Let's face it... Forex is a market that has HUGE potential, HUGE liquidity, and little good information out there on how to trade it with success. That's why I've asked Mark McRae from

Forex Avenger to come and teach us a bit about a 1-2-3 Method that his partner David Curran from

Forex Avenger has had major success with. Please take time, read the blog entry, and visit

Forex Avenger to see the success they have experienced trading forex!

====================================================================

This particular technique has been around for a long time and I first saw it used in the futures market. Since then I have seen traders using it on just about every market and when applied well, can give amazingly accurate entry levels.

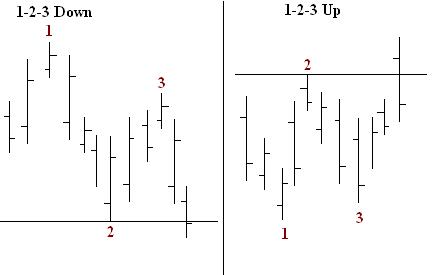

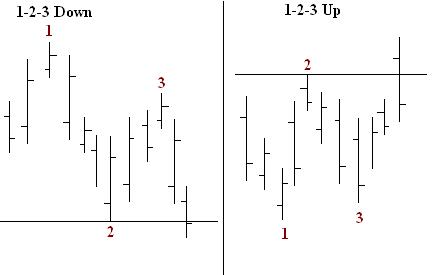

Lets first start with the basic concept. During the course of any trend, either up or down, the market will form little peaks and valleys. see the chart below:

The problem is, how do you know when to enter the market and where do you get out. This is where the 1-2-3 method comes in. First let's look at a typical 1-2-3 set up:

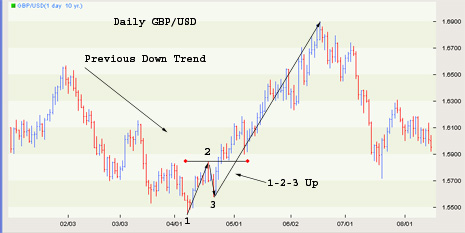

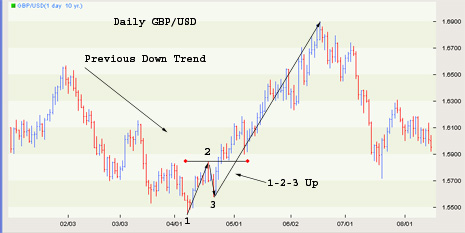

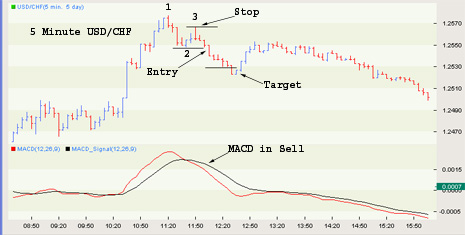

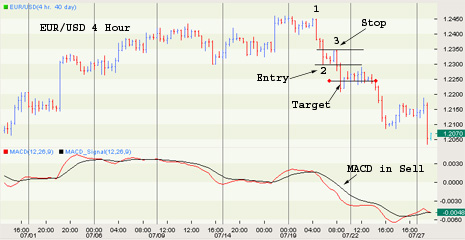

Nice and simple, but it still doesn't tell us if we should take the trade. For this we add an indictor. You could use just about any indicator with this method, but my preferred indicator is MACD with the standard settings of 12,26,9. With the indicator added, it now looks like this:

Now here is where it gets interesting. The rules for the trade are as follows:

Uptrend

- This works best as a reversal pattern, so identify a previous downtrend.

- Wait for the MACD to signal a buy and for the 1-2-3 set up tobe in place.

- As the market pulls back to point 3, the MACD should remain inbuy mode or just slightly dip into sell.

- Place a buy entry order 1 pip above point 2

- Place a stop loss order 1 pip below point 3

- Measure the distance between point 2 and 3 and project thatforward for your exit.

- Point 3, should not be lower than point 1

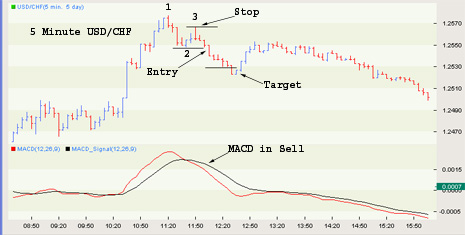

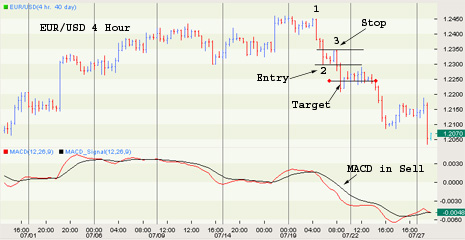

The reverse is true for short trades. As the market progresses you can trail your stop to 1 pip below the most recent low (Valley in an uptrend). You can also use a break in a trend line as an exit.

Some examples:

There are a lot of variations on the 1-2-3 setup but the basic concept is always the same. Try experimenting with it on your favorite time frame.

Good Trading

Best Regards

Mark McRae Forex Avenger

Bio - Mark McRae is a fulltime professional trader, author and coach. He has coached some of the top names in Forex trading. David Curran, Forex's latest rising star attributes his success in the Forex market to the teachings of Mark McRae. To read more about David, go HERE

Today we are looking at a market we have not looked at for quite some time. I am of course referring to the Japanese Yen US dollar relationship.

Today we are looking at a market we have not looked at for quite some time. I am of course referring to the Japanese Yen US dollar relationship.