In Brazil, the year 2016 will no doubt go down in the history books as one of the worst the country has experienced. The Brazilian president, Dilma Rousseff, was impeached for the role they played in a bribery scandal and for illegally disguising the country’s real debt. Moreover, the Brazilian economy had its worst recession in more than half a century.

And yet, there are some encouraging signs that, at least as far as the economy and the Brazilian Real are concerned, the country might have turned a corner.

Brazilian Bonds Revival

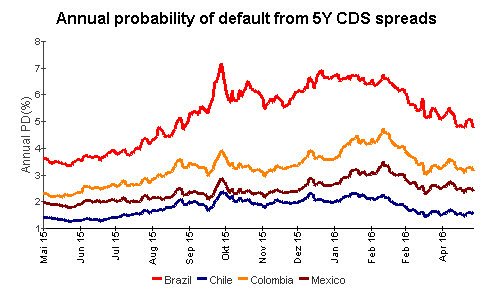

In the months of January and February, when the political climate turned more and more chaotic and Brazilian growth tumbled, yields on Brazilian 10-year bonds were as high as 16.78% and CDS prices, which measure the likelihood of a sovereign debt default, jumped to 7%. One would then expect that, from this point onwards, and especially in recent months with the prospect of a Fed’s tightening weighing on bond markets across the globe, the already fragile Brazilian government bonds would experience an utter meltdown, even to the extent of risking an actual default. But what happened instead was interesting. While bonds across the world were tanking and yields surging (bond yields move in reverse, relative to prices) amid the Fed’s tightening, Brazilian bonds staged an impressive rally, and yields on 10-year bonds fell from their highs back in January to as low as 11.4% today. Unsurprisingly, this was followed by an impressive rebound for the Brazilian Real. Continue reading "Will Brazil Turn A Corner In 2017?"