It’s been a rough year for the major market averages, with the major indexes down roughly 20% in their worst year since 2008.

This poor performance is not surprising after a decade-long bull market that pushed valuations to historic extremes combined with an ultra-hawkish Federal Reserve that has aggressively hiked rates into a recessionary environment.

At the same time that higher rates have dented earnings and resulted in layoffs due to increased interest expense, the outlook for forward earnings is less clear, with consumer spending pulling back and reduced sales leverage for most corporations.

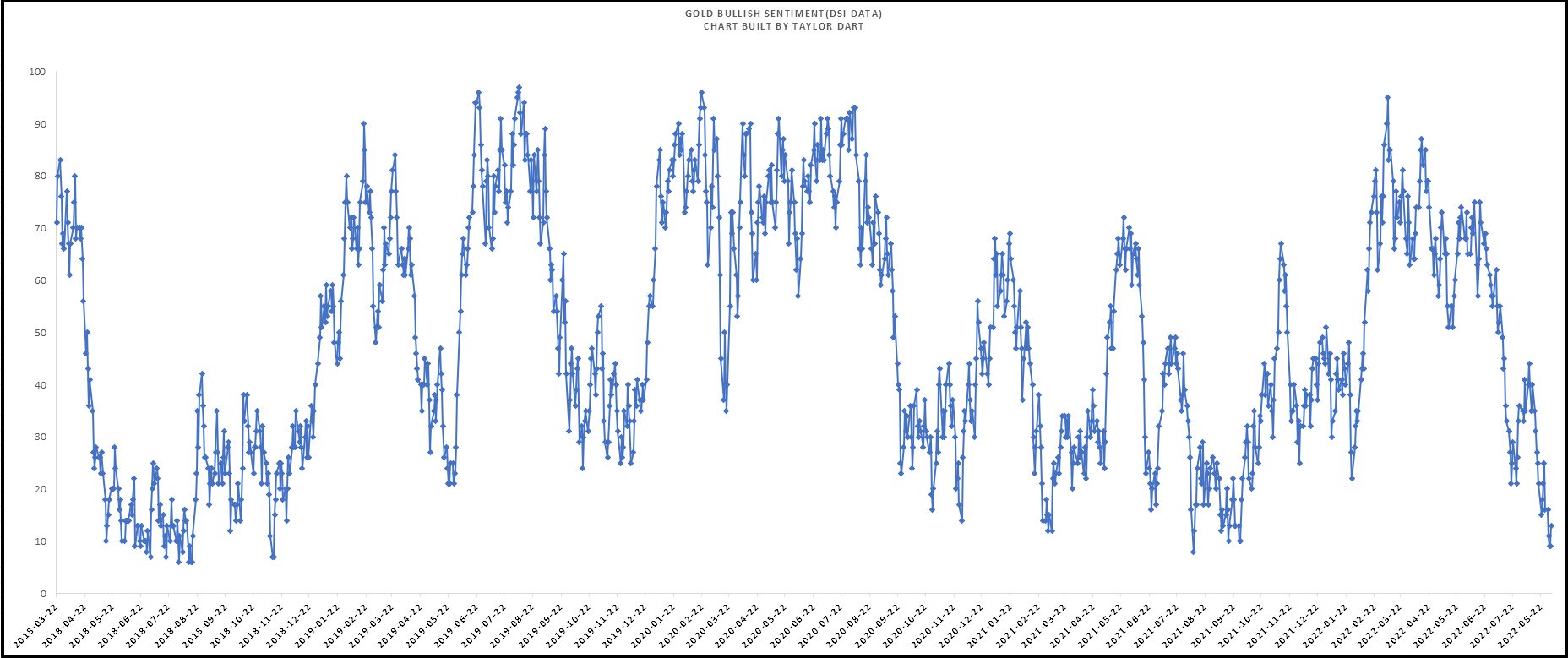

