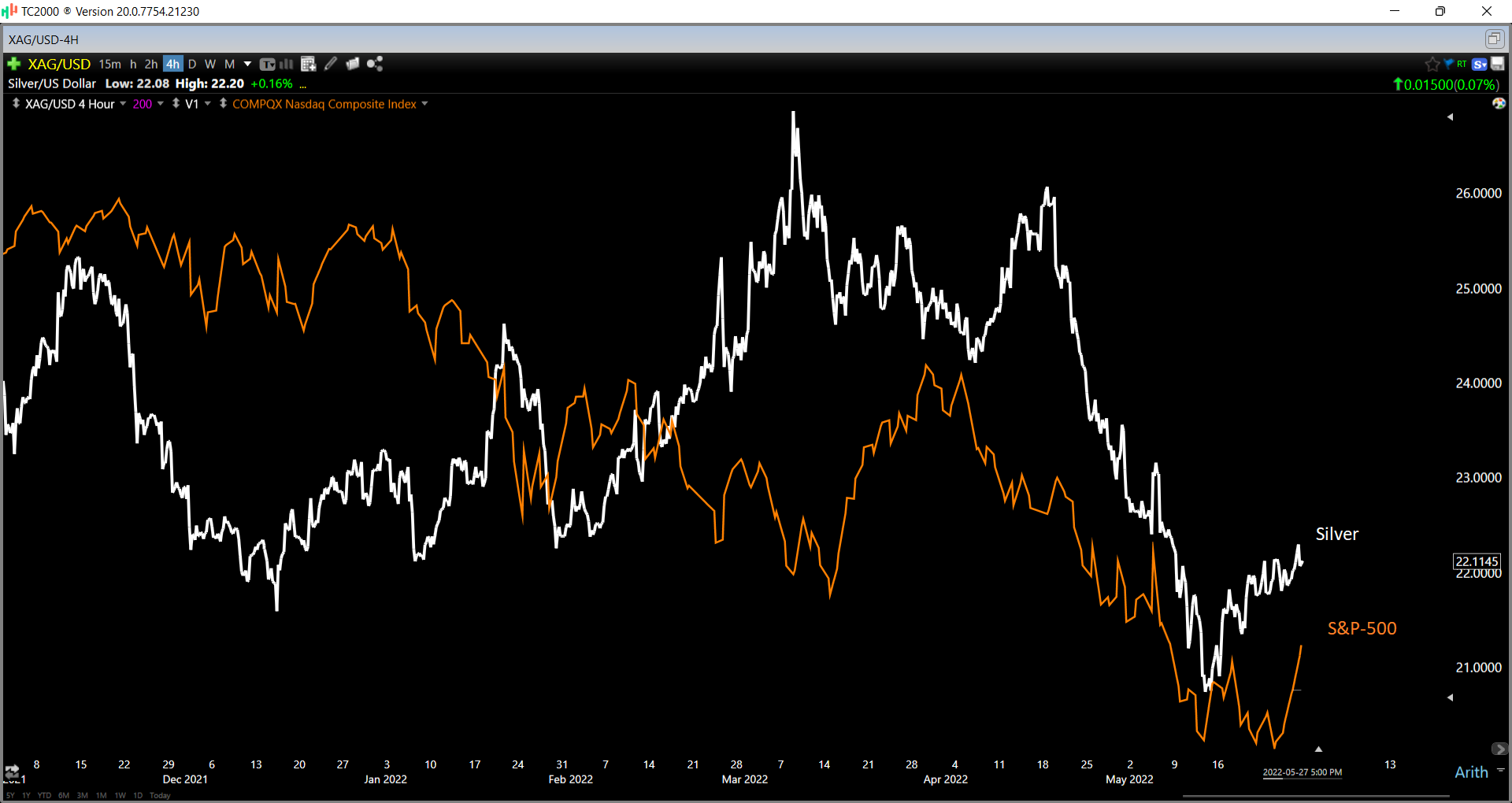

While the gold price has managed to hold onto most of its Q1 gains amid the market turmoil, the silver price has not fared nearly as well. In fact, the metal is sitting at a (-) 5% year-to-date return after briefly being up 16% for the year at its March highs. This retracement in the silver price has put a severe dent in margins for silver producers, explaining why the silver miners have significantly underperformed the metal. However, with the Silver Miners Index (SIL) now down nearly 50% from its Q3 2020 highs, this negativity related to weaker margins looks to be mostly priced in, suggesting it’s time for investors to be open-minded to a bottom in the higher-quality names. Let's take a look at a few of the top names sector-wide below:

Many investors prefer to invest in SIL or the physical metal when it comes to gaining exposure to silver, but neither the ETF nor metal pay dividends and the former is full of poorly run companies with razor-thin margins. For this reason, investing in SIL is even worse than investing in the Gold Miners Index (GDX), where at least the latter has a decent portion of solid companies which balance out the laggards. Given the low quality of SIL, the best way to invest in silver is by selecting the best names sector-wide, and three names that stand out are Continue reading "Three Silver Miners On The Sale Rack"