Today I'd like to welcome back Mark McRae from SureFireTradingChallenge.com. I personally have known Mark for over three years, with Adam knowing Mark well over 5, and Adam and I both agree that Mark is truly an innovator and one of the hardest working traders we know. His latest project, SureFireTradingChallenge.com, kept him holed up with charts and traders from all around the world to find some of the best methods in the world for trading. Check it out here.

Now his blog post today is more applicable now then it ever has been...support and resistance! Let me let Mark teach you a bit more:

=================================================================

Where exactly are the support and resistance points?

Where exactly are the swing points on a chart?

This is a particularly important lesson!

Just about every system or method of trading at least takes note of where the key support and resistance levels are.

I have found a double use for my method of identifying these points - They are also Swing Points!

You may think you know where Support and Resistance is, but do you really?

How do you know where support and resistance really is?

The problem with Support and Resistance (S&R) is that it is not a definite number. It is not an exact point on the chart at which price will, without any hesitation stop.

In fact S&R is actually an area - it is not an exact number as we would all like to think.

The dilemma of course, is that in order to do our calculations we need an exact point. You can't enter $50.10/20 area when using fibonacci or working out your stops and limits. You need an exact number even though S&R is not an exact number.

Try telling your broker that you want a stop loss at somewhere between 50 and 55 and watch him burst a blood vessel.

This is what I want to concentrate on in this lesson. This is a technique I have found to be particularly good at not only identifying strong S&R points but also swing points.

In order to find S&R we must first identify market swing points. There are various ways of doing this but I am going to use the one I have used for years.

For the purpose of swing points we are not interested in the open or close of the bars only the high and low.

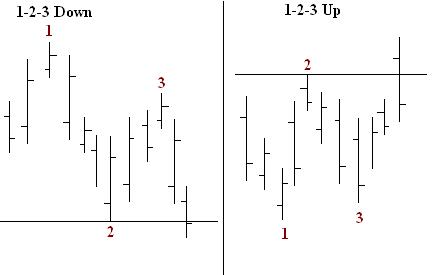

Take any bar and think of that bar as the start bar (S). If there are two consecutive higher highs than the bar you marked (S) then that is a swing up e.g. bar (1) has a higher high than bar (S) and bar (2) has a higher high than bar (1). If there are not two higher highs than bar (S) then you move to the next bar and see if there are two consecutive higher highs.

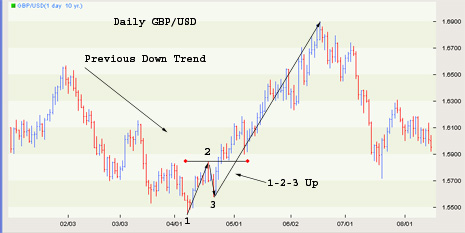

This can be particularly useful if the market is trading sideways and you are trying to determine the breakout point. There may be many peaks and valleys but for me there is only one real point - that is the most recent swing up or swing down.

Look at the next diagram

You can see that although there were a few highs and lows that you could have taken as support or resistance, but it wasn't until bar (M) that a definite swing point had been identified and you could mark bar (K) with an (S).

Swing Down

To work out the swing down point - take any bar on a chart and think of that bar as your start point - bar (S). If the next two consecutive bars make lower lows than the previous bar then that is a swing down e.g. bar (1) has a lower low than bar (S) and bar (2) has a lower low then bar (1). If there are not two consecutive lower lows then it is not a swing point and you move to the next bar.

Just as in the example above you can see exactly the same thing with the swing down. Even though price made a few highs and lows it wasn't until bar (M) that you could mark bar (K) as the (S) point.

Support And Resistance

Only once we have clearly marker swing points can we go on to identify our support and resistance points.

As you can see from the chart I have marked all the swing up points and swing down points. When we are in a down trend then the swing down points act as resistance and when we are in an up trend the swing up points

act as support.

Marking the support and resistance points using this method of first identifying the swing points will give you definite points on a chart from which to calculate your stops, limits and projections.

Good Trading

Best Regards

Mark McRae

==================================================================

Please take some time to visit Mark and see his new project: SureFireTradingChallenge.com.