Since 2007 when Scott Andrews of MasterTheGap.com started calling out daily gap plays in a live trading room, he has been helping traders learn how to use gap trading to their own advantage. He considers gap trading the "bread and butter" of his trading and even earned the nickname, "Gap Guy" due to his successes.

Since 2007 when Scott Andrews of MasterTheGap.com started calling out daily gap plays in a live trading room, he has been helping traders learn how to use gap trading to their own advantage. He considers gap trading the "bread and butter" of his trading and even earned the nickname, "Gap Guy" due to his successes.

Today Scott is sharing tips on how to get the most out of your trades by showing you how to discern high expectancy trades from low expectancy trades. We hope you enjoy reading his guest blog post and leave a comment for him below.

-------------------------------------------------------------------------------------------------------------------------------

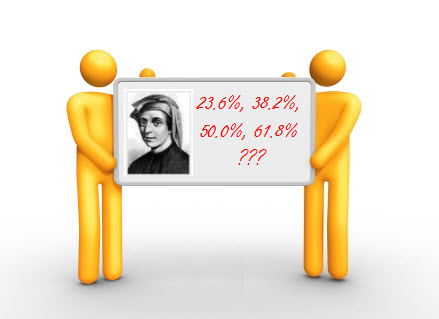

This past week I had the great privilege of enjoying lunch with a fellow North Carolinian, Dr. Van Tharp, the world-renown trading coach and author of some of my favorite trading books: Trade Your Way to Financial Freedom and Super Trader. While trying not to ogle over him like a star-struck teenager meeting his favorite musician for the first time, my mind raced with the many pearls of trading wisdom he has espoused over the years.

Continue reading "Do You Know the Expectancy of Your Trades?"

There are times when markets reverse for no apparent reason and seem to defy any news that would support the direction of the trend. We call the this occasional event the

There are times when markets reverse for no apparent reason and seem to defy any news that would support the direction of the trend. We call the this occasional event the

Unfortunately the President seemed to miss the point - capping BP's huge gusher off the Gulf. Coincidentally, I read today that BP now stands for BIG PROBLEM and not British Petroleum.

Unfortunately the President seemed to miss the point - capping BP's huge gusher off the Gulf. Coincidentally, I read today that BP now stands for BIG PROBLEM and not British Petroleum.