Back in December I called for an unbelievable $20k target for the Bitcoin when it traded around $15.6k, and ten days later that target was hit (click on the play button to see how price emerged). It was one hell of the roller coaster ride that month as Bitcoin then lost almost half of its worth in a matter of days right ahead of Christmas falling to $11k.

Rinse and repeat! The crypto king started to grow again, and then I posted another map at the end of 2017, which implied a pullback to the $16k-$20k area before another huge drop to the $7500 area. Amazingly, both the upside and downside forecasted areas were hit accurately (click on the play button to see how price emerged).

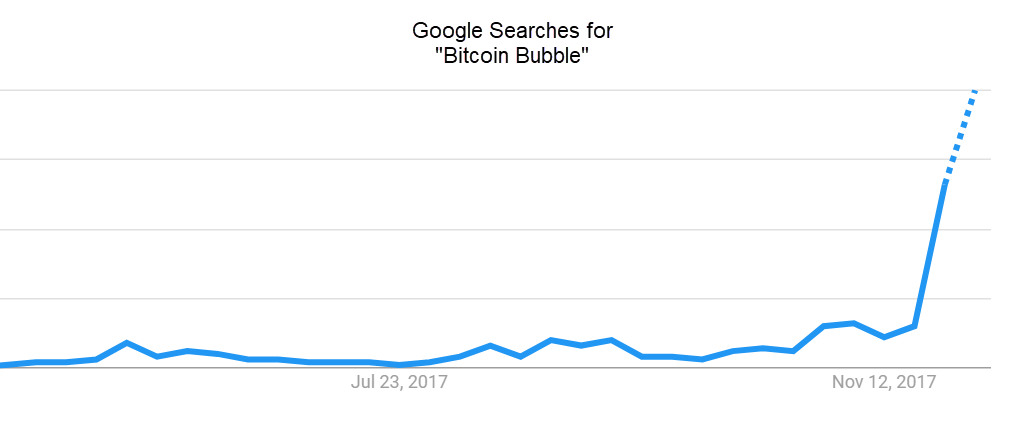

The Bitcoin buzz is coming down with the price staying below $10k. It is like a superstar who has seen his best times already and is on the tour to the countries where he is still warmly welcomed as we are not in the $20k euphoria area now (we can call it a “cocaine” time) although you can still buy some pleasant things selling just one coin for more than $7k these days.

In this post, I would like to share with you a familiar pattern I spotted recently on the Bitcoin chart. Continue reading "Bitcoin Is At A Crossroads"