Hello MarketClub members everywhere. Fed Chairwoman Janet Yellen said last week that the central bank was prepared to raise interest rates at the March meeting unless something unexpected happens and that hasn't happened. A solid February jobs report certainly clears the way for the Fed to raise interest rates at its meeting next week.

The U.S. economy added 235,000 jobs last month, the Bureau of Labor Statistics said, adding the unemployment rate ticked lower to 4.7 percent. Payrolls came in a bit stronger than expected and the average hourly earnings accelerated to a 2.8% rate over the past year, the Labor Department said.

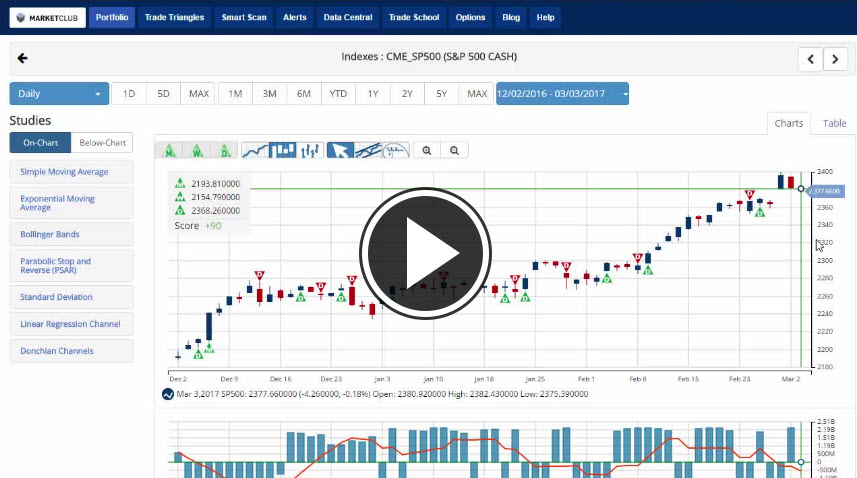

Key levels to watch next week: Continue reading "Solid February Jobs Report Clears The Way For The Fed"