Hello MarketClub members everywhere. The market is relatively unchanged today after erasing earlier losses as real estate and technology turned higher and traders turned their eyes to comments from several Federal Reserve officials.

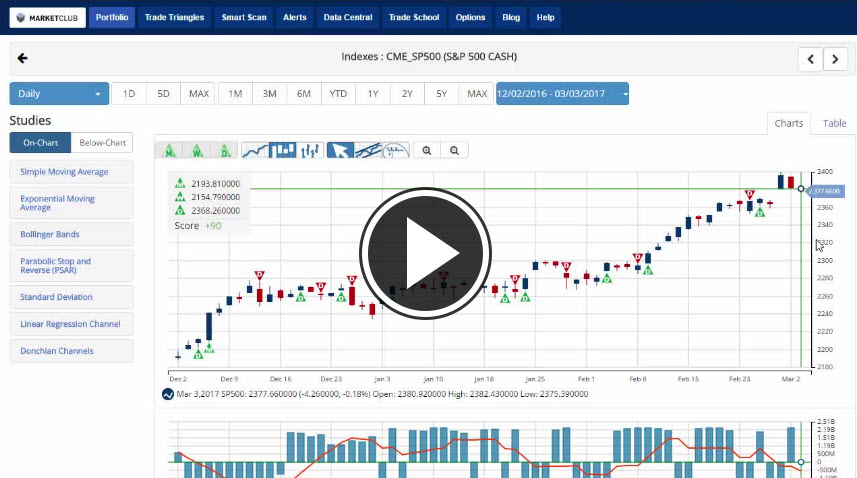

The U.S. central bank raised interest rates for the second time in three months last week, but the "dot plot" that shows each member's expectations for where rates will be in coming years changed little from the last meeting.

Key levels to watch this week: Continue reading "U.S. Dollar Slips As Stocks Fluctuate"