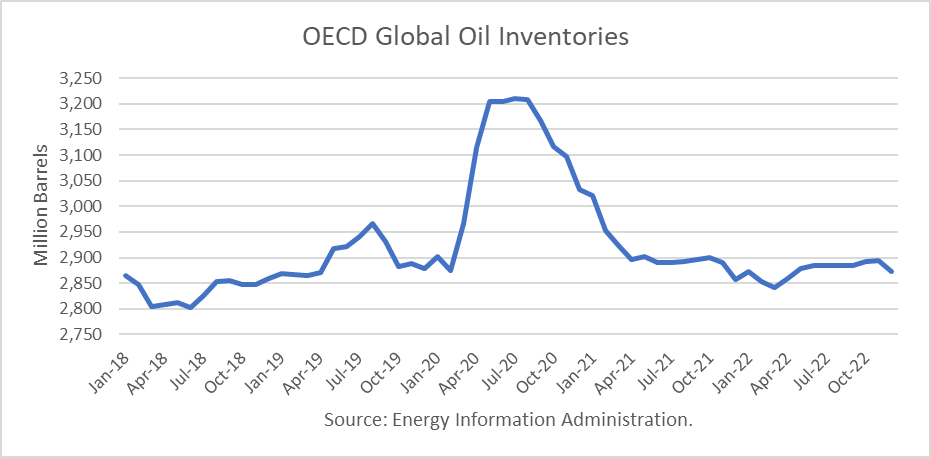

The Energy Information Administration released its Short-Term Energy Outlook for June, and it shows that OECD oil inventories likely peaked at 3.210 billion in July 2020. In May 2021, it estimated stocks rose by 4 million barrels to end at 2.901 billion, 298 million barrels lower than a year ago.

The EIA estimated global oil production at 95.02 million barrels per day (mmbd) for May, compared to global oil consumption of 96.22 mmbd. That implies an undersupply of 1.20 mmb/d, or 37 million barrels for the month. Given the increase in OECD stocks, non-OECD stocks dropped by 41 million barrels.

For 2021, OECD inventories are now projected to draw by net 149 million barrels to 2.877 billion. For 2022 it forecasts that stocks will build by 80 million barrels to end the year at 2.957 billion.

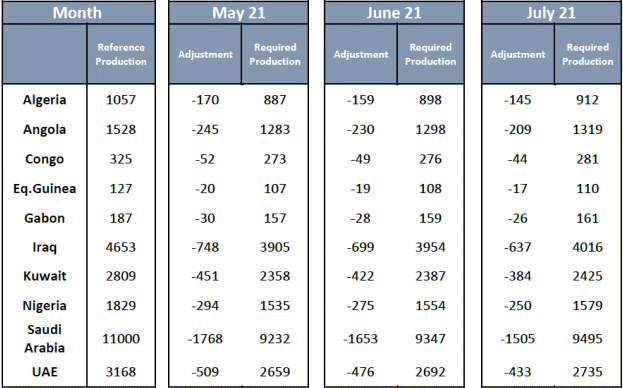

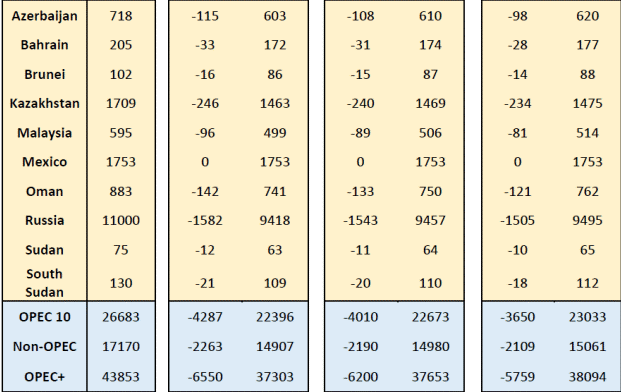

The EIA forecast was made incorporates the OPEC+ decision to cut production and exports. According to OPEC’s press release June 1, 2021:

"Reconfirmed the existing commitment of the 10th OPEC and non-OPEC Ministerial Meeting in April 2020, amended in June, September, and December 2020, as well as in January and April 2021 to gradually return 2 million barrels a day (mb/d) of the adjustments to the market, with the pace being determined according to market conditions.”

The adjustments to the production level for May to July 2021 will be implemented as per the distribution detailed in the table below.

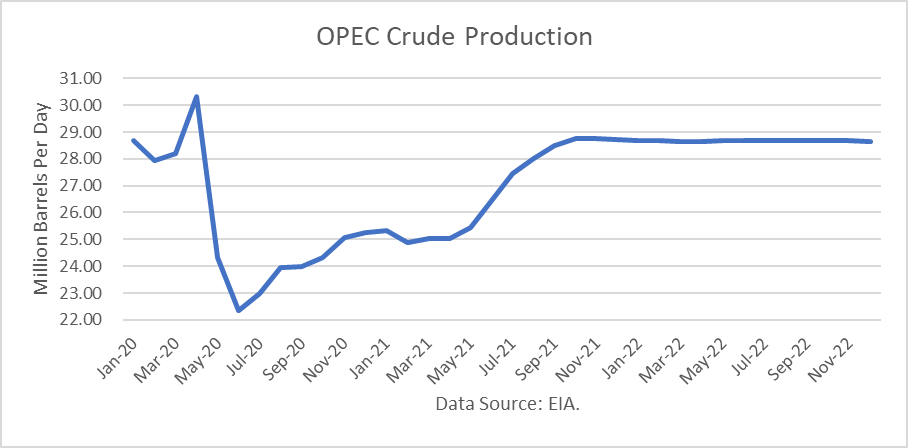

The EIA has assumed the following OPEC production levels for its STEO:

