It seems all we can talk about in the markets are the ongoing Greek charade or the next talking point China. You will hear no end of experts telling you what they think of Greece and China and what will happen if this or that takes place. The reality is, no one knows for sure what's going to happen.

My advice, simplify, simplify, simplify. Keep it simple as the market doesn't pay you more for overthinking. In fact the market doesn't care what you or anyone else thinks, it's going to go its own way no matter what.

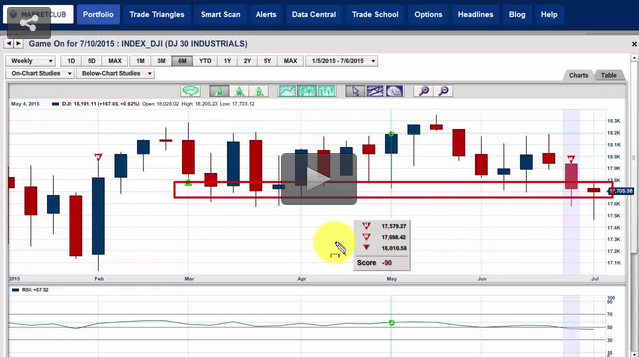

And that's the beauty of the Trade Triangle technology it doesn't over think the markets. In fact it doesn't think at all it's an algorithm.

To the best of my knowledge, no one predicted the recent weakness in crude oil. As everyone knows usage tends to be high in the summer months when people travel for vacations.

Remember I said no one knows, however, the Trade Triangle technology is an unbiased algorithm that literally goes with the flow and does not overthink any situation. You only have to look at a chart of crude oil to see just how this simple unbiased approach has performed. The Trade Triangles have made close to a 150% return in the last eight days based on latest Trade Triangle signal. That represents a gain of about $6,000 per contract in just over a week, and that's not listening to anyone except what the market is telling the algorithm!

So when it comes to investing and trading look no further than MarketClub's Trade Triangle technology as it will over time far outperform most of the so-called experts out there.

Today, I will be looking at two stocks that gave important buy signals yesterday.

They are: Continue reading "Greece, China And The Trade Triangles Have A Lot In Common" →

Straight from Trading Advantage's virtual lessons, Larry Levin guides viewers through the One-Time Framing Technique. Using a simple 30 minute bar chart, Larry helps define the steps that can help you identify short term trends. Discover Larry's technique - learned early in his trading career - through a series of clear signals on multiple S&P chart examples. Larry even shows viewers how to apply this technique when considering technical stops versus money stops. Step into Larry's world and learn more!

Straight from Trading Advantage's virtual lessons, Larry Levin guides viewers through the One-Time Framing Technique. Using a simple 30 minute bar chart, Larry helps define the steps that can help you identify short term trends. Discover Larry's technique - learned early in his trading career - through a series of clear signals on multiple S&P chart examples. Larry even shows viewers how to apply this technique when considering technical stops versus money stops. Step into Larry's world and learn more!