HealthEquity (HQY) was an undervalued and underappreciated stock that was a screaming buy at the sub $50 level back in Q4 of 2020. The stock roared back from those suppressed levels to above $90 in Q1 2021. Since then, HealthEquity has fallen from its 52-week highs of $93 to a current price of ~$79 or about 15% off its highs. The recent weakness presents a great entry point for this healthcare cost containment company.

Considering HealthEquity’s unique position as being distinctly disassociated from drug pricing issues, rising insurance costs, or the pharmaceutical supply chain, this weakness looks appealing. For long-term investors, HealthEquity presents a compelling picture of growth with a large addressable market moving forward.

Total Addressable Market

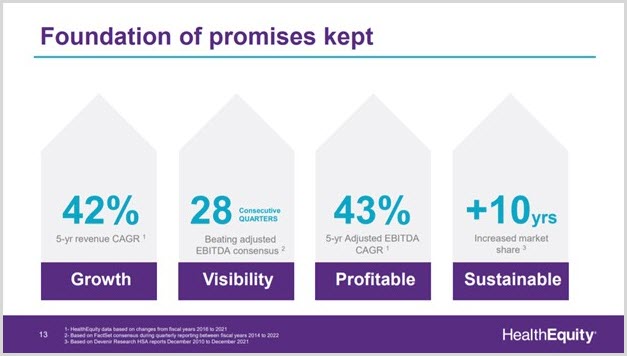

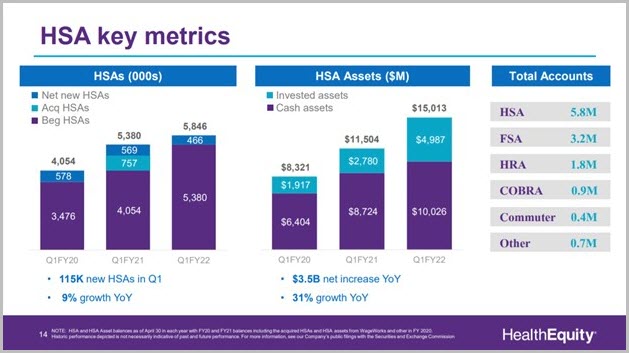

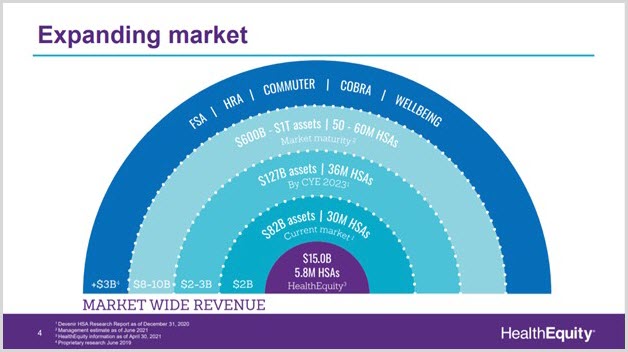

Over the past 5 years, HealthEquity has delivered and combination of growth, transparency, profitability, and a sustainable business model (Figures 1, 2, and 3). Total accounts across the consumer-directed benefits include HSAs, FSAs, HRAs, CORBA, Commuter, and others continue to expand while opening growth verticals within these accounts. At maturity, the total addressable market is estimated to be 50-60 million HSAs with $600 billion - $1 trillion in assets. HealthEquity is in the early innings of market share as it continues to grow into this space.

Figure 1 – HealthEquity demonstrating their compelling long-term growth strategy

Figure 2 – High-level overview of the newly combined HealthEquity company branching out into all segments of consumer-directed benefits

Figure 3 – Total addressable market for consumer-directed benefits

Post-Pandemic HSA Awareness

The COVID-19 pandemic will likely bring more attention to the Health Savings Account (HSA) space and may drive demand from more companies and consumers alike. The Health Savings account serves as a win-win for companies and consumers. This is an effective way to contain healthcare costs while allowing funds to accumulate for potential future medical expenses. This space has already been under a secular growth trend, and this pandemic may accelerate the growth of these accounts as awareness spreads. Over the long term, this trend toward consumer-driven healthcare (i.e., channeling funds into HSAs) is here to stay.

Moat and Business Model

HealthEquity (HQY) has a unique business model that serves as an intermediary servicing the secular growth HSA space that is largely independent of legislative actions, drug pricing, rising insurance costs while not playing any role in the pharmaceutical supply chain that spans from health insurers to end-user pharmacies. The company simply manages funds allocated for medical, dental, and vision expenses that are deducted on a pre-tax basis and deposited into a dedicated HSA account. The HSA space has grown in popularity as corporate adoption has allowed access to these plans in conjunction with consumer awareness. HealthEquity is an intermediary that connects health and wealth to consumers of healthcare.

Diversifying Revenue Streams

HealthEquity made a bold move to acquire WageWorks for approximately $2 billion in an all-cash deal. This acquisition has expanded HealthEquity’s moat in the HSA space while providing new revenue verticals in complementary product offerings. This move is already expanding HealthEquity’s total addressable market as Consumer-Directed Benefits (CDBs) via pre-tax spending accounts such as additional Health Savings Accounts (HSAs), health and dependent care Flexible Spending Accounts (FSAs), health reimbursement accounts (HRA), Commuter Benefit Services, wellness programs, COBRA and other employee benefits are absorbed into its product offerings. In addition, this acquisition provides access to a larger client base and access to health brokers that will help drive HealthEquity’s penetration over the long term. The combination of WageWorks’ leading consumer-directed benefits with HealthEquity’s HSA platform is highly synergistic and will drive growth while expanding the total addressable market in years to come.

Summary

HealthEquity (HQY) has continued its path of accelerating revenue, cash flow, and income growth across all segments of its business in the backdrop of an HSA secular growth market. Its WageWorks acquisition further bolstered this by augmenting its core competencies in the Health Savings Account space while accessing other revenue verticals in the Consumer Directed-Benefits space. HealthEquity continues to post strong growth as it expands the number of accounts, manages more custodial assets, expands gross margins, and more accounts transitioning into investment vehicles. HealthEquity is uniquely positioned as HSAs become an invaluable option for consumers to contain medical costs and control healthcare spending. Best of all, the company’s business model is such that it stands as an intermediary, servicing the secular growth HSA space that is largely independent of legislative actions, drug pricing, rising insurance costs while not playing any role in the pharmaceutical supply chain from health insurers to end-user pharmacies. As a result, the WageWorks acquisition has expanded HealthEquity’s moat while providing additional long-term revenue sources for durable growth.

Noah Kiedrowski

INO.com Contributor

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. He may engage in options trading in any of the underlying securities. The author has no business relationship with any companies mentioned in this article. He is not a professional financial advisor or tax professional. This article reflects his own opinions. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned. Kiedrowski is an individual investor who analyzes investment strategies and disseminates analyses. Kiedrowski encourages all investors to conduct their own research and due diligence prior to investing. Please feel free to comment and provide feedback; the author values all responses. The author is the founder of www.stockoptionsdad.com where options are a bet on where stocks won’t go, not where they will. Where high probability options trading for consistent income and risk mitigation thrives in both bull and bear markets. For more engaging, short duration options based content, visit stockoptionsdad’s YouTube channel.