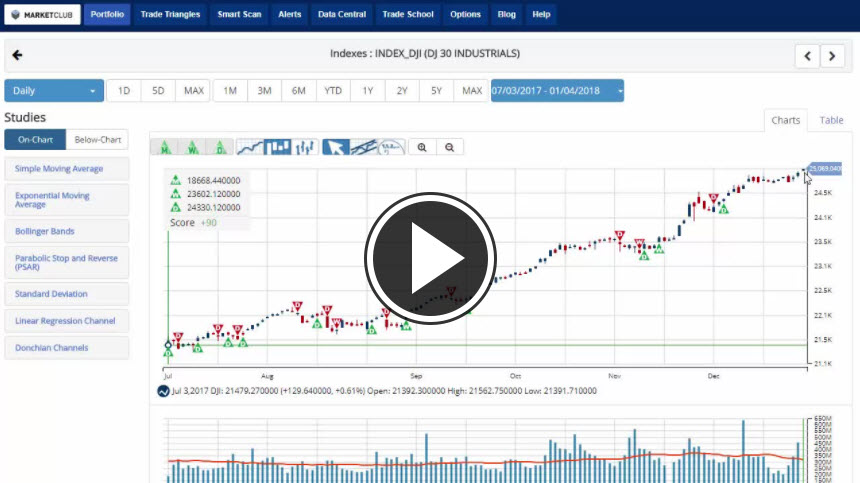

Hello traders everywhere. Luckily for us the old saying "New Year, New Me" doesn't seem to apply to the U.S. market as the DOW surpasses the 25,000 mark for the first time ever and the other major indexes soon followed, posting new records as well. This record breaking move higher was propelled by strong U.S. private jobs numbers that added to a stream of robust economic data from across the world.

President Donald Trump even weighed this morning by proclaiming that his new number for the DOW is 30,000. What do you think? Will the DOW hit 30k before then end of 2018? Or are we due for a major correction?

Key levels to watch this week: Continue reading "DOW To 30,000?"

As the New Year approaches us with hopes anew, here's to wishing you and your family a wonderful year ahead.

As the New Year approaches us with hopes anew, here's to wishing you and your family a wonderful year ahead.