The UK economy, it seems, has been a study in opposites. It has swung from having been the fastest to the slowest, from experiencing high growth and then sluggishness, from moving from a high inflation environment to a low inflation environment. The UK economy is the great dichotomy, comprised of fading expectations and the bursting of optimistic sentiment that together carves the path of the Pound Sterling, a path that is as shaky now as it ever was and which, it seems, has been broken just this week.

Sterling Not Coming Back?

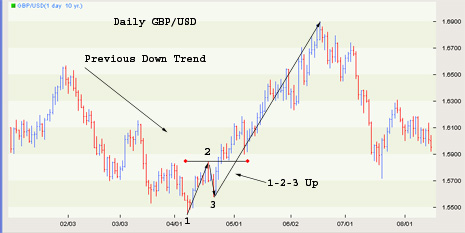

Looking at the chart below, we can tell much about the governing dynamics of Sterling buyers and sellers. Dips in the Sterling trade vs the Dollar were plentiful; back in 2009, when the crisis was at its climax, back in 2010, when UK growth was pegged as just “sluggish,” and then back in 2013, when it seemed the UK economy had finally lost all steam. Yet each and every time Sterling buyers emerged; in fact, not only did they emerge and crowd back into what they deemed an undervalued currency, but each time they emerged at a higher point, painting a picture of a fragile but steadily ascending path for the Pound vs the Dollar. Yet as the latest point on the chart shows, at this point in time the buyers have not re-emerged, letting the Pound break its ascending path. Why, this time in particular, are Sterling buyers not coming back? Continue reading "Sterling by the Charts"