Hello MarketClub members everywhere. The Federal Reserve left interest rates unchanged while saying the argument for higher borrowing costs strengthened further amid accelerating inflation, reinforcing expectations for a hike in December.

"The committee judges that the case for an increase in the federal funds rate has continued to strengthen but decided, for the time being, to wait for some further evidence of continued progress toward its objectives," the FOMC said in a statement Wednesday following a two-day meeting in Washington. Fed officials confirmed their growing confidence that inflation is on track to reach their 2 percent target. The central bank said Wednesday that the pace of price gains "has increased somewhat since earlier this year" and that market-based measures of inflation compensation "have moved up." The committee also omitted previous language saying inflation would probably "remain low in the near term."

Oil continues to fall after a government report showed that U.S. crude oil inventory surged. Crude oil stockpiles rose 14.4 million barrels, or 3.1%, last week, according to the Energy Information Administration. It's the biggest gain since 2008 in percentage terms.

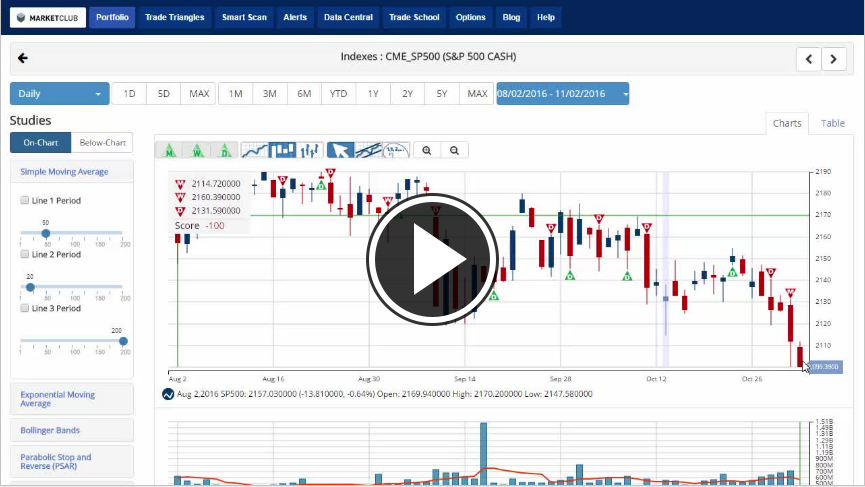

Key levels to watch rest of this week: Continue reading "The Fed Speaks and Oil Continues Lower" →