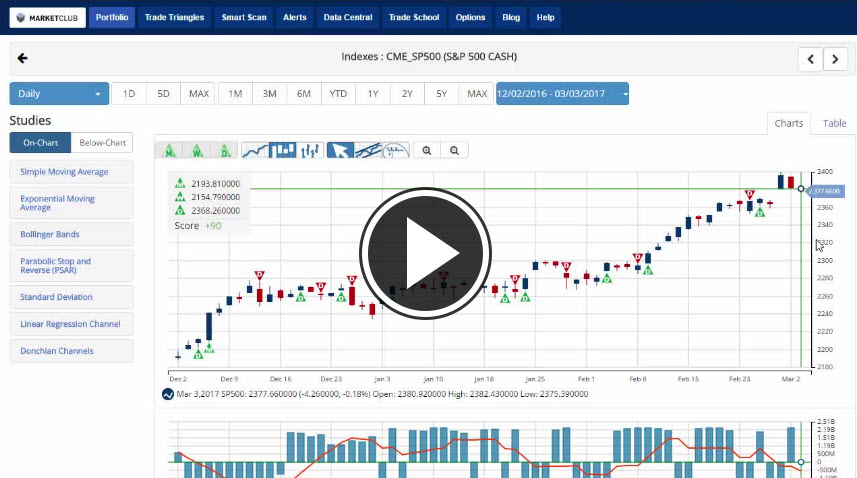

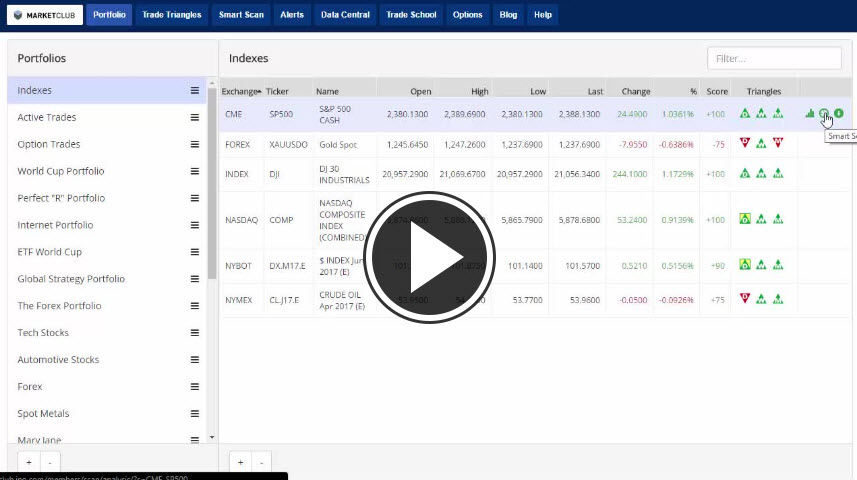

Hello MarketClub members everywhere. The stock market is taking a breather today and the dollars five-day advanced has ended as traders have turned cautious before Fed Chair Janet Yellen discusses the state of the economy later today. Everyone will be listening for clues about when and how much the Federal Reserve will raise interest rates.

Gold (FOREX:XAUUSDO) has slipped 0.3% to $1,229.20 an ounce. It's down 2.1 percent for the week, after four straight weeks of gains. The U.S.Dollar Index (NYBOT:DX.M16.E) is down .3% as well, ending a five day rally that saw it top $102.19.

Key levels to watch next week: Continue reading "The Dollar Rally Comes To An End"