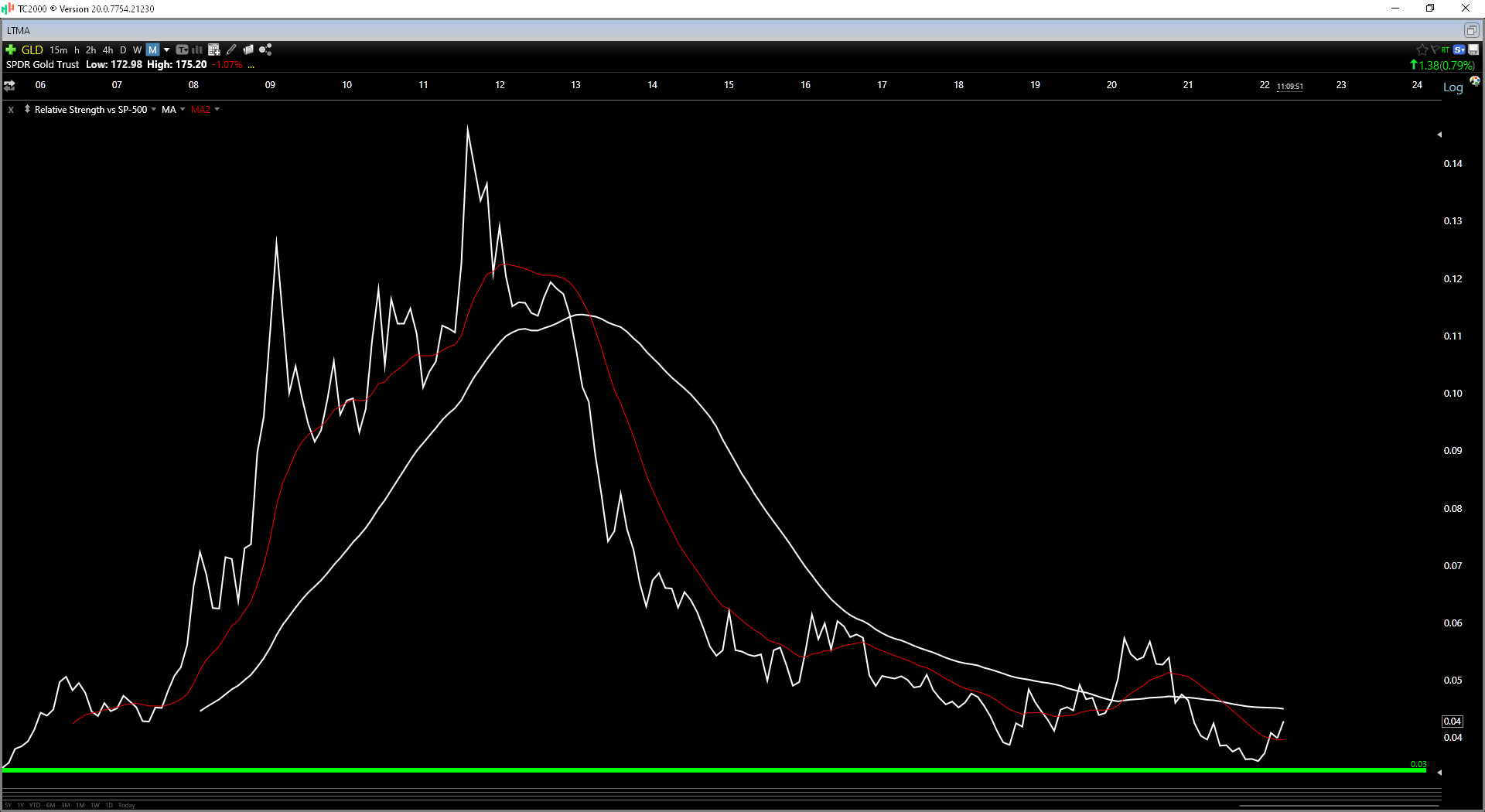

However, one sector stands out and has been trending higher over the past two months: the gold mining sector. In fact, the Gold Miners Index (GDX) has clawed back from a 30% year-to-date loss to just a 13% year-to-date loss, and many gold miners are trading in positive territory year-to-date.

Given that they’ve suffered through a much larger bear market than the Nasdaq (COMPQ) with a ~55% decline, these names are not only undervalued, but they’re long-term oversold, and the sector could have meaningful upside as we head into a strong seasonal period for the GDX.

