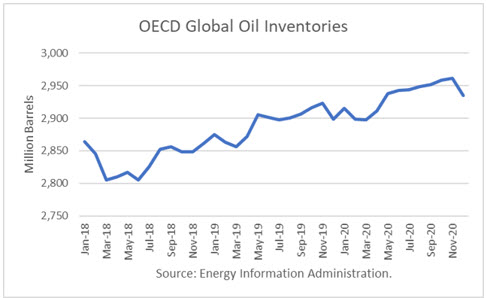

The Energy Information Administration released its Short-Term Energy Outlook for July, and it shows that OECD oil inventories likely bottomed last June 2018 at 2.805 billion barrels. It estimated stocks dipped by 4 million barrels in June 2019 to 2.902 billion, 97 million barrels higher than a year ago.

However, throughout 2019, OECD inventories are no longer expected to rise any further, on balance. At year-end, EIA projects 2019 to be with 2.899 million barrels, 37 million more than at the end of 2018. For 2020, EIA projects that stocks will build 35 million barrels to end the year at 2.934 billion.

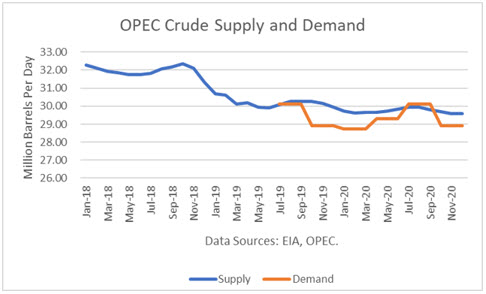

The EIA has revised its estimates for future OPEC production down significantly, given the sanctions on both Iran and Venezuela. For much of the balance of 2019 and 2020, it expects OPEC production to remain under 30 million barrels per day. June was reported at 29.8 mmbd.

OPEC has revised its call (demand) for OPEC oil. For 2020, the average is 29.2 mmbd. Therefore, OPEC must cut supply by another 550,000 b/d from June next year just to balance stocks.

Oil Price Implications

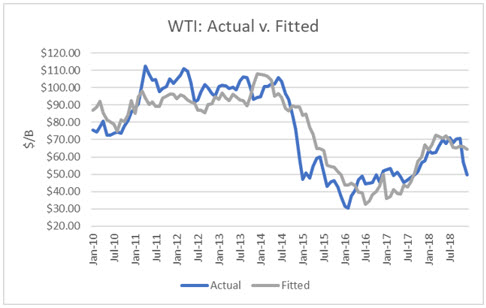

I updated my linear regression between OECD oil inventories and WTI crude oil prices for the period 2010 through 2018. As expected, there are periods where the price deviates greatly from the regression model. But overall, the model provides a reasonably high r-square result of 80 percent.

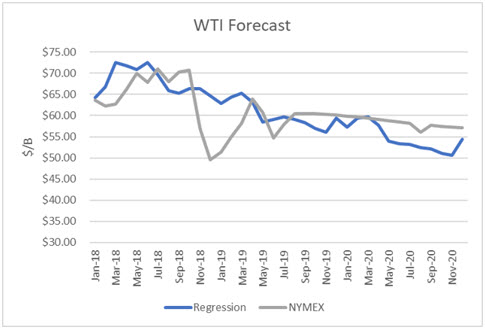

I used the model to assess WTI oil prices for the EIA forecast period through 2019 and 2020 and compared the regression equation forecast to actual NYMEX futures prices as of July 10th. The result is that oil futures prices are presently overvalued throughout much of the forecast period.

After April 2020, it shows the valuations dropping down to where NYMEX futures prices are in the low $50s. More below on the uncertainties of a single projection.

Uncertainties

The 4Q18 proved that oil prices can move dramatically based on expectations and that they can drop far below the model’s valuations. The recent unexpected builds in U.S. inventories have caused prices to be far softer than the model suggests.

OPEC+ recently decided to roll-over the December 2018 agreement. However, OPEC’s June production is already below that limit.

Saudi energy minister Khalid Al-Falih recently told reports that Aramco would adjust its production as needed to balance stocks to make room for shale. Given OPEC’s forecast for demand to drop, KSA will be under pressure to make another cut starting in the 4Q19 from its June output of 10.1 mmbd.

President Trump wants to keep oil prices down to enable the economy to continue growing as the 2020 election cycle is about to begin. One “surprise” he may have in mind is settling with Iran. Although the parties do not appear to be close publicly, there are back channels that are reportedly meeting to help broker a deal.

I think it is likely he will come to terms with Iran before the election because it would remove the sanctions and allow Iran to put about 2 million barrels per day into the market. In that event, oil prices would collapse.

Finally, Venezuela remains a key uncertainty. EIA estimated its production at 730,000 b/d for June. However, if and when a Western-friendly government takes over, reviving the oil industry will be a key goal, and it could unlock the potential to put another 2 million barrels a day into the world market.

Conclusions

Based purely on the model, oil prices are currently overvalued. OPEC production is in retreat, and the base case by EIA and OPEC is that demand for its oil will drop to the low 29 mmbd average. It will be up to Saudi Aramco to reduce production to balance stocks.

A settlement with Iran could spell disaster for oil prices. So I think Trump will do the deal if he can to get prices low for the 2020 election.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

The US horizontal industry is hanging itself, and everyone else along with them. They cannot make money at $50/b oil and $2/mcf gas. Yet they insist on building our domestic production through the roof and gobbling up every bit of the global demand increase year after year. Hey, it's a free market alright. You're free to go bankrupt. Their lack of discipline is hastening the day of reckoning that is coming.

This is what you get when governments report statistics (EIA) and control prices (the futures market) and control production (Saudi Arabia, Iran and Venezuela). Good luck to private, non-crony producers.