HealthEquity (HQY) was an undervalued and underappreciated stock that was a screaming buy at the sub $50 level back in Q4 of 2020. The stock roared back from those suppressed levels to above $90 in Q1 2021. Since then, HealthEquity has fallen from its 52-week highs of $93 to a current price of ~$79 or about 15% off its highs. The recent weakness presents a great entry point for this healthcare cost containment company.

Considering HealthEquity’s unique position as being distinctly disassociated from drug pricing issues, rising insurance costs, or the pharmaceutical supply chain, this weakness looks appealing. For long-term investors, HealthEquity presents a compelling picture of growth with a large addressable market moving forward.

Total Addressable Market

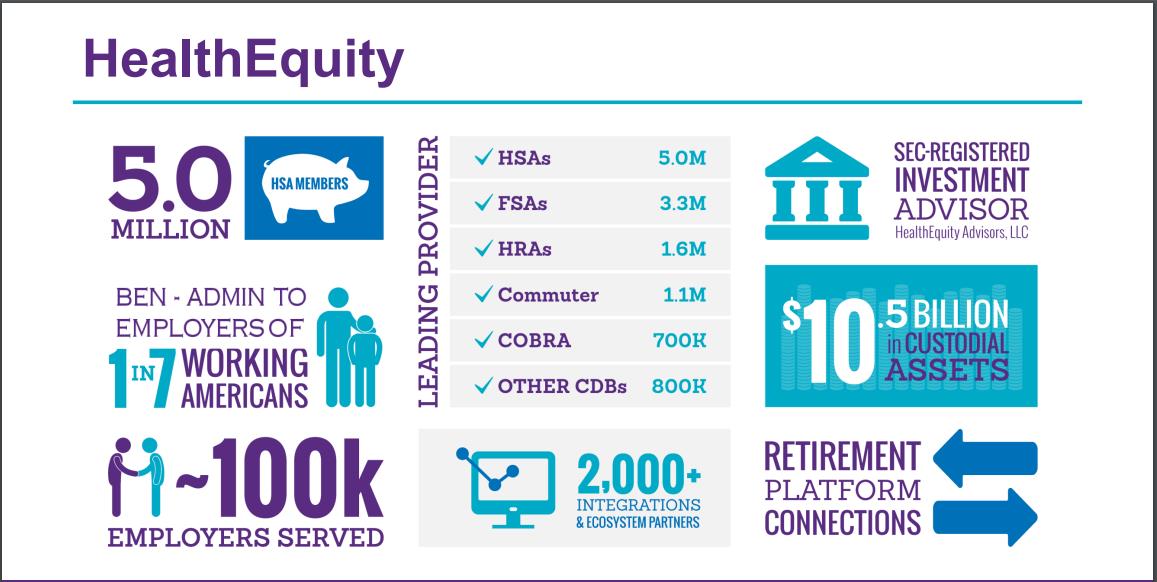

Over the past 5 years, HealthEquity has delivered and combination of growth, transparency, profitability, and a sustainable business model (Figures 1, 2, and 3). Total accounts across the consumer-directed benefits include HSAs, FSAs, HRAs, CORBA, Commuter, and others continue to expand while opening growth verticals within these accounts. At maturity, the total addressable market is estimated to be 50-60 million HSAs with $600 billion - $1 trillion in assets. HealthEquity is in the early innings of market share as it continues to grow into this space. Continue reading "HealthEquity - 2021 Second Half Upside"