By: Elliott Wave International

Robert Prechter's monthly Elliott Wave Theorist once published a ten-part study explaining why traditional financial models failed to foresee the 2007-2009 financial crisis -- and, more importantly, why they are doomed to fail again (and again).

On Thursday (Sept. 17), the Fed decided to keep interest rates unchanged. On Friday, stocks opened down big. But before you join those who blame it on the Fed, please read this excerpt from Prechter's eye-opening study.

***************

Economic theory holds that bonds compete with stocks for investment funds. The higher the income that investors can get from safe bonds, the less attractive is a set rate of dividend payout from stocks; conversely, the less income that investors can get from safe bonds, the more attractive is a set rate of dividend payout from stocks. A statement of this construction appears to be sensible.

And it would be, if it were made in the field of economics. For example, "Rising prices for beef make chicken a more attractive purchase." This statement is simple and true. But in the field of finance such statements fly directly in the face of the evidence.

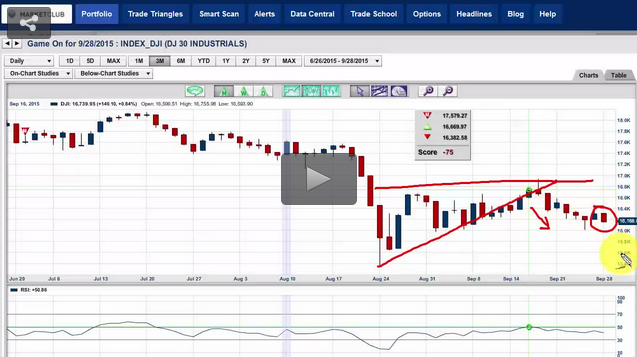

Figure 3 shows a history of the four biggest stock market declines of the past hundred years. They display routs of 54% to 89%. Continue reading ""Interest Rates Drive Stocks"? See 4 Charts That Tell You the Truth" →