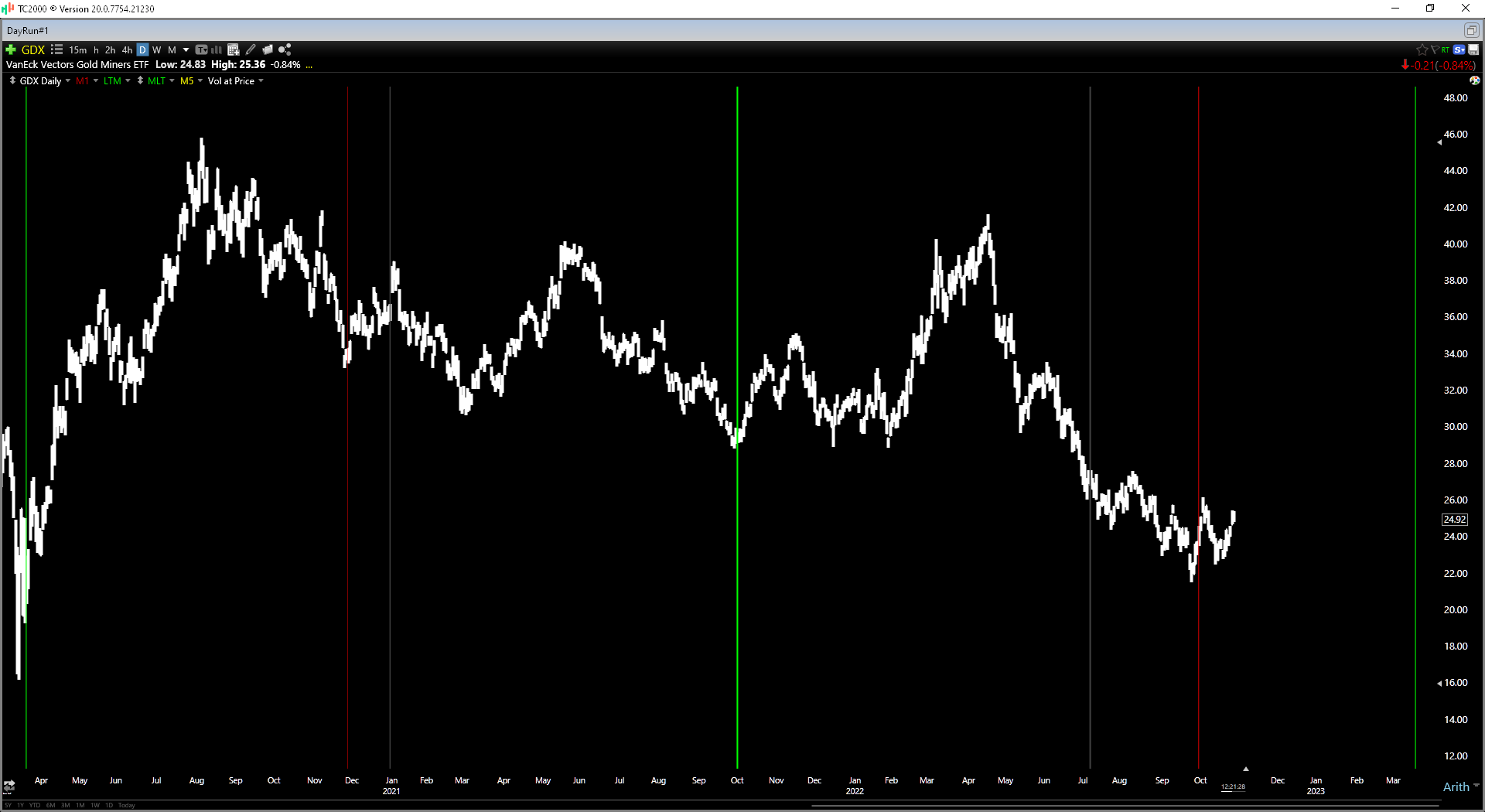

While 2022 was a year to forget for the major market averages, the Gold Miners Index (GDX) managed to claw its way back from significant underperformance to finish the year down just 10%, outperforming the S&P 500 (SPY) by 1000 basis points.

Fortunately for investors in the gold space, we’ve seen follow-through to this outperformance to start the new year, with the GDX up 13% year-to-date and back into positive territory on a 1-year trailing basis.

However, while the index may be up sharply off its lows and gold miners are outperforming most stocks, this doesn’t mean that any miner can be bought on dips, and a few have become expensive and increasingly risky now that they’re up more than 50% off their Q3 2022 lows.

In this update, we’ll look at two names that continue to fire on all cylinders and are much safer ways to buy any upcoming pullbacks in the space, given their operational excellence, attractive dividend yields, and superior diversification vs. their peer group.

Let’s take a closer look below:

Agnico Eagle Mines (AEM)

Agnico Eagle Mines (AEM) is the world’s third-largest gold producer and has been one of the busiest companies in the sector from an M&A standpoint.

In Q1 2022, the company closed its merger with the 9th largest gold producer globally, Kirkland Lake Gold, and is now in the process of acquiring Yamana Gold’s Canadian assets in a two-way acquisition with Pan American Silver (PAAS).

The result of these two acquisitions is that the company will grow into a ~3.9 million-ounce producer by 2024 (assuming the Yamana deal closes), placing it just behind Barrick Gold (GOLD) for the #2 spot among the world’s largest gold miners.

The result of this M&A activity is that Agnico Eagle now has ten mines in the safest mining jurisdictions globally (up from seven previously) and will gain the other 50% ownership of one of its largest gold mines in Quebec if the Yamana deal closes. Continue reading "Get Exposure To Gold With These 2 Leaders"