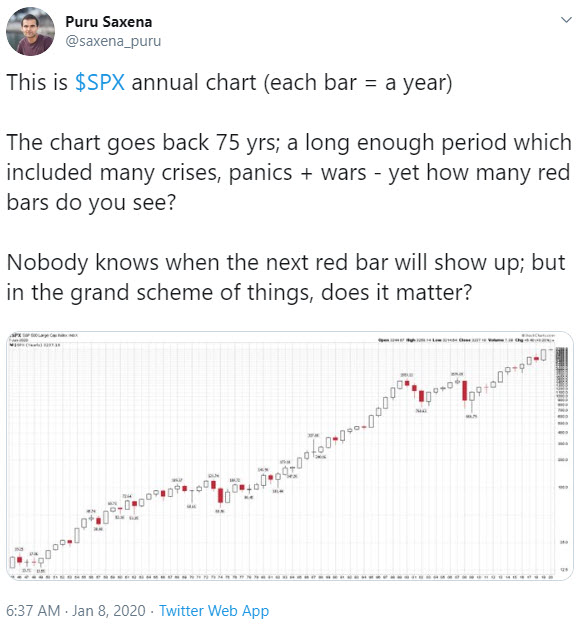

The broader indices have been in a blistering bull market for a year straight, only accelerating from November 2020 into April 2021. The rally has been largely uninterrupted, with minor blips in September and October of 2020 before reaching new all-time highs after new all-time highs by mid-April. The initial rally was narrowly focused on technology and the stay-at-home economy stocks. With the improving vaccine prospects, November saw a sea change with broad market participation with value stocks breaking out with huge moves to the upside. To boot, Washington's massive stimulus is being priced into the markets via fiscal and monetary stimulus. All three major indices (S&P 500, Nasdaq, and Dow Jones) are at all-time highs and continue to break into uncharted territory in what seems like a daily basis.

Stocks are overbought and at extreme valuations, as measured by any historical metric (P/E ratio, Shiller P/E ratio, Buffet Indicator, Put/Call Ratio, and percentage of stocks above their 200-day moving average) or technical metric (Bollinger Bands and Relative Strength Index - RSI). Valuations are stretched across the board, with the major averages at all-time highs and far above pre-pandemic levels. A rise in rates due to inflation could be lurking in the shadows of this frothy market.

If/When Inflation Hits

If the Consumer Price Index (CPI) continues to push higher, The Federal Reserve may be compelled to entertain the idea of raising rates finally. Although interest rate risk disproportionally impacts fixed-income investments such as bonds and annuities, stocks will undoubtedly be impacted as well. This is especially true for highly leveraged companies such as tech and super-charged growth companies. Even the prospect of higher rates hit the Nasdaq in March for a sharp decline, albeit that decline was quickly erased. This is a case in point of how quickly the markets can turn negative with the hint of rising rates which may be exacerbated in an already frothy market. Continue reading "Stock Market: What Happens When Rates Rise?"

Hello traders everywhere! Adam Hewison here, President of INO.com and Co-creator of MarketClub, with your

Hello traders everywhere! Adam Hewison here, President of INO.com and Co-creator of MarketClub, with your