Investors may want to keep an eye on discount retailers, like Dollar General (DG).

For one, the latest pullback may be a great buy opportunity.

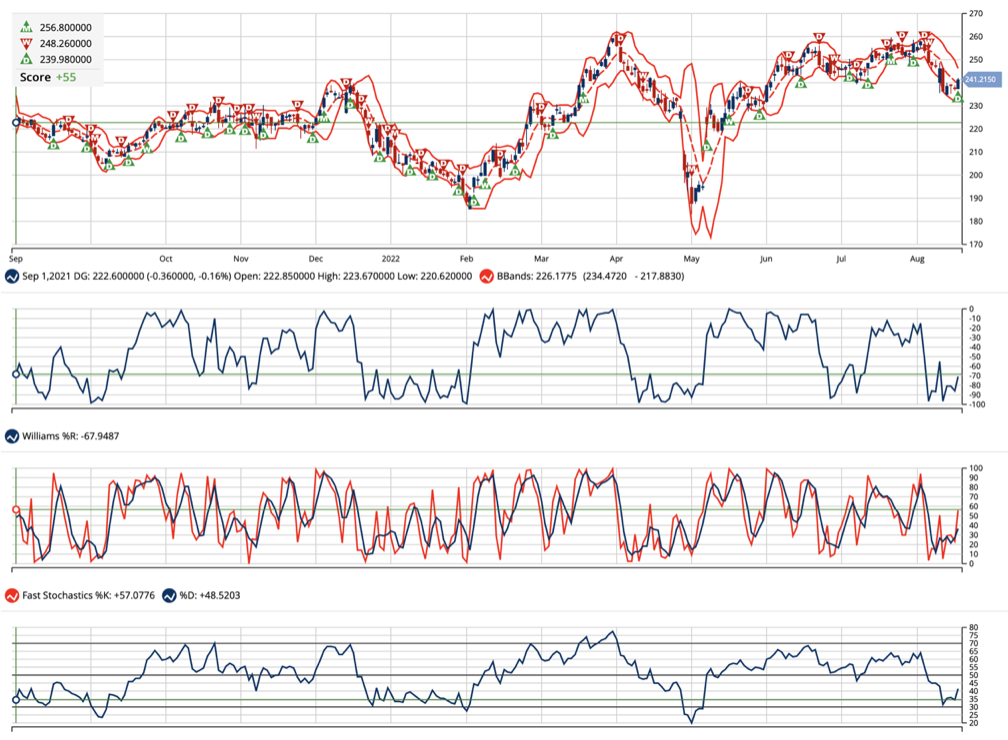

If you take a look at this chart, you’ll notice that Williams’ %R, Fast Stochastics, and RSI are all starting to pivot well off oversold conditions. With patience, I’d like to see the Dollar General stock retest $260 resistance, near-term from $241.65 support.

Two, while other major retailers take a hit with inflation, Dollar General is rising because of inflation. In fact, we can see that with the company’s recent earnings report.

Not only did Dollar General report second quarter EPS of $2.98, which was better than the expected $2.94 a share, sales were up to $9.4 billion, same-store sales were up 4.6% as compared to expectations for 3.9%. The company even increased its same-store sales forecast to a range of 4% to 4.5% for the fiscal year, from a prior call for 3% to 3.5%.

Three, wealthier people are now shopping at dollar stores because of inflation.

According to Business Insider, Todd Vasos, CEO of Dollar General, said on a call with analysts that the store saw a rise in higher-income households shopping there, "which we believe reflects more consumers choosing Dollar General as they seek value." Continue reading "Chart Spotlight: Dollar General (DG)"