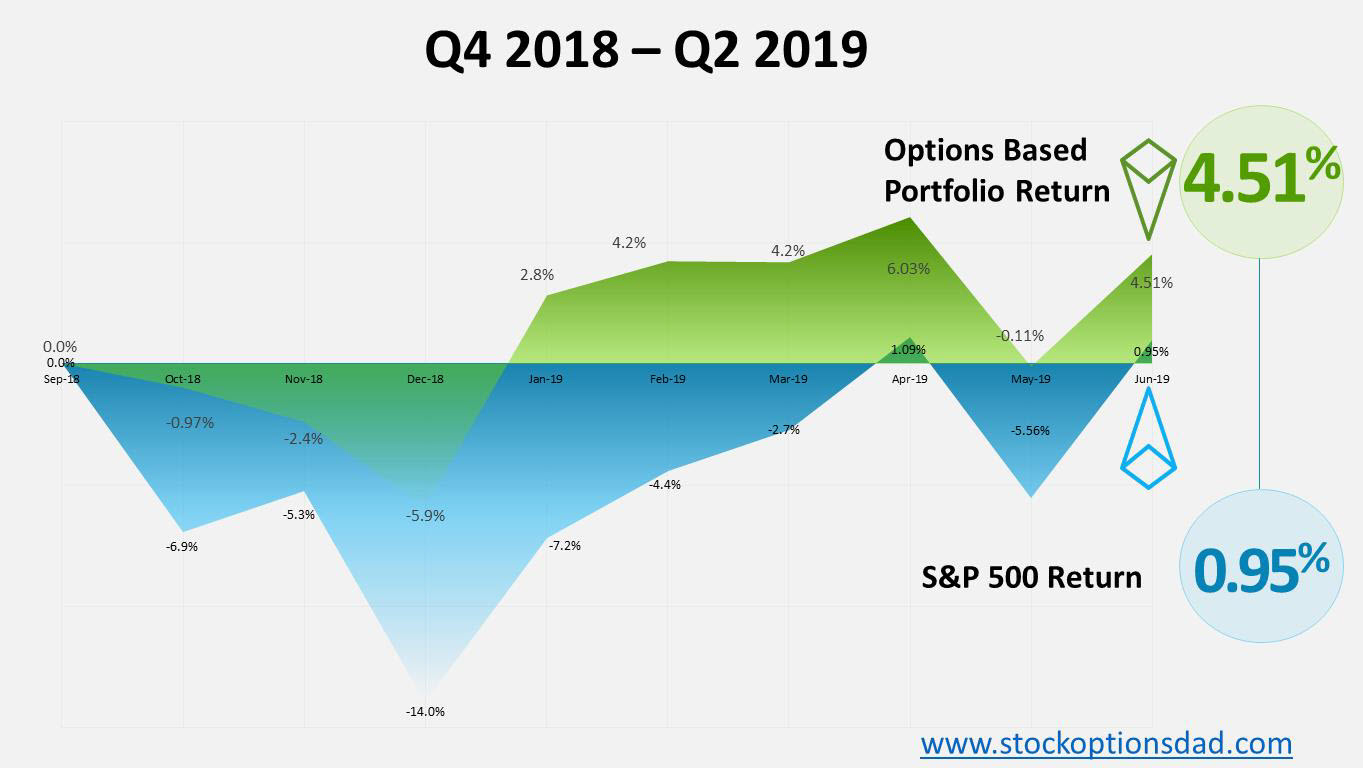

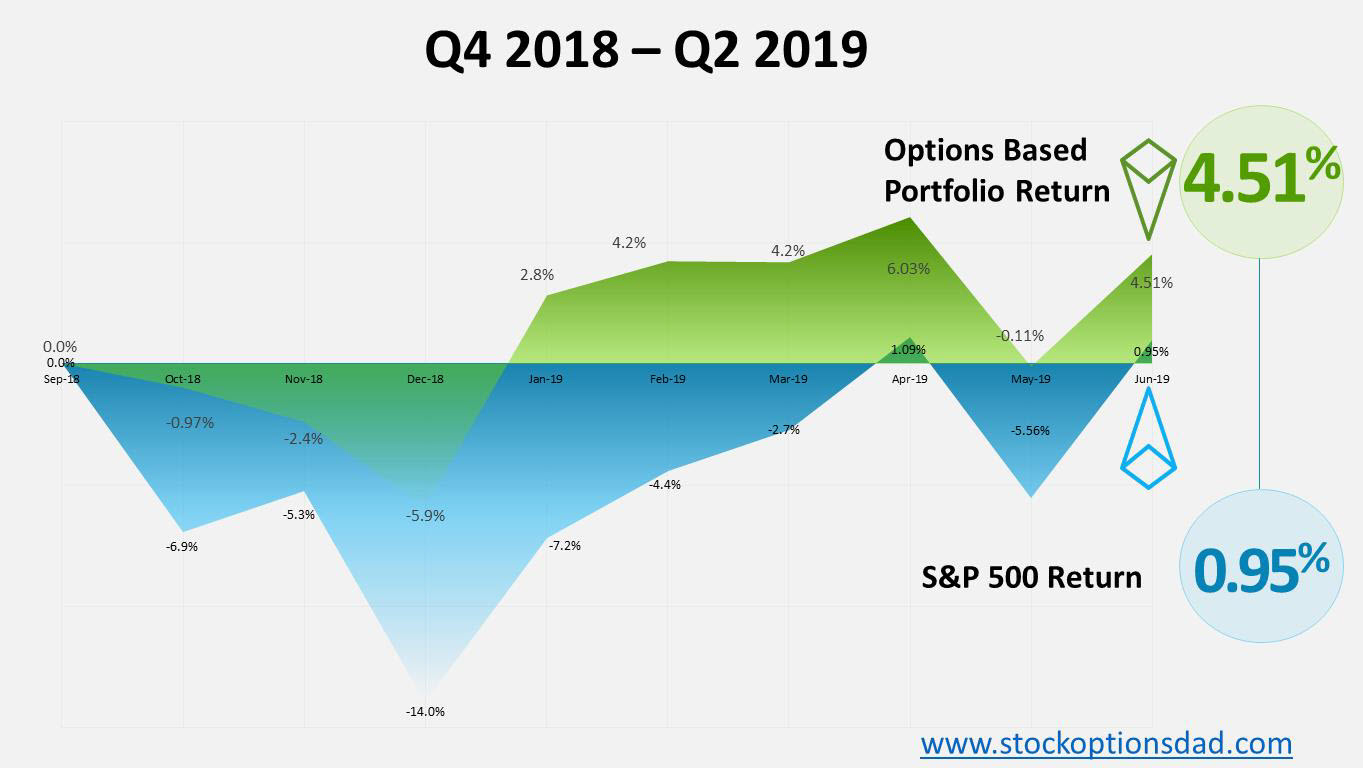

Options trading is a long game that requires discipline, patience, time, maximizing the number of trade occurrences and continuing to trade through all market conditions. To this end, an options-based portfolio requires discipline and time to materialize in order to reach its full benefits when benchmarked to a broader index. An options-based approach provides a margin of safety with a decreased risk profile while providing high-probability win rates. An options centric portfolio ebbs and flows just like any portfolio as various types of trades are executed, management of trades are carried out and the inevitability of assignment of occurs. Over the long-term, this approach provides smooth portfolio appreciation while generating consistent income. Since options are a bet on where stocks won’t go, not where they will go, this is accomplished without predicting which way the market will move. When adhering to options trading fundamentals, this approach can provide long-term durable high-probability win rates to generate consistent income while mitigating drastic market moves. Following these option trading fundamentals, I’ve demonstrated an 85% (175/205) options win rate over the previous 9 months through both bull and bear markets while outperforming the S&P 500 over the same period by a wide margin producing a 4.51% return against a 0.95% for the S&P 500.

Results

The broader market has been tumultuous over the past 9 months, to say the least. In Q4 2018, the S&P 500 posted one of its worst quarters and since the Great Depression with the index selling off 14% and erasing all of its gains for the year. 2019 started off on a high note for the S&P 500 with January posting a 7.9% gain, logging its best January in over 30 years. This was followed by continued strength in February, putting the index on its best footing since 1991 with a cumulative return of 11% through the first two months and rounding out Q1 2019 up just over a 13% return. May witnessed a market sell-off which saw a decline of -5.8%. June 2019 was the best June for the Dow since 1938 whereas the S&P 500 posted its best first half of a year since 1997, notching a 17.3% gain. Sticking to a set of disciplined fundamentals through this volatile market over the previous 9 months generated superior returns relative to the historic run by the S&P 500 (Figures 1-4).

Figure 1 – Options based portfolio return (4.51%) in comparison to the S&P 500 return (0.95%)

Continue reading "Options: Long-Term Game of Discipline and Outperformance" →