Hello everyone! GoPro, Inc. (NASDAQ:GPRO) had a sell signal exactly a year ago today indicating that this stock was in trouble and headed lower. That signal came in at $46.50 on a monthly Trade Triangle. GoPro is currently trading below $12 a share.

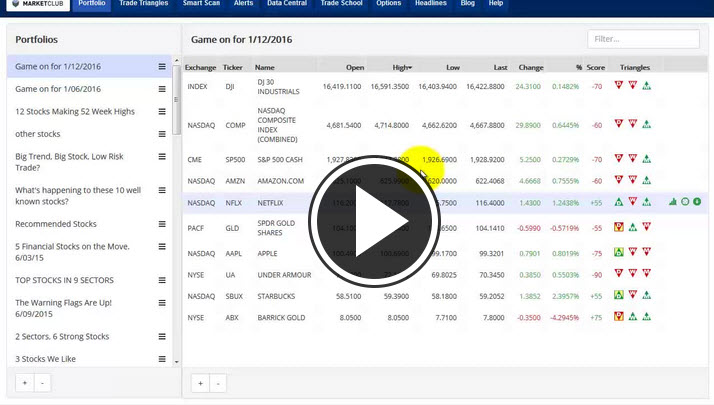

Two of the major indices are now officially in bear markets based on the Trade Triangle technology. I have talked about the power of the Trade Triangles and how they can give off early warning signals of impending changes in the market. For example, if you look back last December, members received an early warning signal that all was not well in the S&P 500. That signal came in the form of a weekly Trade Triangle on December 11th at 2,019.39. As I write this commentary, the S&P 500 is currently trading at 1,880! The same warning signals occurred in both the Dow and the NASDAQ. These warning signals occur in stocks as well, take a look at Apple Inc. (NASDAQ:AAPL), Best Buy Co. Inc (NYSE:BBY), Under Armour Inc. (NYSE:UA) and a host of other stocks that were once thought to be invincible.

If you have been reading this blog for any length of time you've heard me make the statement, "they slide faster than they glide". That means that markets tend to go down much faster than they go up. Some market pundits blame it on gravity, I just say that perception may be the real culprit here. Right now confidence in the market is low and perception is high that there is more trouble ahead. Continue reading "Exactly 1 Year Ago Today, GoPro Gave A Sell Signal At $46.50"