How do you spell Greece? D-I-S-A-S-T-E-R

Remember Greece? Yes, that's the very same country that created all the problems for the world's economies back in 2008. Well, Greece is back and the problems could be even greater this time. I'm not sure who it was who said this, but it has been said that you don't solve debt problems by piling more debt on to more debt. I agree, but that is exactly what the world has been doing since 2009.

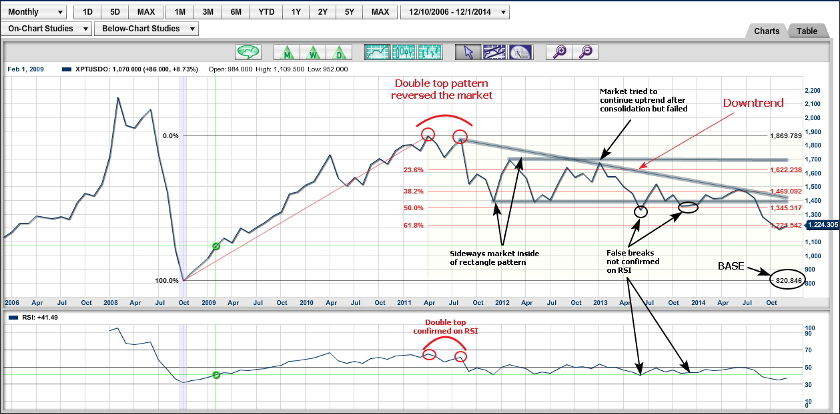

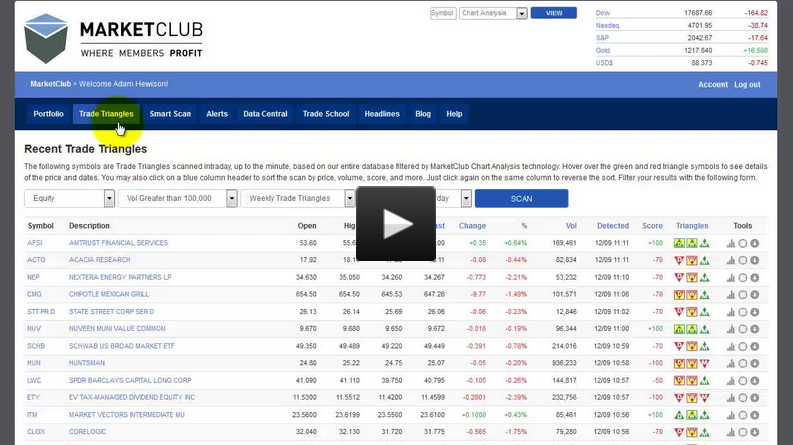

In every great challenge there are great opportunities and 2015 could be one of those extraordinary years when smart investors can do very, very well. I don't think it's going be on the long side of the market, however. I think this bull market that has been going on for six years is about to come to a screeching halt as reality finally sinks in and we begin to pay for the folly of our deeds. Continue reading "The Looming Greek Disaster"