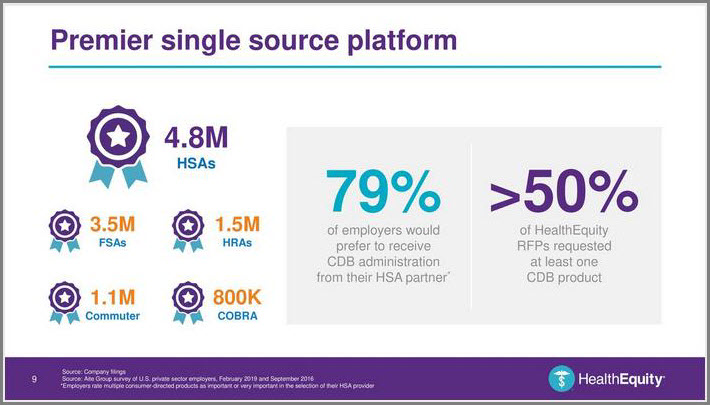

HealthEquity Inc. (HQY) made a bold move to acquire WageWorks for approximately $2 billion in an all-cash deal. This acquisition will expand HealthEquity’s moat in the Health Savings Account space while providing new revenue verticals in complementary product offerings. This move will expand HealthEquity’s total addressable market as Consumer-Directed Benefits (CDBs) via pre-tax spending accounts such as additional Health Savings Accounts (HSAs), health and dependent care Flexible Spending Accounts (FSAs), health reimbursement accounts (HRA), Commuter Benefit Services, wellness programs, COBRA and other employee benefits are absorbed into its product offerings. This acquisition provides access to a larger client base and access to health brokers that will help drive HealthEquity’s penetration. The majority of HSA clients would prefer to have its CDBs administered by its HSA provider, and more than 50% of HealthEquity’s clients have requested a CDB product. The combination of WageWorks’ leading consumer-directed benefits with HealthEquity’s HSA platform will be highly synergistic and drive growth while expanding the total addressable market in years to come.

HealthEquity’s Unique Positioning

A potential economic slowdown, a trade war with China, tariffs, yield curve inversion, etc., are irrelevant when it comes to HealthEquity. HealthEquity’s business model is such that it stands as an intermediary servicing the secular growth Health Savings Account (HSA) space that’s largely independent of legislative actions, drug pricing, rising insurance costs while not playing any role in the pharmaceutical supply chain from health insurers to end-user pharmacies. The company simply manages funds allocated for medical, dental and vision expenses that are deducted on a pre-tax basis and deposited into a dedicated HSA account. The HSA space has grown in popularity as corporate adoption has allowed access to these plans in conjunction with consumer awareness.

HealthEquity is an intermediary that connects health and wealth to consumers of healthcare. Think of this as a parallel to the credit card companies that only focus on the transactions and not the financial liability of the card user. The banks take on the financial liability of the branded card (i.e., Visa or Mastercard) and merely facilitate the financial transaction. HealthEquity has partnerships with over 45,000 employers and 141 health, retirement, and other benefit plan providers nationwide. HealthEquity is the custodian of $8.3 billion in assets for 4.1 million HSA members nationwide. The company continues to post quarter after double-digit quarter growth in revenue and EPS without any debt on the balance sheet. Recently, the company released its Q1 2020 results and updated investors with total HSA members coming in at 4.1 million, an increase of 17% compared to Q1 FY19. Total custodial assets were $8.3 billion, an increase of 21% compared year-over-year. Q1 revenue came in at $87.1 million, an increase of 25% while adding 89,000 new HSA accounts. For long-term investors, HealthEquity presents a compelling picture of growth with a large addressable market moving forward and further strengthened with its latest acquisition of WageWorks.

HealthEquity and WageWorks Combination

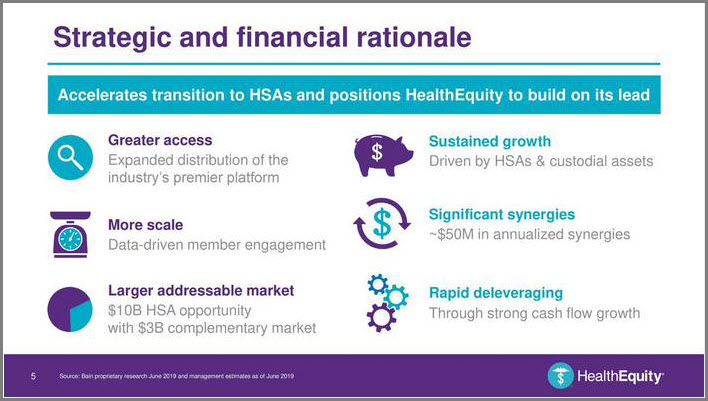

The acquisition will ostensibly provide HealthEquity with “access to more of the fast-growing HSA market by expanding its direct distribution to employees and benefits advisors as a single source, premier provider of HSAs and complementary CDBs, including flexible spending accounts, health reimbursement arrangements, COBRA administration, and commuter accounts.” Not only is this combination of the two companies complementary, financial synergies of $50 million in annualized savings will be realized within 24 to 36 months of closing via operating efficiencies. The company expects on-going synergies over time as the combined client base takes advantage of the end-to-end offerings.

