What is a dead cat bounce? It is simply a rally from a very oversold condition. That's the case today as many of the markets have literally gone straight down in the first weeks of 2016 and contributed to the worst start of any year in the history of trading.

A dead cat bounce does not mean a trend change or that you have made a major bottom in the market. Technically, a dead cat bounce is really just a short covering rally from a market that is very oversold. If and when the major indices are going to reverse the trend and move back up, they are going to have to do quite a bit of repair work to change the negative technical picture that we are currently facing.

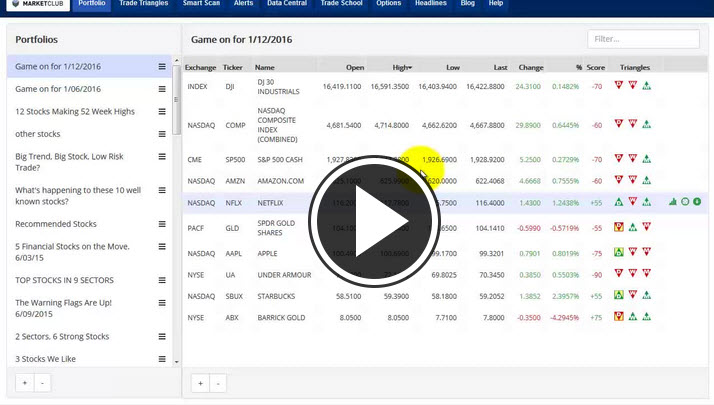

After the close today Netflix.com Inc. (NASDAQ:NFLX) will report earnings - the current technical picture for this stock is mixed. The longer-term trend for Netflix is positive with a green Trade Triangle in place. However, the intermediate-term trend is down with a red weekly Trade Triangle. I would suggest standing on the sidelines at the moment. Continue reading "Beware Of Dead Cat Bounces"