In this update, we’ll look at two of the more undervalued names in the sector:

Osisko Gold Royalties (OR)

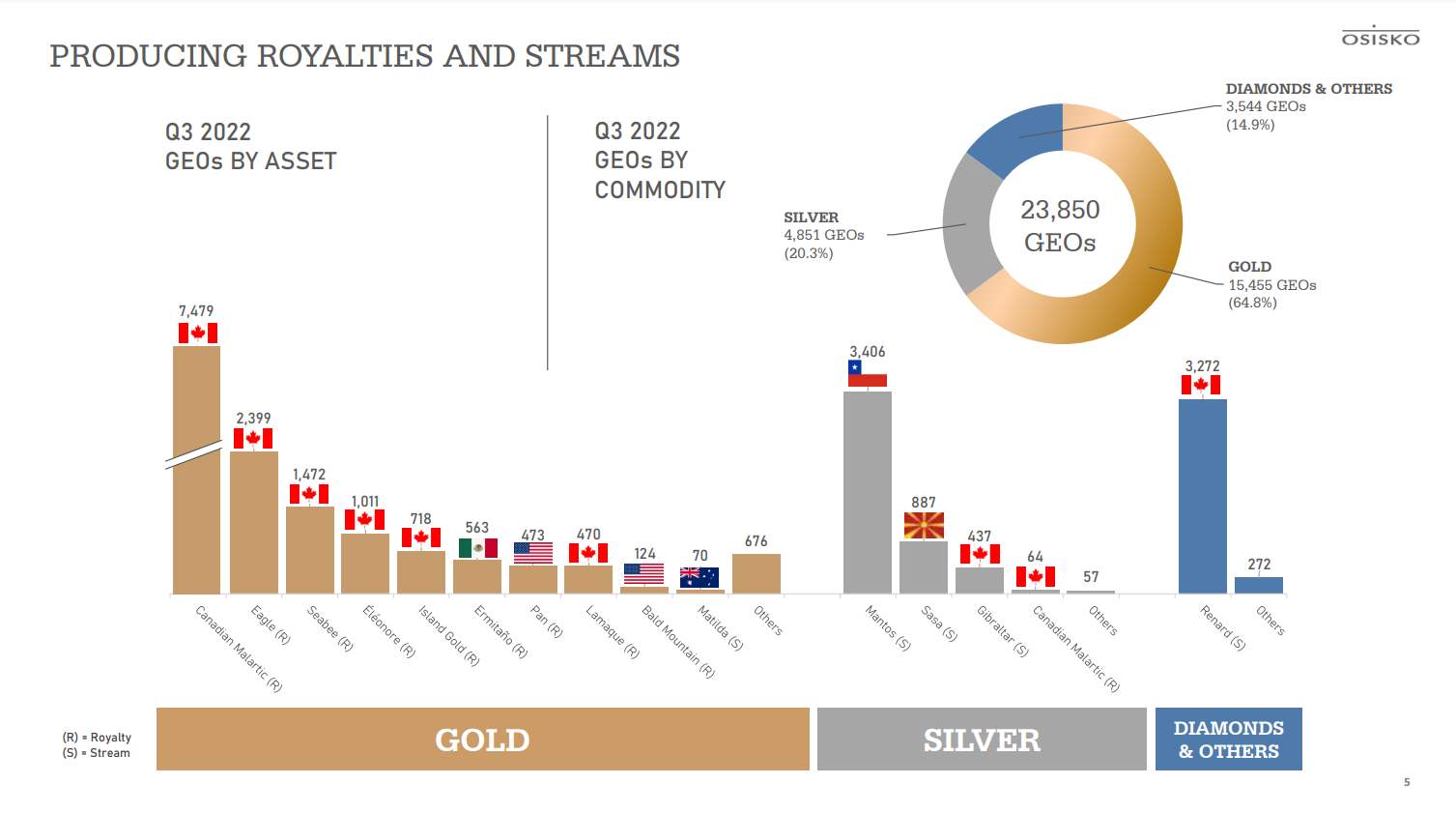

Osisko Gold Royalties (OR) is a $2.23 billion company in the precious metals royalty/streaming space.

This means that It finances developers, producers, and explorers in the commodity sector with a gold/silver focus, providing them capital upfront to build or expand their assets.

In exchange, Osisko Gold Royalties receives either a royalty or stream on the asset over its mine life, with the latter giving it a right to buy a percentage of metal produced at a fixed cost that is well below spot prices.

The result is that royalty/streaming companies have their tentacles in several projects, have their revenue streams spread across several countries, and are inflation-resistant. Hence, they are superior businesses from a margin and risk standpoint vs. most gold producers.

So, what’s so special about Osisko? Continue reading "Gold Miners On The Sale Rack"