Jon Kessler will serve as President and CEO of the combined company. Kessler stated, “Acquiring WageWorks positions us to accelerate the market-wide transition to HSAs, with greater market access and an end-to-end proprietary platform built to drive members to spend smarter while saving for healthcare in retirement. Together, we can meet employers and employees wherever they are on their journeys to connect health and wealth, while simultaneously accelerating our growth in an expanding industry. This transaction is compelling for team members and stockholders of both companies, and it accelerates the strategic goals of both companies immediately by adding WageWorks’ market-leading CDB services to HealthEquity’s highly acclaimed HSA platform.”

Edgar Montes, President, and CEO of WageWorks noted: “The combination of WageWorks and HealthEquity will be transformative in our industry and will amplify our impact among clients, brokers, and policymakers. Together with HealthEquity, WageWorks can bring broader, deeper, more innovative solutions to our customers – giving them greater choice and peace of mind. This transaction recognizes and reflects our strong brand and reputation in the market.” (Figures 1-4)

Figure 1 – Highly complementary combination of the two companies

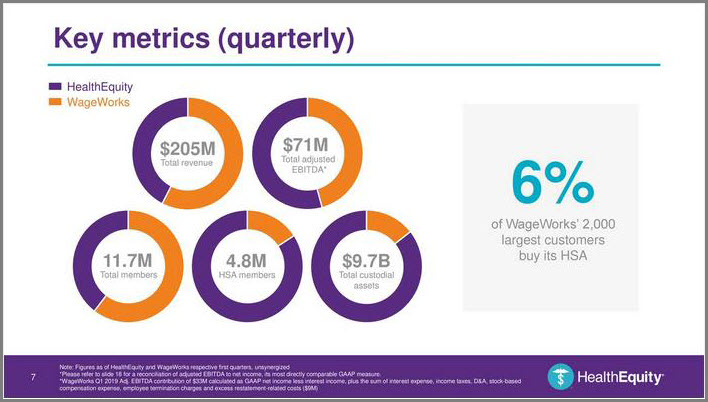

Figure 2 – Growing client base and driving revenue

Figure 3 – Access to additional revenue sources via Consumer-Directed Benefits

Figure 4 – Expands the total addressable market by layering-in Consumer-Directed Benefits

WageWorks Will Expand HealthEquity’s Moat

HealthEquity currently manages $8.3 billion in assets across 4.1 million accounts against a potential market maturity of $1 trillion in assets across 50-60 million accounts. The durability of this growth has a long runway due to the secular growth in the HSA market. The company is sitting on largely untapped revenue sources where the vast majority of account holders have yet to invest any HSA money in their investment offerings. Expanding margins for greater profitability is also unfolding as the older the account, the greater the gross margins. The company continues to post accelerating revenue, cash flow, margin expansion, and income growth. I feel that HealthEquity will continue to post strong growth as it services the double-digit HSA growth market and manages more assets, accounts, and investments within these accounts. HealthEquity has demonstrated to be a great investment in the proxy healthcare space that’s independent of the health insurances, pharmaceutical supply chain companies, drug makers or pharmacies.

HealthEquity is uniquely positioned as HSAs are becoming an invaluable option for consumers to contain medical costs and take control of healthcare spending. High Deductible Health Plans (HDHP) coupled with HSAs has contained family plan deductibles at a far lower level than any other healthcare plan. Additionally, funds deposited in the companion HSA account can be invested into mutual fund options to grow these funds over time. At age 65 these funds can be withdrawn without penalty at your effective rate, effectively serving as a second 401k over time. This dual-purpose account serves as a great means to contain healthcare costs while building wealth via investments over the long term.

Summary

HealthEquity Inc. (HQY) has continued its path of accelerating revenue, cash flow, and income growth across all segments of its business in the backdrop of an HSA secular growth market. The WageWorks acquisition will augment its core competencies in the Health Savings Account space while providing access to other revenue verticals in the Consumer Directed-Benefits space. HealthEquity looks compelling after this healthy correction as the long term narrative remains intact. The company is sitting on untapped revenue sources, and gross margin expansion is beginning to bear fruit as accounts age and more funds are channeled into investment vehicles. HealthEquity is continuing to post strong growth as it expands the number of accounts, manages more custodial assets, expands gross margins and more accounts transitioning into investment vehicles. HealthEquity is uniquely positioned as HSAs are becoming an invaluable option for consumers to contain medical costs and take control of healthcare spending. Best of all, the company’s business model is such that it stands as an intermediary, servicing the secular growth Health Savings Account space that’s largely independent of legislative actions, drug pricing, rising insurance costs while not playing any role in the pharmaceutical supply chain from health insurers to end-user pharmacies. The WageWorks acquisition will widen HealthEquity’s moat and provide additional long-term revenue sources for durable growth.

Noah Kiedrowski

INO.com Contributor

Disclosure: The author does not hold shares in any of the mentioned stocks or ETFs. However, he may engage in options trading in any of the underlying securities. The author has no business relationship with any companies mentioned in this article. He is not a professional financial advisor or tax professional. This article reflects his own opinions. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned. Kiedrowski is an individual investor who analyzes investment strategies and disseminates analyses. Kiedrowski encourages all investors to conduct their own research and due diligence prior to investing. Please feel free to comment and provide feedback, the author values all responses. The author is the founder of www.stockoptionsdad.com where options are a bet on where stocks won’t go, not where they will. Where high probability options trading for consistent income and risk mitigation thrives in both bull and bear markets. For more engaging, short duration options based content, visit stockoptionsdad’s YouTube channel.