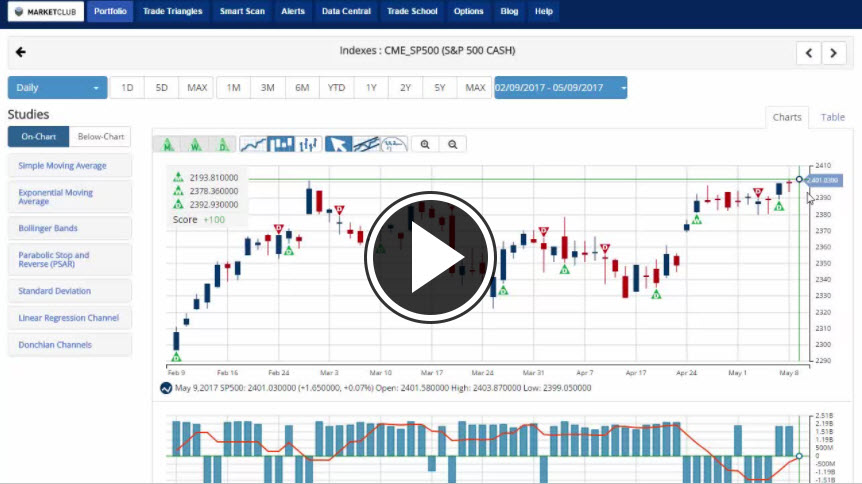

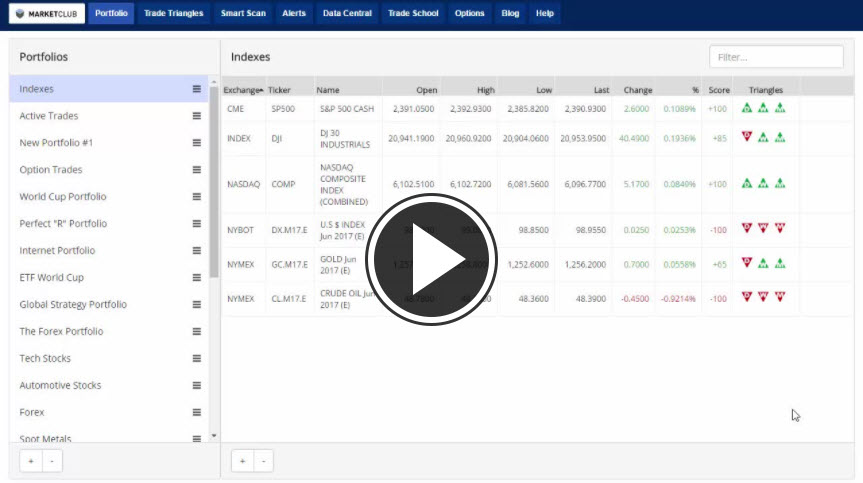

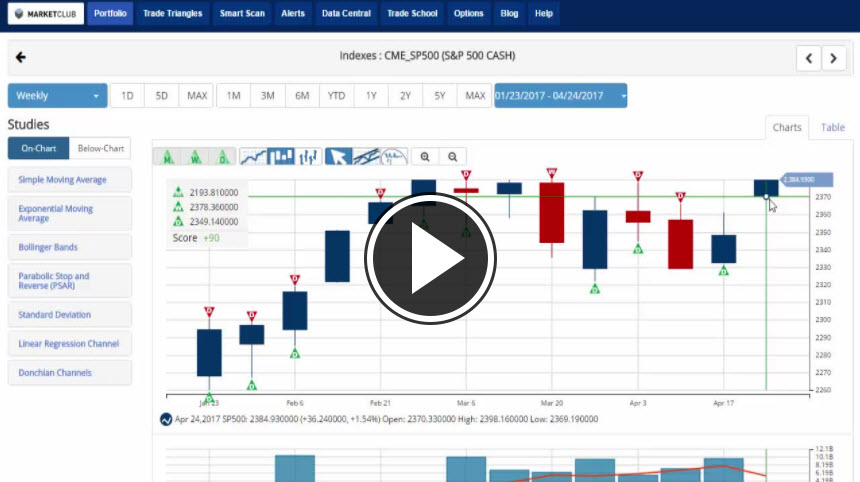

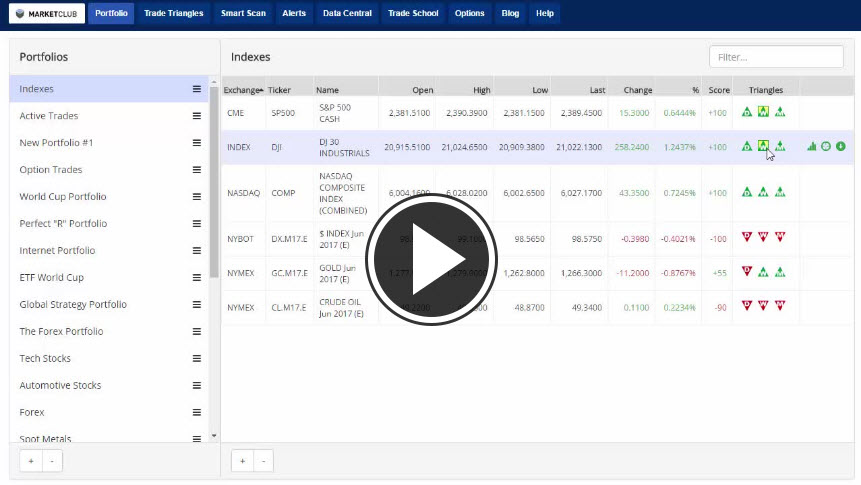

Hello MarketClub members everywhere. The S&P 500 and the Nasdaq touched record highs for the second straight day following a batch of upbeat corporate earnings, while Emmanuel Macron's victory in the French presidential election improved risk appetite.

The VIX, Wall Street's "fear gauge," hit its lowest level in more than a decade earlier in the day. A lower VIX typically indicates a bullish outlook for stocks.

Oil prices headed lower today over concerns about slowing demand and the rise in U.S. crude output which has shaken traders faith in the ability of OPEC to rebalance the market.

Key levels to watch this week: Continue reading "Stocks Lingering Near All-Time Highs"