The non-farm payrolls report released last Friday dropped a bombshell on the market, revealing the US economy added 517K jobs in January 2023, surpassing expectations of 185K and the highest since July 2022.

Growth was seen in leisure and hospitality, professional and business services, health care, government, retail trade, construction, transportation and warehousing, and manufacturing. Despite tech layoffs and potential economic slowdown, the labor market remains tight, with November and December job numbers revised higher.

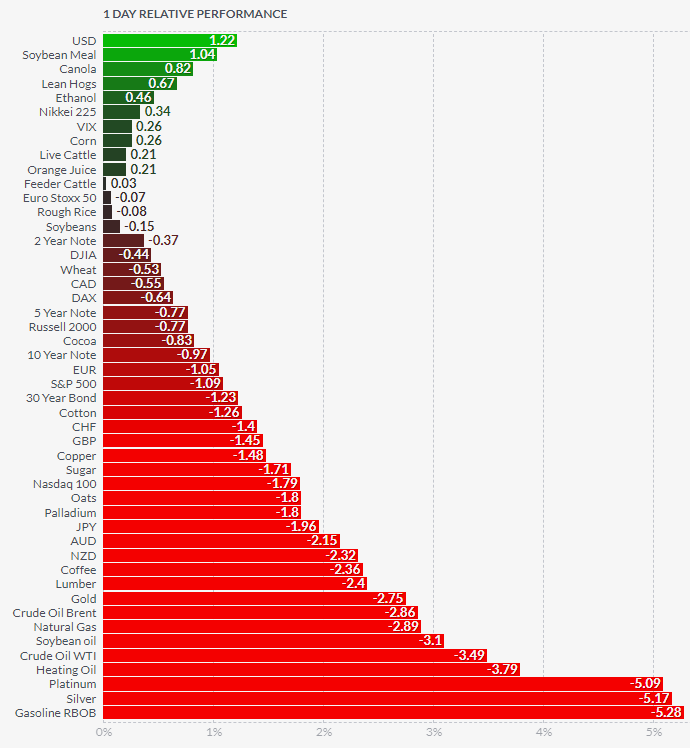

This was a real shocker that caused huge, unexpected waves of volatility in the markets. Let’s have a look at 1-day futures performance last Friday in the diagram below. It looks like a red sea with a small island covered in green grass.

Gasoline, silver and platinum were the ultimate losers that day with massive losses of -5.3%, -5.2% and -5.1% respectively. Gold futures lost huge -2.8% as well. Palladium futures price plummeted -1.8%. Among metals, Copper futures were the most resilient at -1.5%.

The U.S. dollar index definitely took center stage. High hopes for a soft landing for the Fed, supported by a robust labor market, fueled huge demand for the dollar as a rate hike, potentially larger than 0.25%, seems imminent. The DX futures gained +1.2% last Friday.

Last month, I shared my thoughts about the future of the dollar in the post titled “Is Dollar's Dominance Over?” covering both technical and fundamental factors. The former has shown the bearish scenario and the latter has highlighted the bullish potential.

The majority of readers voted that “the dollar has already peaked”.

In fact, the 50-day moving average crossed below the 200-day moving average right after the last article about the dollar was published, triggering the bearish "Death Cross" pattern. The dollar index futures have lost almost 3% since that post.

Last Friday, the DX futures reversed to the upside closing above two earlier small peaks at $102.8. How far it could go to the upside? Let me show you in the quarterly chart of dollar index futures below.

This map above was shown to you almost four years ago, on a distant date in 2019.

At $114.2, it reached the preset target set last year located at the same distance as red leg 2 in blue leg 2. The upside of the purple uptrend channel was also there offering a double resistance. At that exact spot, the DX futures reversed and lost quite a bit of value from $114.7 to $100.7, lowest point last week.

There are two possible paths for the upcoming price move.

Essentially, the red path within the zigzag indicates the possibility of a correction following the first move down that occurred recently. It could reach the “golden ratio” of 61.8% Fibonacci retracement level first at $109.4 ahead of the following massive drop to retest the low of 2008 at $71.1.

There are two interim support levels on this path. The first one, located near the $99 handle, is at the bottom of the purple uptrend. The second one is in the valley of a large consolidation around $89.2, preceding the final rally.

The blue path has two targets marked by blue up arrows. The first target, $114.7, is to retest the former top if the Fed raises interest rates past 5% and inflation slows. The second target, $121.3, is the 2001 peak and requires higher demand for the dollar, potentially from a higher real interest rate or a major geopolitical event.

Intelligent trades!

Aibek Burabayev

INO.com Contributor

Disclosure: This contributor has no positions in any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.