Hello MarketClub members everywhere. You've probably heard by now that the Ford Motor Company (NYSE:F) is not going to be moving one of its plants to Mexico. Finally, the U.S. is waking up and realizing that it cannot be a superpower while having a service economy. Whether you voted for Trump or not, I think we have to give him credit for this save. Hopefully, some of the other promises he made will also help the U.S. economy like lowering taxes and nixing some of the onerous regulations that are handicapping businesses in the U.S.

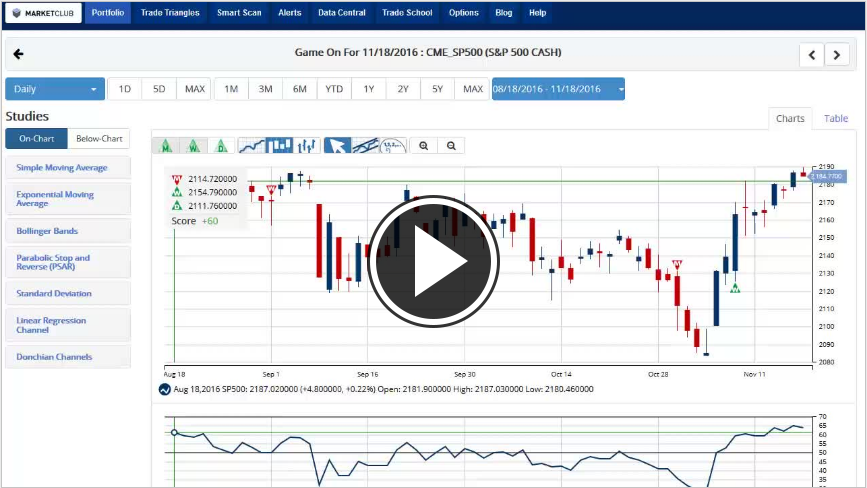

So far the markets seem to like what they see with all of the indexes higher for the week. The big winner this week was the NASDAQ (NASDAQ:COMP) which jumped +1.84%.

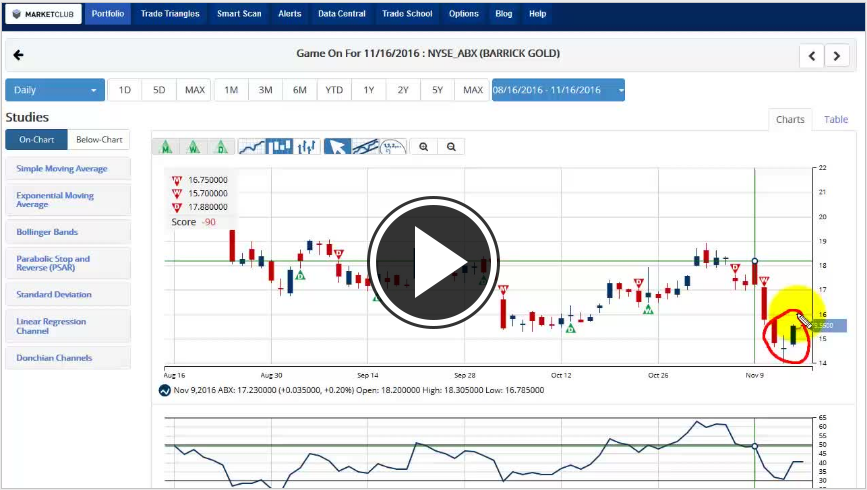

However, the biggest winner for the week is Crude Oil (NYMEX:CL.Z16.E) which is up +5.32% for the week. The big loser is gold (NYMEX:GC.Z16.E) which is down -0.87%. Let’s examine how the Trade Triangles are positioned in both of these markets. Continue reading "Ford To Stay In America, Two Trump Thumbs Up On This One"