Hello traders everywhere. Stocks are trading higher after erasing slight losses from earlier in the session, as the Senate reached a deal that would resume full government operations.

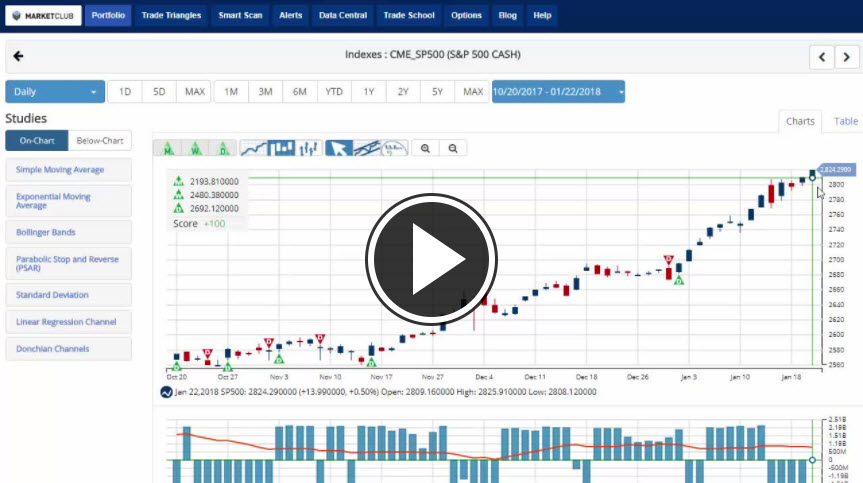

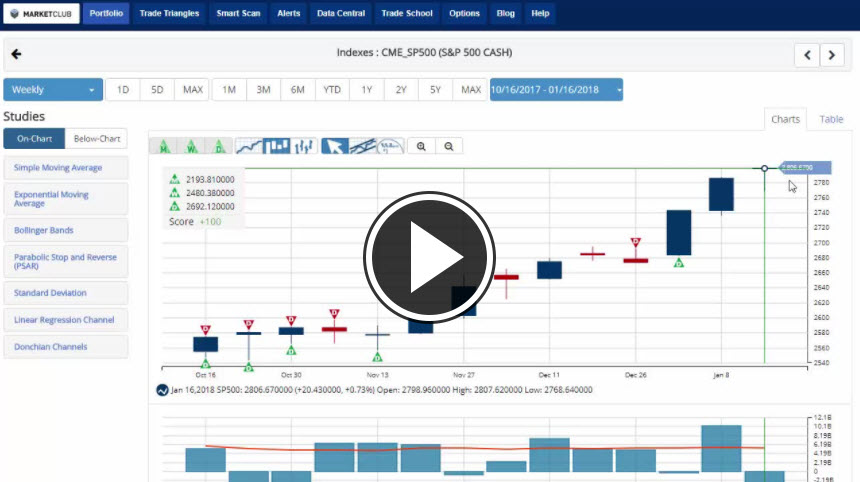

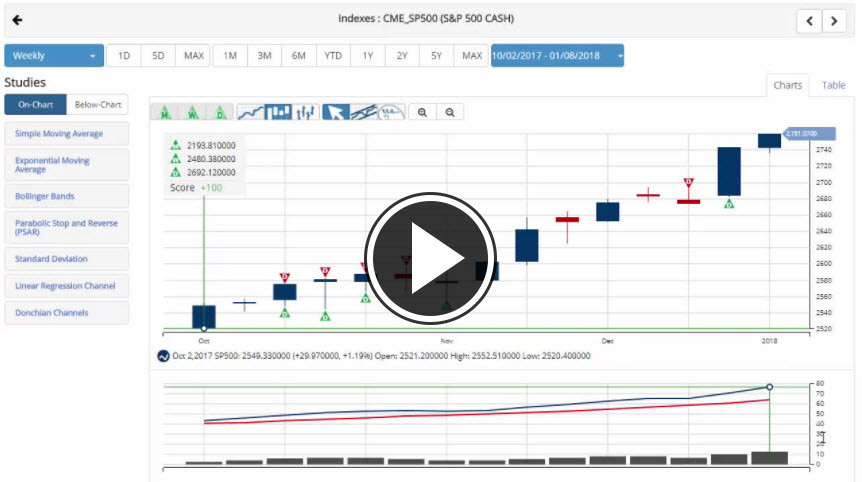

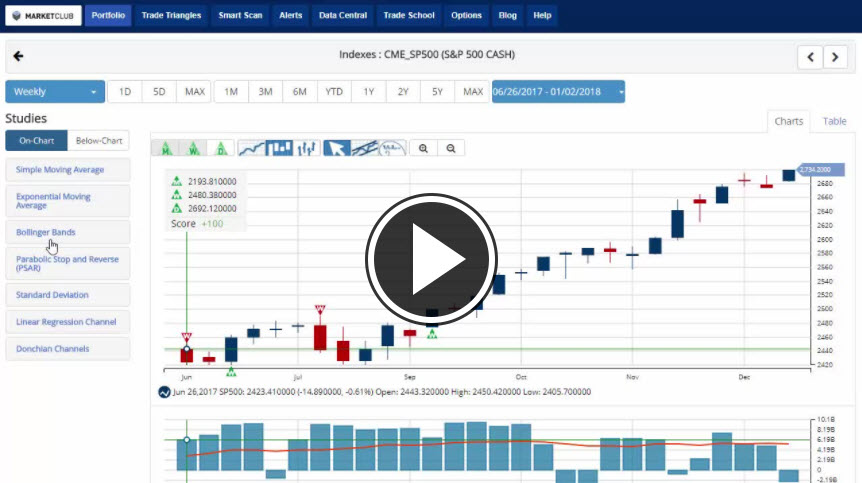

The S&P 500 is hitting record highs, rising 0.5%, with energy and telecommunications as the best-performing sectors.

The NASDAQ is also hitting all-time highs, advancing 0.7%, with shares of Netflix Inc. (NASDAQ:NFLX) hitting a record ahead of their earnings today.

The Dow has gained over 70 points to establish a new intra-day record, with The Boeing Company (NYSE:BA) leading the way.

Members of the Senate are expected to advance a stopgap bill to keep the government open through Feb. 8. Democratic Sen. Mark Warner said the party has the assurance it needs on the budget and immigration issues.

On Saturday, the U.S. government shut down after a bill that would have kept the government funded through mid-February was voted against in the Senate. The shutdown continued for a third day on Monday after the Senate on Sunday failed to reach an agreement to break an impasse before the work week began in Washington.

Key levels to watch this week: Continue reading "Stocks Erase Early Losses After Senate Vote"