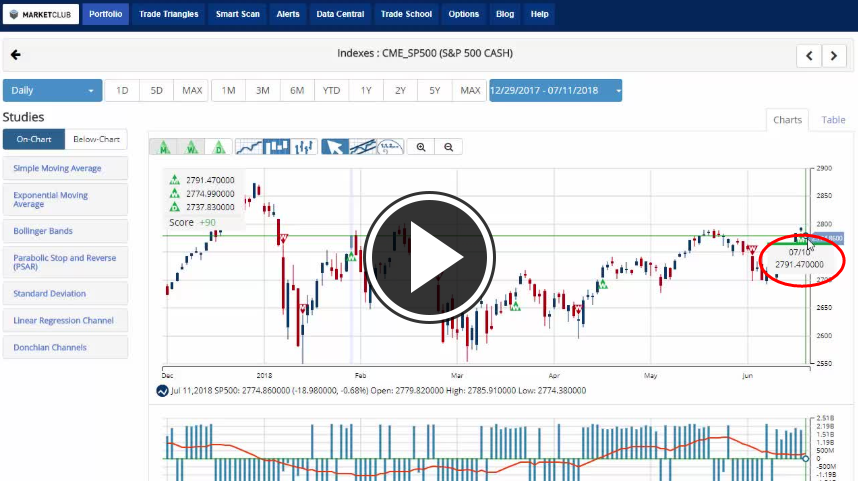

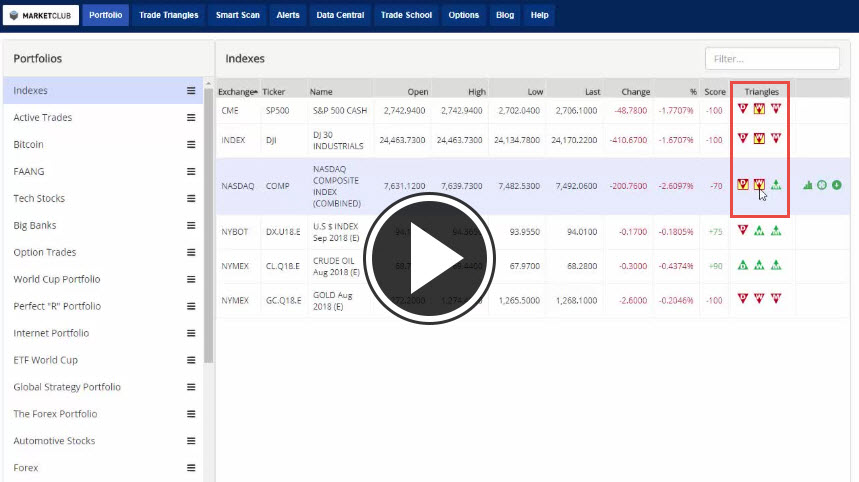

Hello traders everywhere. As we hit the middle of July and the doldrums of summer the S&P 500 is hovering near a new five-month of 2,835.96, presently trading at the 2,815.00 level and up roughly 3.5% on the month. The move higher has been propelled by a positive earnings season, for the most part, led by the big banks. Morgan Stanley (MS) rounded off earnings from big banks, gaining 3% after its profit topped analysts' estimates on gains in fixed income and equities trading businesses.

The DOW remains to trail the S&P needing to get to above 26,306.70 to hit a new five-month high. However, it does lead the S&P 500 with a monthly gain of 3.78% on the month so far. But the real leader of the bunch remains to be the NASDAQ, which is trading near all-time highs at the 7,800 level and looking to head higher with a monthly gain over 4.4% at the moment.

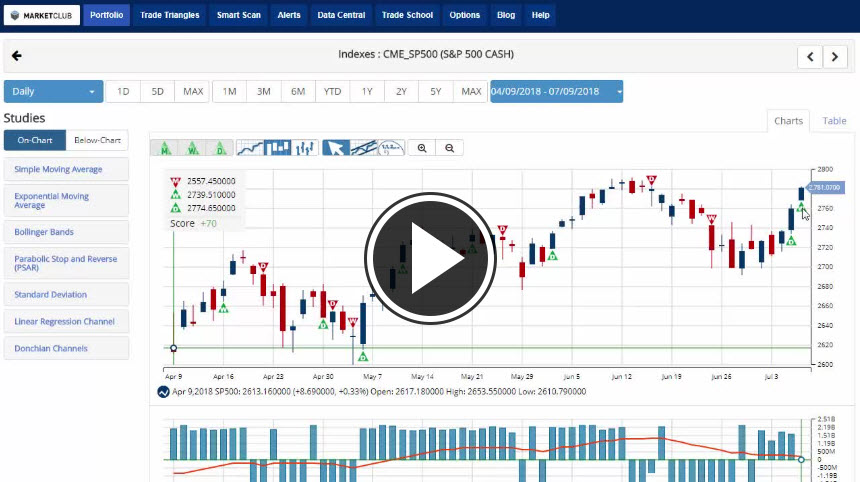

Can the S&P 500 catch the NASDAQ this month as the tech sector stumbles?