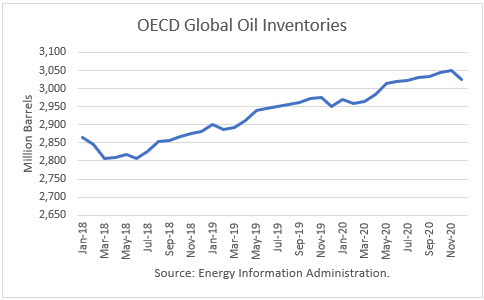

The Energy Information Administration released its Short-Term Energy Outlook for January, and it shows that OECD oil inventories likely bottomed last June at 2.806 billion barrels. It estimated an 8 barrel gain for December to 2.883 billion, 39 million barrels higher than a year ago.

Throughout 2019, OECD inventories are generally expected to rise. At year-end, EIA projects ending the year with 2.951 million barrels, 68 million more than at the end of 2018.

EIA also extended its outlook through 2020 for the first time. It projects that stocks will build another 75 million barrels to end the year at 3.025 billion. That would push stocks into glut territory.

Oil Price Implications

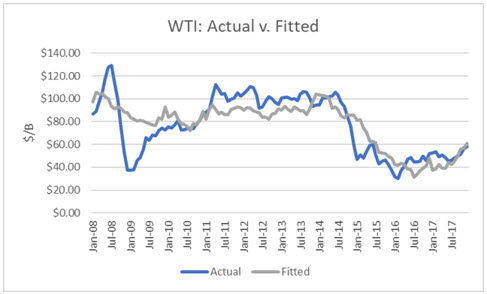

I performed a simple linear regression between OECD oil inventories and WTI crude oil prices for the period 2008 through 2017. As expected, there are periods where the price deviates greatly from the regression model. But overall, the model provides a reasonably high r-square result of 79 percent.

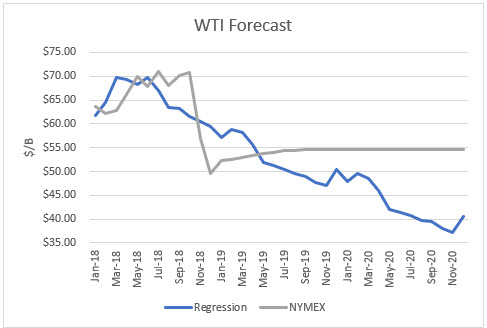

I used the model to assess WTI oil prices for the EIA forecast period through 2019 and compared the regression equation forecast to actual NYMEX futures prices as of January 16th. The result is that oil futures prices are presently undervalued though from May and beyond, they are overvalued. In August 2019, oil prices would drop into the low $40s if these inventories are realized. And in the latter part of 2020, oil prices would drop below $40.

Conclusions

Based purely on this model, the oil price crash was overdone. However, the market was shocked by the sudden oversupply since it was expecting an undersupply once sanctions went into effect.

U.S. oil inventories have been building fast, taking into account both crude and products. And so the price recovery following the crash is subject to another round of selling sooner or later.

Two ‘surprises’ that could jolt the market in 2019 are that the OPEC+ cut of 1.2 million barrels per day is not actually occurring, and Trump may cut a deal with Iran, ending the sanctions. In the first case, there is no evidence that the Russians and other non-OPEC producers have cut anything like 400,000 b/d as promised. In the second case, Iran’s economy is suffering, and Trump would probably be happy to make a deal if Iran agrees to his terms.

According to this analysis:

“Anyone certain that the Iranians won't negotiate any modifications on the nuclear deal shouldn't be so sure. Domestic pressures and the readiness of the Russians to play the arbiter role can provide the Iranians an out. Their history suggests they will go for it.”

A deal with Iran ending the sanctions would result in the unleashing of Iran’s additional exports of more than 1 million barrels per day. I would doubt Saudi Arabia and friends would be willing to cut again to make room for Iran.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Those prices will self-govern Permian activity. Look for another slowdown which would have a big effect on supplies.

Those stats are of concern to me as one that wants higher oil prices. Logically it would seem to me that Saudi Arabia, Opec + Russia will have to match over supply with cuts if they are to survive economically, at least in the short term. Even 2 or 3 MBD cuts make sense if they can sell for 40% more. They still hold over 50% of world supply and currently about 46% of global production.