Candlesticks; used by many...truly understood by few. As a special treat to Trader's Blog readers, Gary Wagner is offering you an in-depth look into candlestick charting. Join the co-founder of Wagner Financial Group and acclaimed author as he walks you through set ups that can your take your candlestick charting to a new level.

Candlesticks; used by many...truly understood by few. As a special treat to Trader's Blog readers, Gary Wagner is offering you an in-depth look into candlestick charting. Join the co-founder of Wagner Financial Group and acclaimed author as he walks you through set ups that can your take your candlestick charting to a new level.

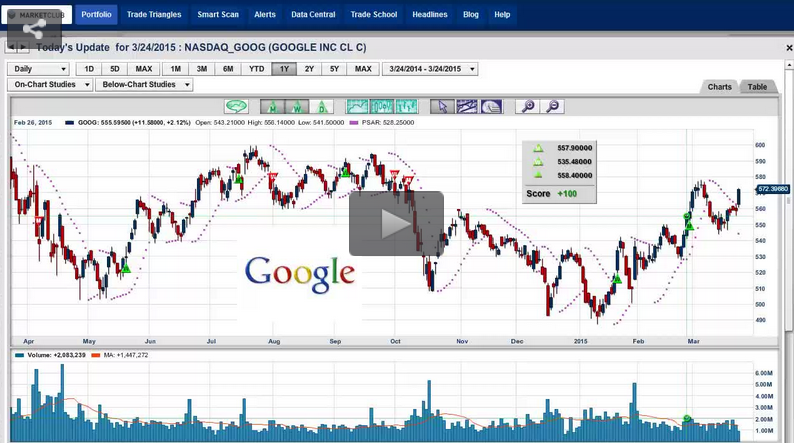

In this video workshop you'll discover the crucial chart patterns that candlesticks reveal - how to interpret them and how to use them to pinpoint market turns. You'll also learn how to use candlesticks in combination with familiar technical indicators like Stochastics, %R, Relative Strength Index and Moving Averages to create a dynamic, synergistic and extremely successful trading system.

WATCH NOW: Advanced Trading Applications of Candlestick Charting

Best,

The INOTV Team