Controlling portfolio beta (a measure of volatility or systemic/market risk of a portfolio compared to the market on the whole) while generating the same or superior returns can be achieved with options. A beta-controlled portfolio can be achieved via a blended approach where 50% cash is held in conjunction with long index-based equities and an options component.

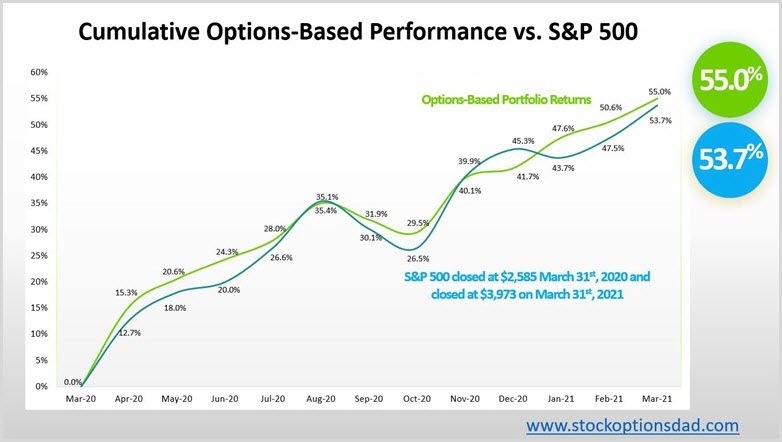

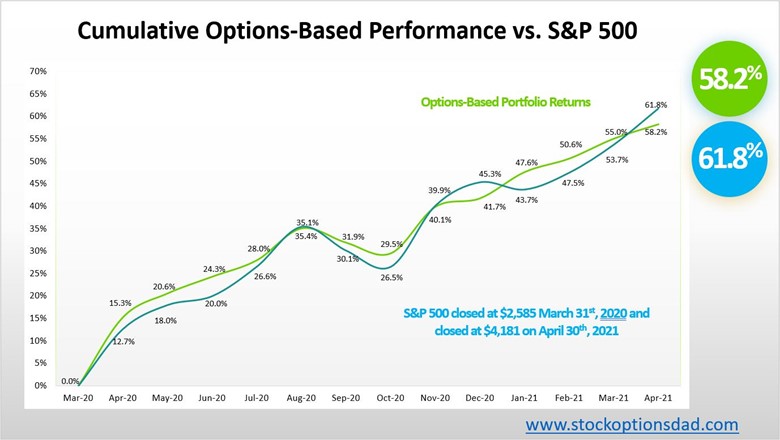

Over the past ~13 months, post COVID-19 induced lows, generating consistent monthly income while defining risk, leveraging a minimal amount of capital, and maximizing return on capital has been the core of this options-based/beta-controlled portfolio strategy. They enable smooth and consistent portfolio appreciation without guessing which way the market will move and allow one to generate consistent monthly income in a high probability manner in various market scenarios. Over the past 13 months (April 2020 – April 2021), 249 trades were placed and closed. A win rate of 98% was achieved with an average ROI per winning trade of 8.0% and an overall option premium capture of 85% while outperforming the S&P 500. The performance of an options-based portfolio demonstrates the durability and resiliency of options trading to drive portfolio results with substantially less risk via a beta-controlled manner. The options-based approach circumvented the September 2020, October 2020, and January 2021 sell-offs while outperforming/matching the S&P 500 over the 13-month post-pandemic bull run, posting returns of 58.2% and 61.8%, respectively (Figures 1, 2, and 3).

Figure 1 – Overall options-based performance compared to the S&P 500 from April 2020 – April 2021

Continue reading "Beta-Controlled Options Portfolio"