Oil Price Implications

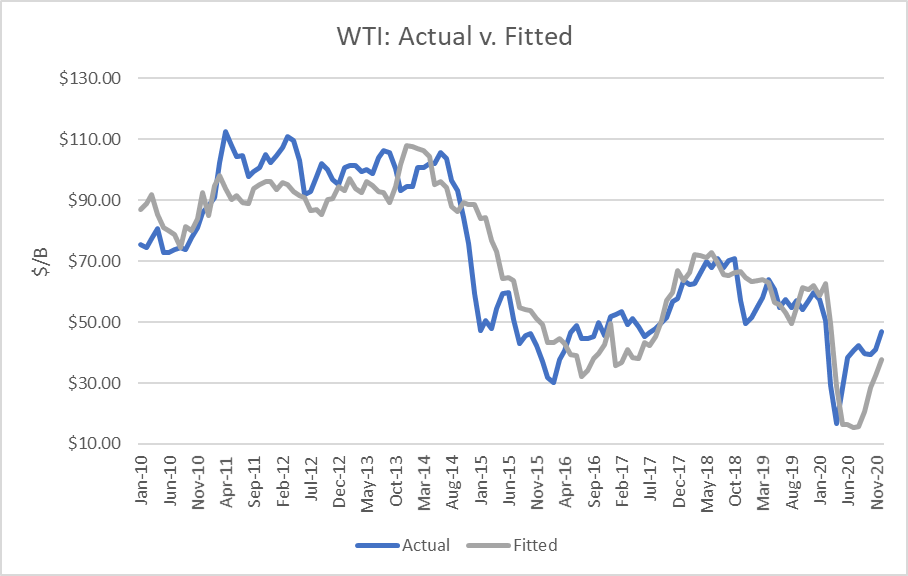

I updated my linear regression between OECD oil inventories and WTI crude oil prices for the period 2010 through 2020. As expected, there are periods where the price deviates greatly from the regression model. But overall, the model provides a reasonably high r-square result of 82 percent.

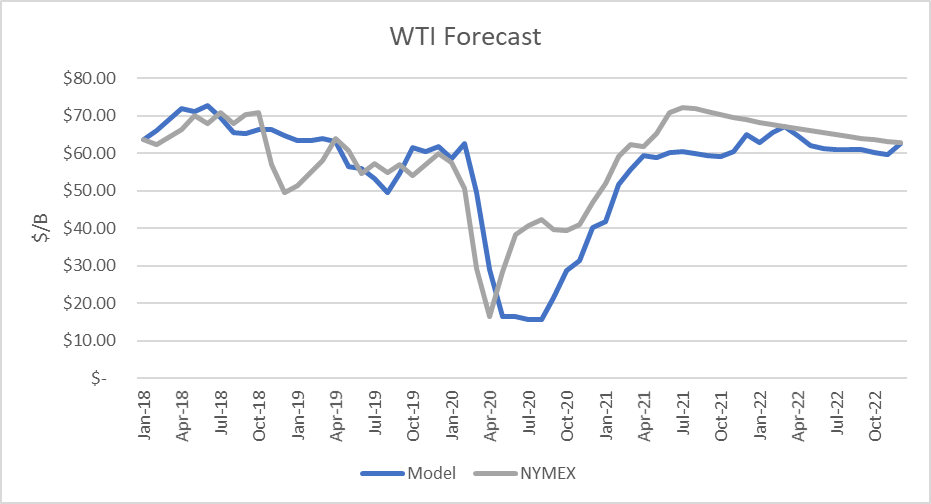

I used the model to assess WTI oil prices for the EIA forecast period through 2021 and 2022 and compared the regression equation forecast to actual NYMEX futures prices as of June 14th. The result is that oil futures prices are presently overpriced through November 2021 but then overpriced for much of the forecast horizon ending December 2022.

Uncertainties

April 2020 proved that oil prices can move dramatically based on market expectations and that they can drop far below the model’s valuations. In contrast, prices through May 2021 proved that the market factors in future expectations beyond current inventory levels.

In addition to the uncertainty of how deeply and how long the coronavirus will disrupt the U.S. and world oil consumption. The U.S. economy is fully opening, though there are reports by companies, notably Apple, that employees would prefer to work mainly from home. If so, that will change commuter fuel use indefinitely.

Another uncertainty is whether the U.S. will lift sanctions on Iran while rejoining the Iran nuclear deal. Again, reports are mixed, but they largely imply that while more time is needed, the obstacles can be overcome.

Another issue is how long OPEC+ will constrain production, knowing that high prices provide an incentive to other producers, such as shale, to restore their production.

Conclusions

Given the recovery in oil prices, some are extrapolating further rises to $100 per barrel. The inventory forecast above clearly does not support such a rise. A return of Iranian barrels to the market appears likely, and EIA’s inventory forecast has been revised higher as a result.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Great information.