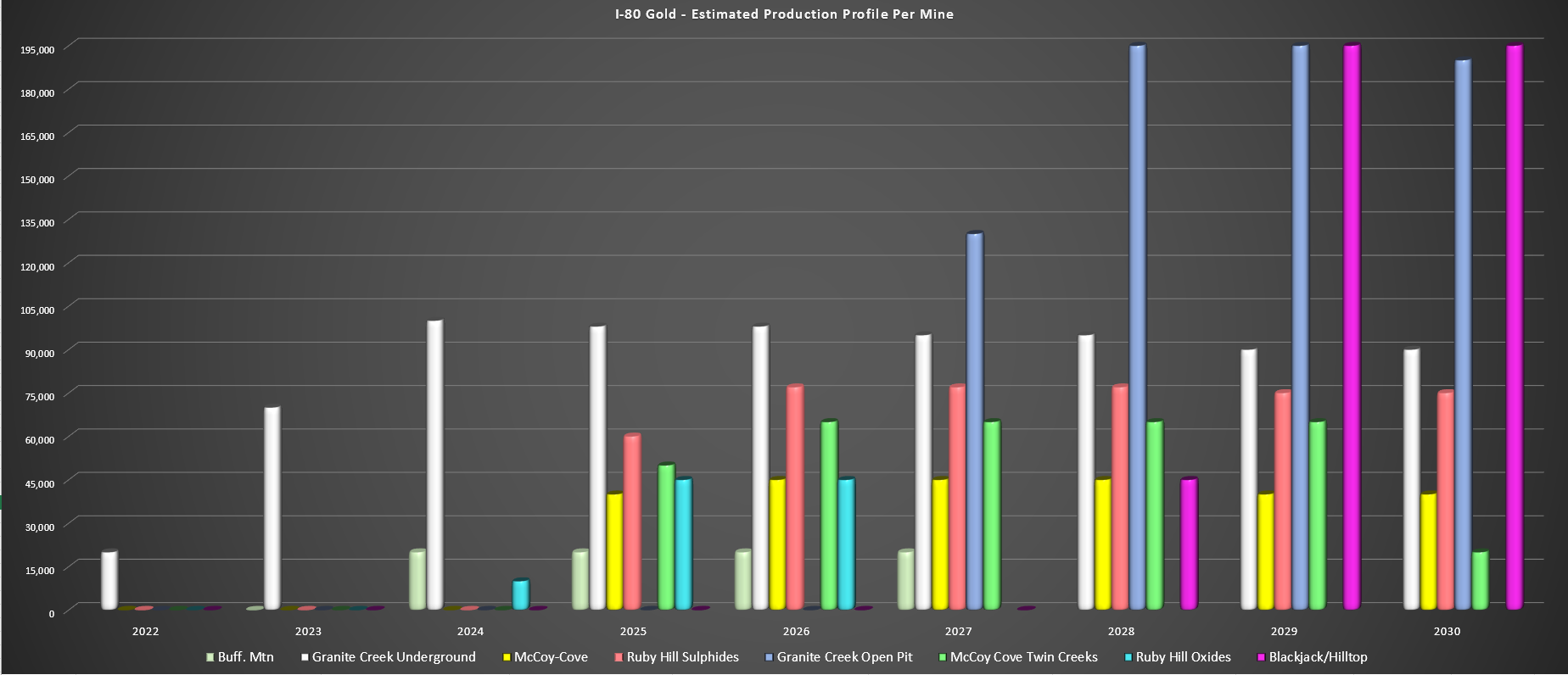

i-80 Gold (IAUX) is a much smaller cap company with a market cap of $400MM that has an industry-leading production growth rate.

Usually, I do not invest in small-cap gold stocks, given that there are more than enough options in the mid-cap and large-cap producer space. However, occasionally an opportunity comes along that is far too interesting to pass up, which is the case here.

This is because i-80 Gold is expected to be a 70,000-ounce producer in FY2023, but plans to increase production to more than 250,000 ounces by 2025 and over 500,000 ounces by 2028.

Notably, all of its assets are in the #1 ranked mining jurisdiction globally due to infrastructure, geologic potential, and ease of permitting: Nevada.

On top of this exceptional growth rate and a relatively simple Hub & Spoke model that it plans to employ (three mines feeding a centralized autoclave facility), i-80 Gold continues to hit some of the highest-grade intercepts sector-wide at its Ruby Hill and Granite Creek Projects.

In fact, the drill results at these properties are in line with the grades we’re seeing from the best projects held by $20BB+ companies, and this should help i-80 Gold to increase its resource base from 15.0 million ounces of gold to more than 19.0 million ounces of gold over the next two years.

This would leave i-80 Gold trading at a valuation of just $21.00/oz for a company that’s expected to extract gold at less than $1,000/oz costs ($700/oz margin).

It’s also worth noting that this $21.00/oz market cap per ounce figure doesn’t factor in the company’s $100MM in cash on its balance sheet.

So, why is the stock down sharply over the past month?

During a bear market, good news often gets ignored, and when it comes to tax-loss selling and redemptions, investors sell without logic and because they have to, with this form of forced selling occasionally leaving stocks trading at deep value levels.

I believe this is the case for i-80 Gold, given that the company has released world-class polymetallic results which the market yawned at, and it added more ounces at one of its flagship projects, and the result was that the stock was sold off further.

So, for those that understand the story closely, this has created a phenomenal opportunity to start a position.

If i-80 can deliver on its promises, I see a fair value for the stock of $1.45BB (1.0x price to net asset value) or US$4.90 per share by 2025 (190% upside).

If it delivers on its stretch targets, I would not be surprised to see the stock trade above US$6.00 by 2026.

In summary, I see this pullback as one of the best buying opportunities in the gold sector I’ve seen in the 15 years I’ve traded the sector; I plan to continue accumulating the stock on weakness below US$1.90.

Disclosure: I am long AEM, IAUX

Taylor Dart

INO.com Contributor

Disclaimer: This article is the opinion of the contributor themselves. Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information in this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.

Soy Santiago Romero soy sabios y acertados ganáis de las dos maneras a la baja y cuando sube enhorabuena vuestro santiago Romero