Hello traders everywhere! Adam Hewison here, co-founder of MarketClub with your mid-day market update for Monday, the 8th of October.

Hello traders everywhere! Adam Hewison here, co-founder of MarketClub with your mid-day market update for Monday, the 8th of October.

I've been thinking about this for a while and decided today was the perfect day to put my thoughts in writing...

I think the Internet is a job killer and not a job creator.

Here are my reasons why:

A relatively small number of staff can run a multibillion dollar company. For example, FaceBook only has 3,000 employees. Compare that to General Motors, who currently employs 202,000 folks.

Amazon, another name that is ubiquitous on the internet, has only 69,100 employees. Now compare that to traditional retailers that have millions of employees in malls across the country. More and more Americans are turning to to shop online because of its convenience and that could be the demise of many jobs in traditional shopping outlets. For example, Circuit City could not complete in the new world and quickly fell prey to the Internet. Is Best Buy the next company to throw in the towel?

Apple, the most valuable company in the world, even with its retail outlets, still only employs less than 65,000 Americans. However, Apple in China through a company called Foxconn has over 400,000 Chinese working to make iPhones, iPads, and practically everything "i" for Apple. You can only wonder what kind of impact almost half a million manufacturing jobs would have in the US. Think about what it could do for our economy.

America has to rethink, reset, readjust and retool if it is going to get serious about creating jobs in the new global internet world. Countries, including the United States, cannot just rely on past successes. History has proven time and time again that a country resting on its laurels soon becomes a country in trouble. Continue reading "Daily Video Update: The biggest job killer is …" →

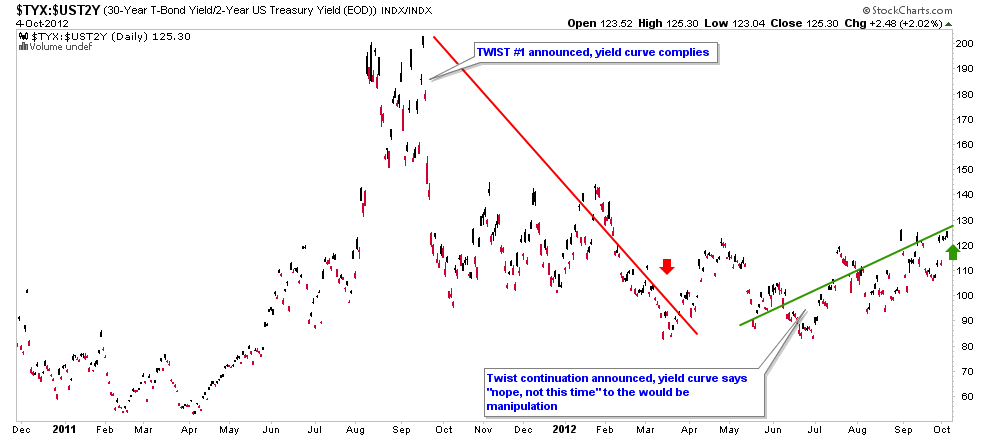

ngleaftrading.com will be providing us a chart of the week as analyzed by a member of their team. We hope that you enjoy and learn from this new feature.

ngleaftrading.com will be providing us a chart of the week as analyzed by a member of their team. We hope that you enjoy and learn from this new feature.